97% of customers are satisfied with the speed of the credit decision²

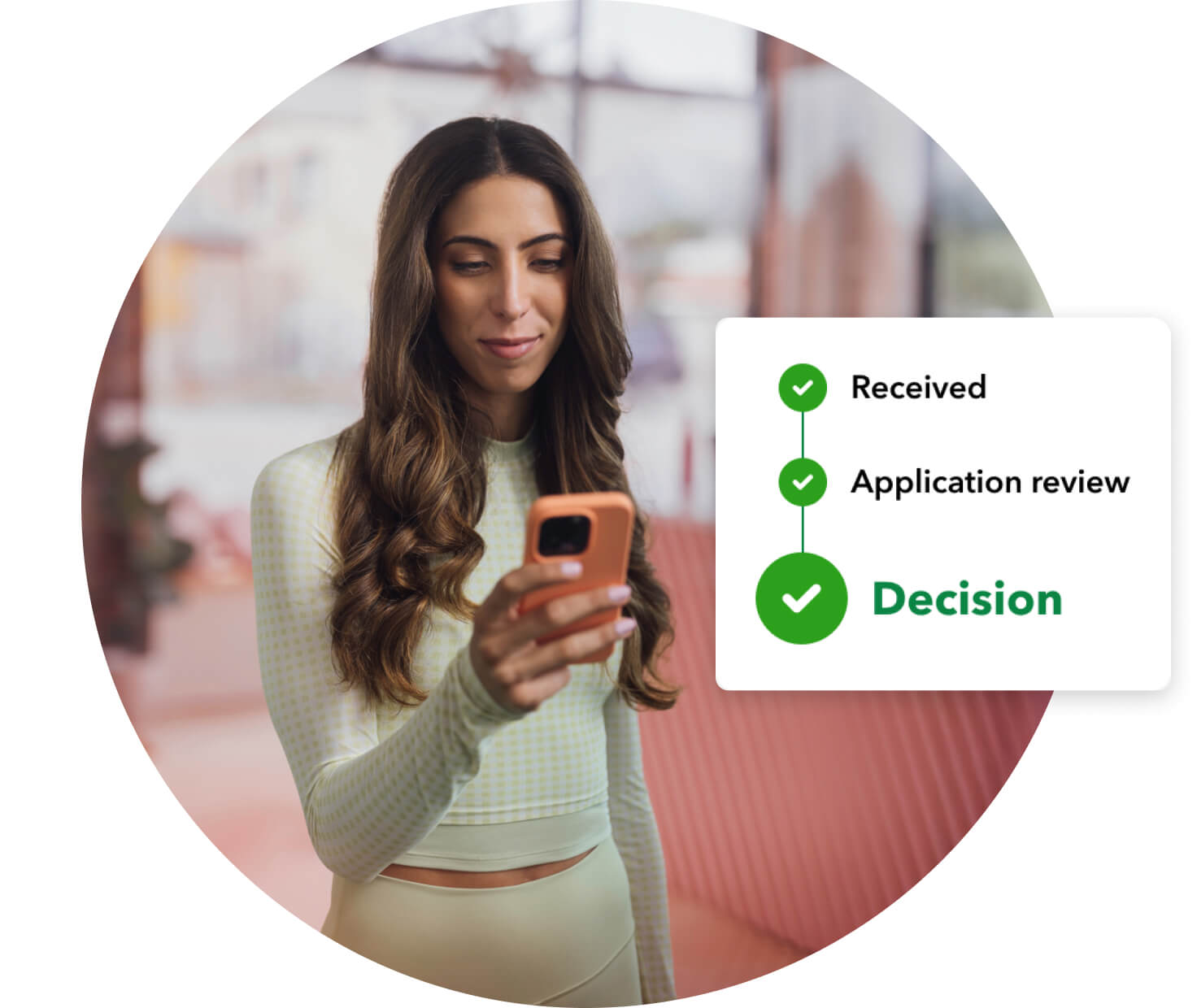

A simple, transparent process

Access a QuickBooks Term Loan with no origination fees, prepayment penalties, or hidden charges.³ Your clients know where they stand at every step.

Apply in QuickBooks

Save time—it only takes minutes to apply and get a decision.

Get flexible terms

Loans from $1.5K–$200K with terms from 6–24 months.

Access competitive rates³

Business loans with no origination fees or prepayment penalties.

Explore lending options

Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow.

Keep business on track with a Line of Credit you can access when you need to.³ Draw cash from your total credit limit or get an advance on eligible outstanding invoices—and only pay interest on the amount you borrow.⁴

Browse additional funding options through QuickBooks Capital’s partners that provide small business loans and lines of credit.

Business eligibility

Here are a few things used to determine if a business is eligible for a QuickBooks Term Loan:

- Up-to-date and accurate business data in QuickBooks

- Primary business bank accounts connected through QuickBooks (not required)

- Generally, revenue of at least $50,000 over the past 12 months

Why small businesses rely on QuickBooks for access to capital

“QuickBooks Capital has proven to be a reliable and effective partner, offering solutions that truly cater to the needs of small business owners like myself.”

Lionell Ball

Inflect Digital

January 2024

“Thanks to QuickBooks Capital, my business has flourished, and I highly recommend their loan services to any entrepreneur seeking financial assistance to fuel their growth.”

Misael Garcia

Five Star Car Services

January 2024