QuickBooks Accountant Desktop 2024

Help your clients get more visibility and control with QuickBooks Desktop 2024

QuickBooks Desktop gives you and your clients visibility across their business so you can help them improve decision-making, efficiency, and productivity.

Our latest tools automate everyday tasks, so you and your clients can focus on business. Bypass busy work and streamline projects so you can do more than ever for your clients.

Enhanced security

You can be confident your data is protected with our enhanced security using industry-leading AES 256-bit encryption.1 QuickBooks safeguards your reputation by protecting critical customer and vendor data, such as business financials, banking information, and credit card details.

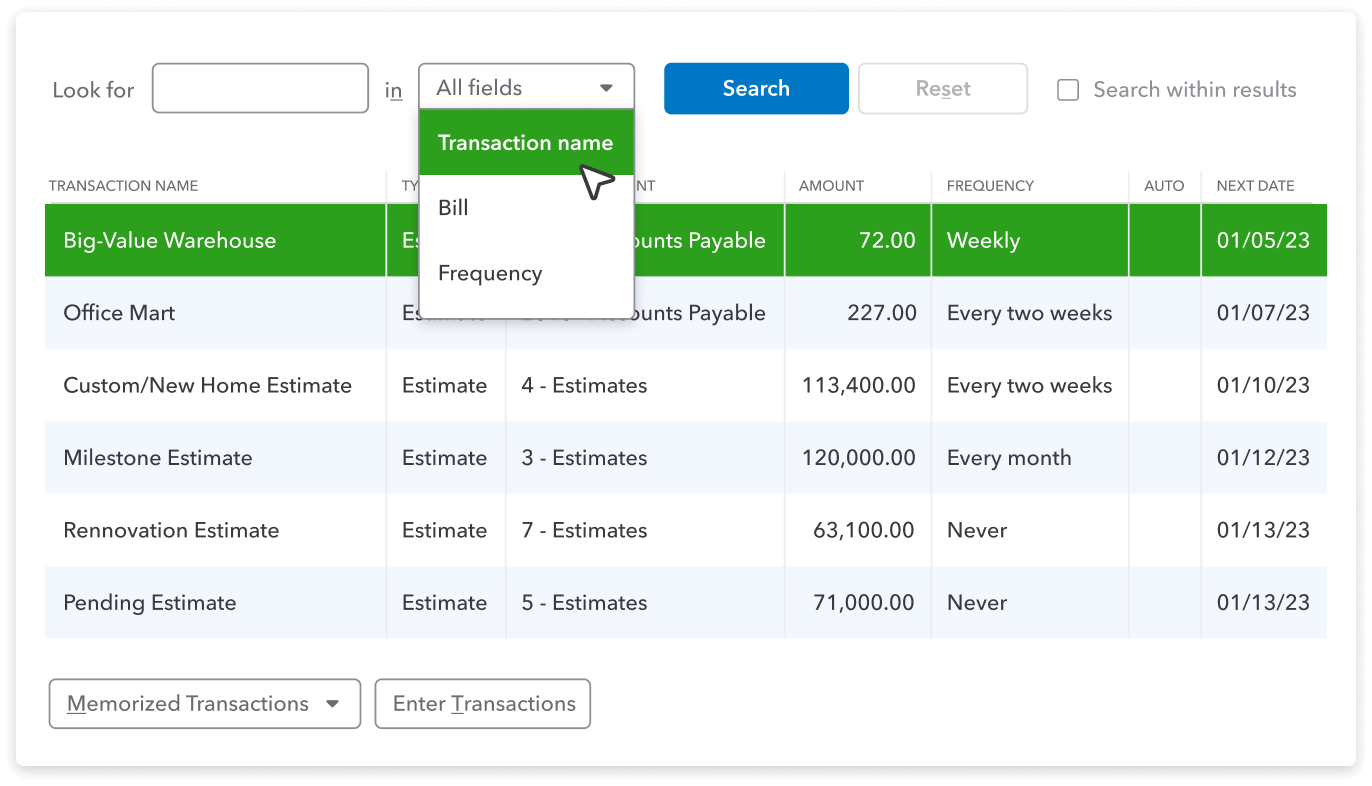

Improved search of item lists

Work faster by using enhanced search to find specific items within a large list of memorized transactions, fixed assets, or payroll items. You can also edit transactions and items by quickly using the search functionality, rather than manually scrolling to find them like before.

Seamless product updates

Now your clients won’t be interrupted by product updates. QuickBooks Enterprise installs them quietly in the background.2 Plus, they can easily learn what product updates are available, and when, so they can decide when to install.

QuickBooks Enterprise Accountant 24.0

Manage customer prepayments

Help your clients improve efficiency, productivity, and the bottom line by easily recording and tracking customer prepayments and deposits on sales orders. Then you can automatically apply that payment when the sales order is converted to an invoice. Give customers transparency and proof of payment through the whole process.

Feature not available with multi-currency

Item category enhancements

Manage inventory more effectively with enhanced multi-level categorization. Improved productivity with enhanced search, add, edit, and delete options. Save time with bulk edits and by copying and pasting from Microsoft Excel to add or edit multiple list entries. Improve the bottom line by setting pricing rules by item categories in Advanced Pricing.*

Pricing rules by categories in Advanced Pricing are available with Enterprise Platinum or Diamond subscriptions only

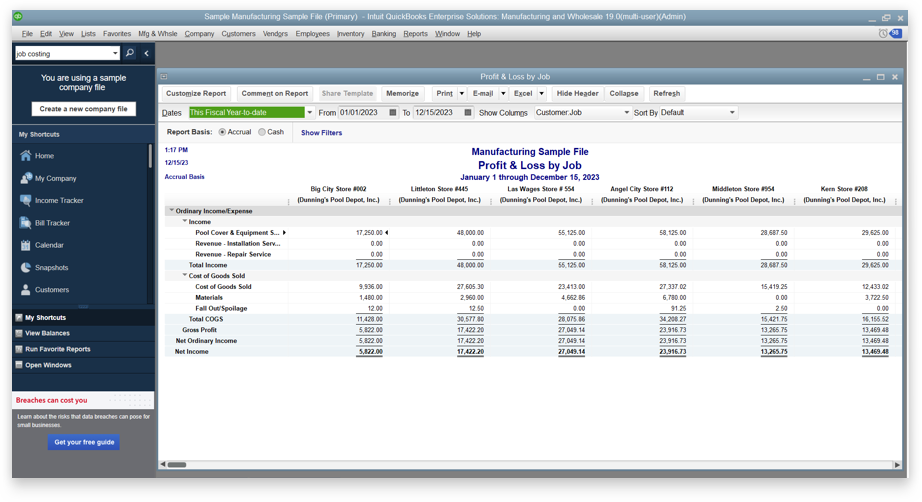

Inventory reports enhancements7

Gain insights, stay on top of sales, and control inventory costs using a hierarchical view of categories in “Inventory Valuation Summary,” “Inventory Stock Status by Item,” and “Sales by Item Summary” reports. Other reports let you track inventory of products developed in the same batch and component quantity used on assemblies and pending builds.

Everything your growing clients need to succeed

Accounting

Productivity that grows with your clients

Your clients’ business may be getting more complex, but your workflow shouldn’t. Enterprise is built to seamlessly pivot between accounting tasks, at scale.

- Up to 40 simultaneous, full-access users8 and 1 million list items9

- Anytime, anywhere access10

- Enhanced Payroll11 with unlimited paychecks

- Multi-entity combined reports

- Preferred rates for credit card payments

- Multi-currency

Business management

Advanced capabilities, accelerated potential

Enterprise doesn’t stop at accounting. With an array of advanced tools, you and your clients can streamline and manage their entire business in one place.

- Advanced Inventory12: FIFO inventory costing, mobile barcode scanning, order tracking and management from a single dashboard

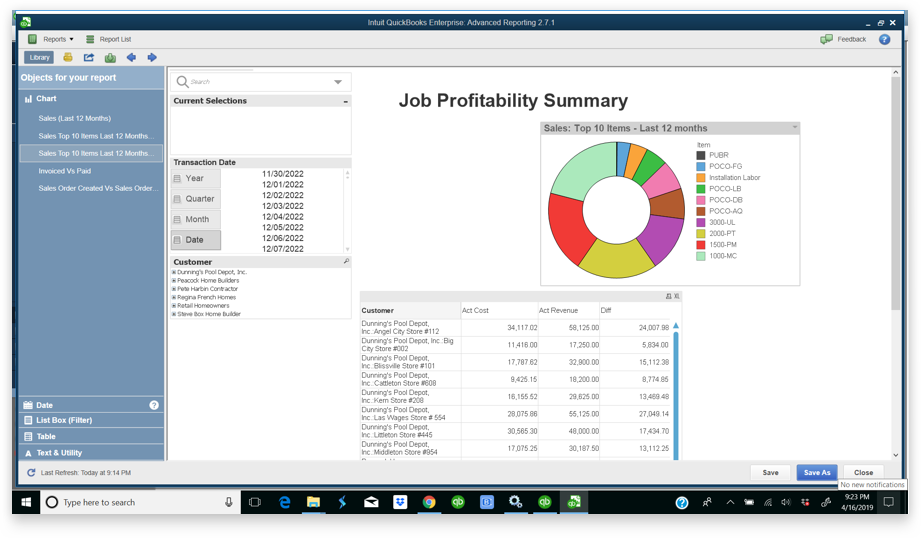

- Advanced Reporting13: Over 200 custom and standard reports to give clients insight into taxes, job-costing, profitability, and more

- Advanced Pricing14: Automated price changes for more control with less labor

Customizations

The right tools for their job

You wouldn’t give a wrench to a lawyer or tracing paper to a plumber. With Enterprise, your clients can customize solutions for success in their industry.

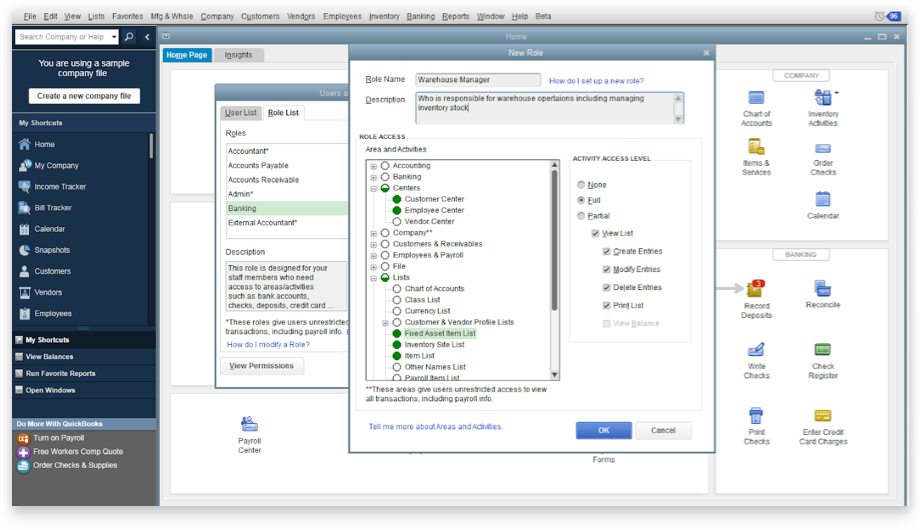

- Custom user permissions for up to 115 activities and 14 pre-defined roles

- Unique Enterprise editions for: manufacturing, wholesale, contracting, accounting, professional services, nonprofit, and retail15

- More than 200 third-party apps, including your preferred e-commerce solutions, integrated with QuickBooks Enterprise16

Call sales to learn more about discounted pricing for your clients: 800-458-3175.

Enterprise training resources

Gain the skills and confidence to support your mid-market clients, all on your schedule.

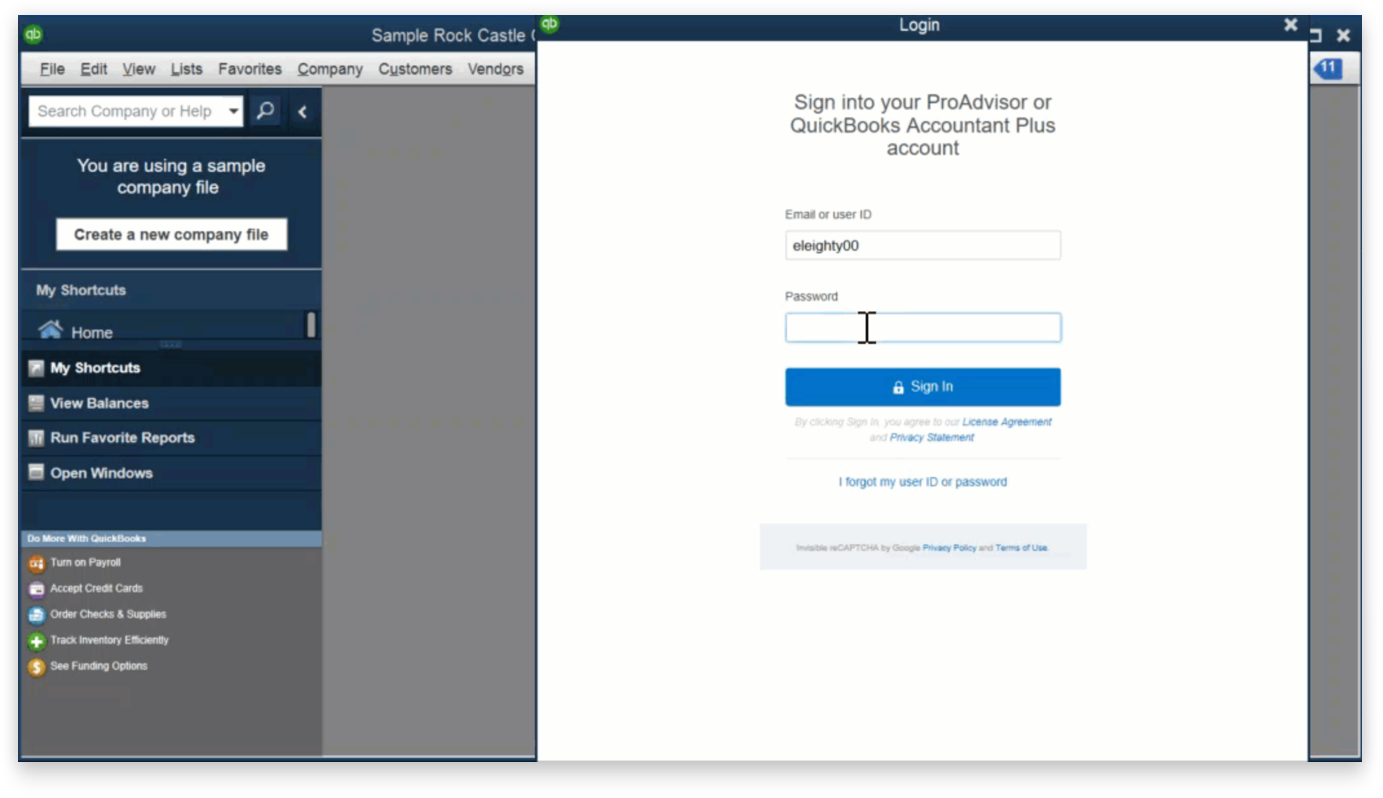

Powerful work, pro perks

ProAdvisor Premier and ProAdvisor Enterprise software bundles include QuickBooks Accountant Desktop 2024.17 Get the software and training you need to maximize productivity, and complete the QuickBooks Desktop Certification to demonstrate your expertise.

$799 /yr*

$1,299 /yr*

To learn more and purchase ProAdvisor Bundles or QuickBooks software for your clients, contact sales at 800-458-3175.

More to love in QuickBooks Desktop Accountant

Powerful productivity

Take action from anywhere with Accountant Toolbox

Get quick access to your most essential tools so you can make your day-to-day feel a whole lot lighter.

- Access your Accountant Toolbox4 from your clients’ QuickBooks Pro or Premier, remotely or in a hosted setup.

- Find and fix entry errors fast with Client Data Review.

- Delete, void, or reclassify hundreds of transactions at once.

- Write off multiple invoices in one screen.

Client collaboration

Their books. Your schedule.

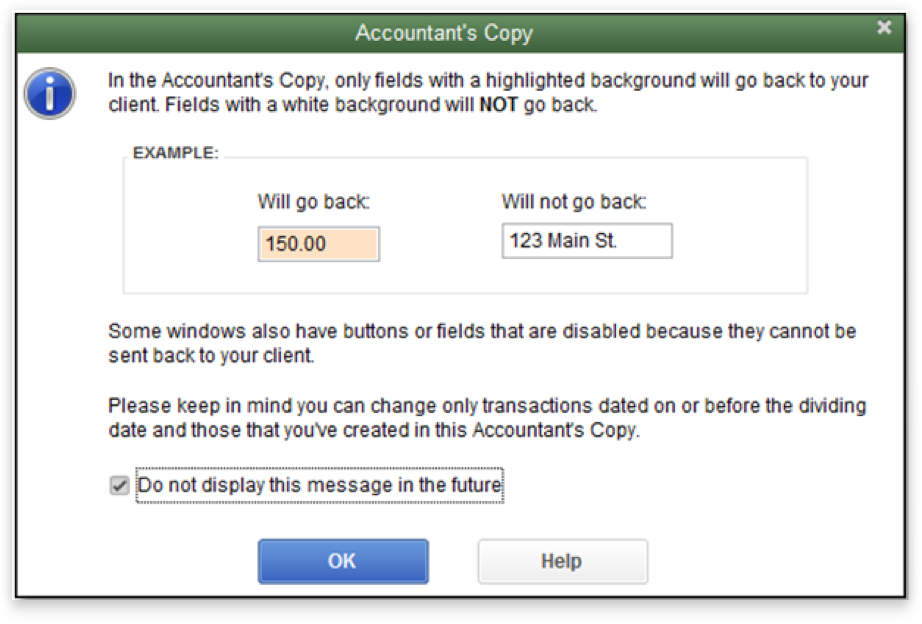

With Accountant’s Copy, you and your clients don’t have to plan work around each other.

- Transfer files seamlessly instead of having to save your work to a computer or thumb drive.

- Work on your own copy of your client’s files, even if clients are working at the same time.5

- Your adjustments are merged quickly and easily.

Work flexibility

Find your sweet spot

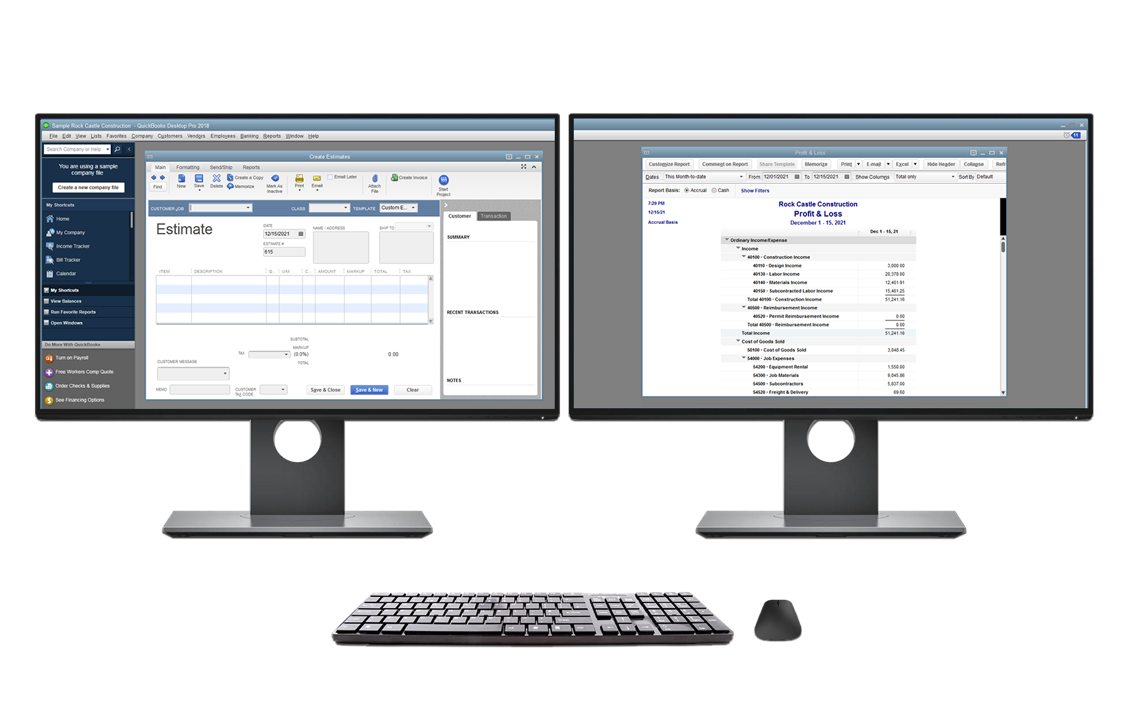

Make it easier to view and access multiple client files and work how you’re most comfortable.

- Tailor your office for enhanced efficiency and productivity with Multi-Monitor mode.6

- Save time by working in two company files at the same time with Multi-Instance.7

- Locate items, accounts, and clients faster with search auto-fill.

- Search a range of values to help recall transaction amounts.

QuickBooks Accountant Desktop Premier Software Bundle

- Quickly create and e-File Federal and state tax forms

- Support up to 50 clients with just one subscription

- Direct deposit for only $1.75 per check

QuickBooks Accountant Desktop 2024 system requirements

System and browser requirements

- Client: Windows 10 (64-bit) , or Windows 11 (64-bit), update/version supported by Microsoft. Windows 8.1, Windows 10 S mode, Windows 11 IOT, and Linux are not supported.

- Server: Windows Server 2016, 2019, or 2022 (Regular or Small Business Server)

- 2.4 GHz processor

- Client RAM: 8GB RAM; 16GB RAM recommended; Server RAM (for multi-user support): 8GB (5 users)

- 2.5 GB disk space recommended (additional space required for data files); Solid State Drive (SSD) recommended for optimal performance

- Plus subscriptions, Payroll, and online features require internet access

- QuickBooks Desktop App access is included with Desktop subscriptions. Must be installed on a camera-enabled mobile device using Android 6.0 or iOS 12 or later

- Product registration required

- Optimized for 1280×1024 screen resolution or higher. Supports one Workstation Monitor, plus up to 2 extended monitors. Optimized for Default DPI settings.

- Google Chrome recommended

Integration with other software

- Microsoft Word and Excel integration requires Office 2016-2021, or Microsoft 365 (64-bit)

- E-mail Estimates, Invoices, and other forms with Microsoft Outlook 2016 - 2019, Microsoft 365 (64 bit), Gmail™, and Outlook.com®, other SMTP-supporting email clients. Integration with QuickBooks POS 19.0.®, other SMTP-supporting email clients. Integration with QuickBooks POS 19.0.

- Transfer data from Quicken 2016-2022, QuickBooks Mac/Mac Plus 2021-2024 (US only) and Microsoft Excel 2016 - 2021, Microsoft 365 (64-bit)