2018 Billing Rate Survey: Billing Rates, Value Pricing and More

Intuit ProAdvisors, Michelle Long, CPA, and Heather Satterley, EA, surveyed more than 1,000 accounting and tax professionals and promoted via social channels. They analyzed results independently to provide an in-depth look at several areas of business, featuring rates and technology adoption.

The 2018 Billing Rate Survey has closed and the results are in! This year, we received responses from all over the world and will share the insights we learned here.

This year’s survey asked a variety of questions related to firm demographics, methods used to bill clients for different types of services, and of course, how much practitioners are charging for these services. New to this year’s survey is how accountants are attracting new business to their firms; we asked a series of questions about referral sources, and the use of social media in marketing and firm growth. We were also curious how billing rates were affected by using automation tools, such as bank feeds, to complete their work.

Who Participated in the Survey?

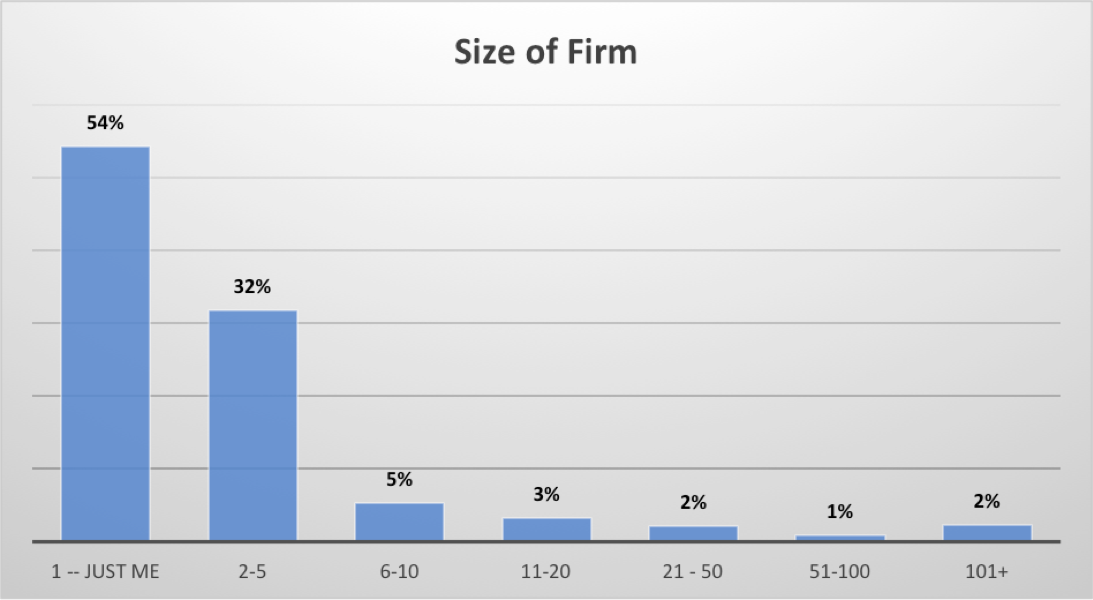

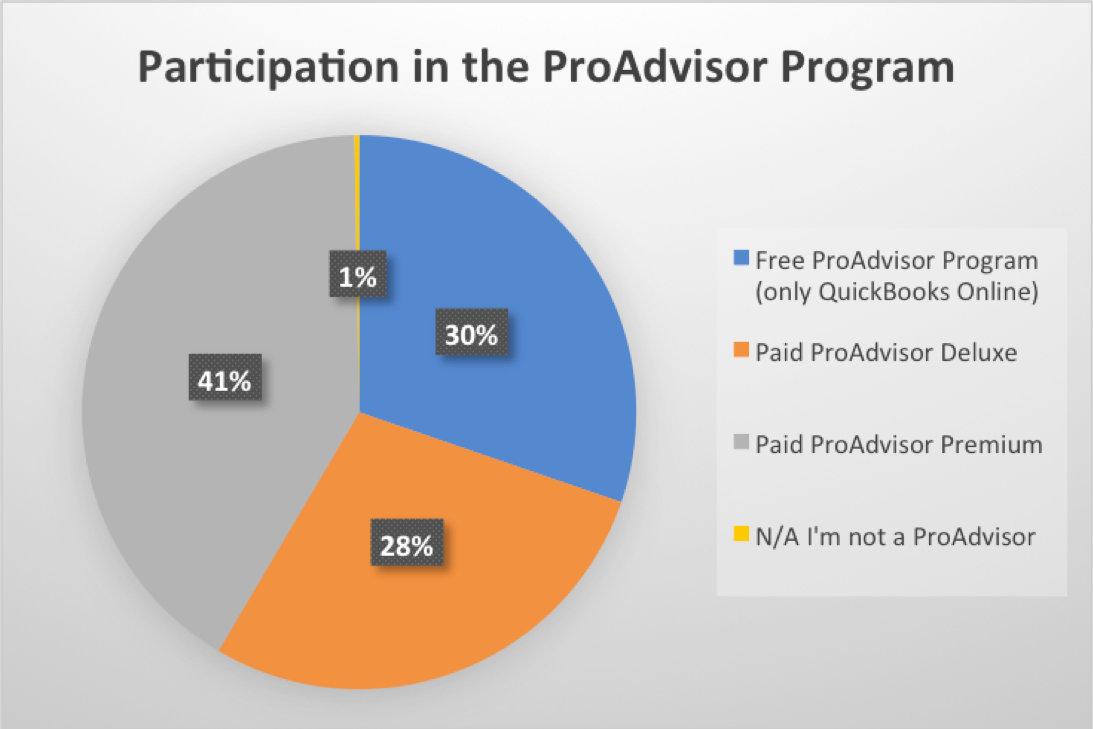

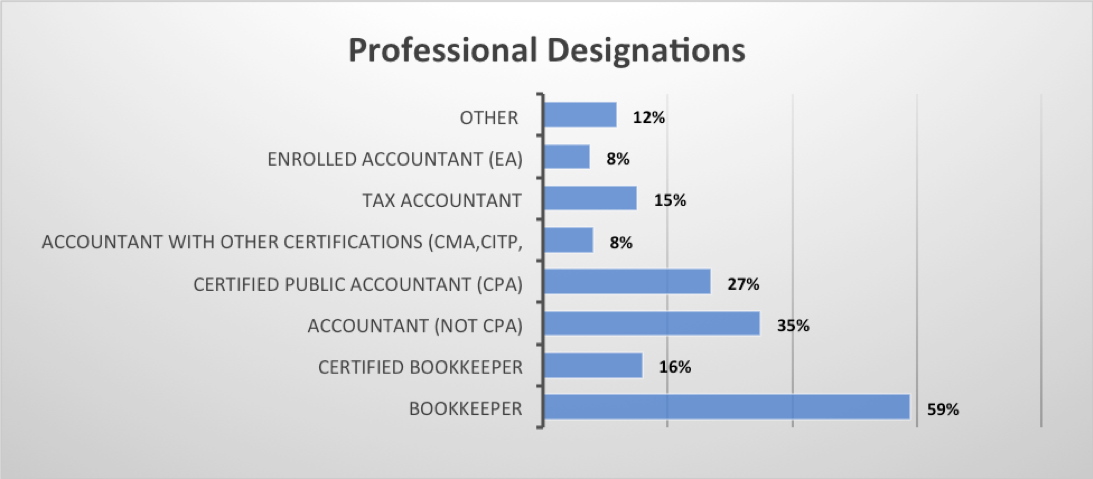

As you can see from the following charts, most of the respondents to the survey:

- were sole practitioners (54 percent) or small firms with less than five employees (32 percent);

- belonged to the QuickBooks ProAdvisor® program, with 30 percent belonging to the free QuickBooks® Online program and 69 percent (combined) belonging to one of the QuickBooks Desktop paid programs; and

- selected bookkeeper (59 percent) or accountant (35 percent) as one their professional designations

Billing Practices

The survey asked practitioners how they billed their clients for various service offerings based on the following definitions:

- Hourly billing based on the hours worked.

- Value pricing based on the maximum amount a given client is willing to pay for a service, typically set before the work begins.

- Value billing is usually marking up – or more frequently marking down – the invoice to the client after the work has been performed.

- Fixed fees with the fee often determined based on estimated hours (or cost) to complete the work.

When billing for QuickBooks-related services, clearly hourly billing is still most widely used for catch-up bookkeeping (75 percent), cleanup and troubleshooting (79 percent), and training (73 percent). Fixed fee billing, on the other hand, is gaining popularity with ProAdvisors who provide monthly services (50 percent) compared to hourly billing (57 percent).

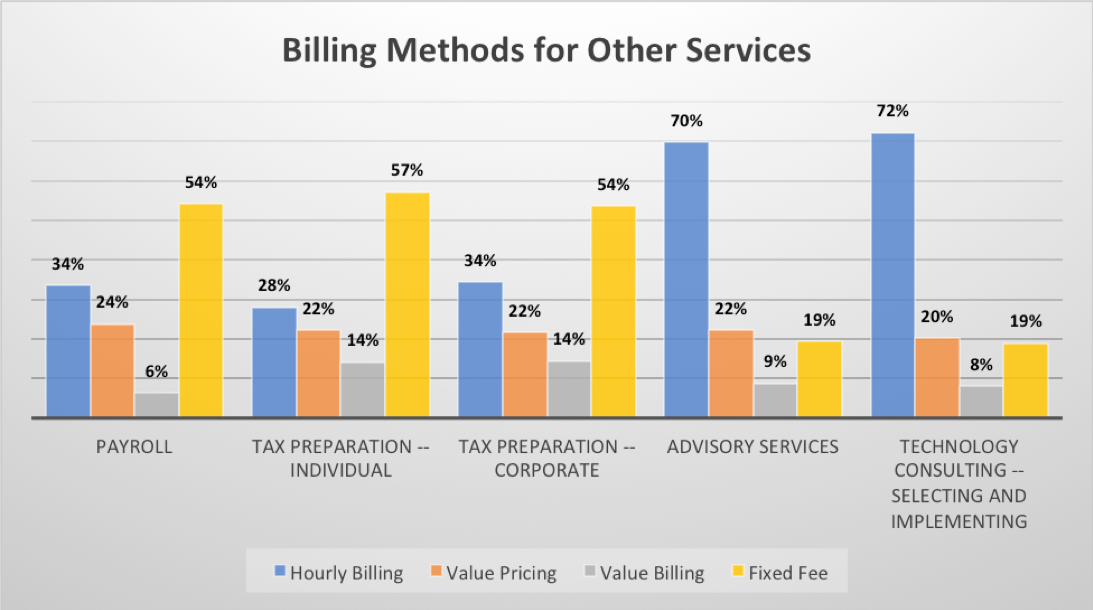

The survey results seem to suggest that accounting professionals prefer to bill hourly for services where there is higher degree of variability about the time and effort needed to complete the work. If the process used to complete a service has been standardized or there is there is lower risk of variability, practitioners are comfortable and even prefer using fixed fees or value pricing to bill their work. But, if the risk of variability is high, they tend to stick with hourly billing to protect the profitability of the job.

What is interesting about this notion is that 73 percent of respondents admitted to discounting or writing down their fees occasionally, suggesting that hourly billing may provide less protection than is perceived.

Average Hourly Rates

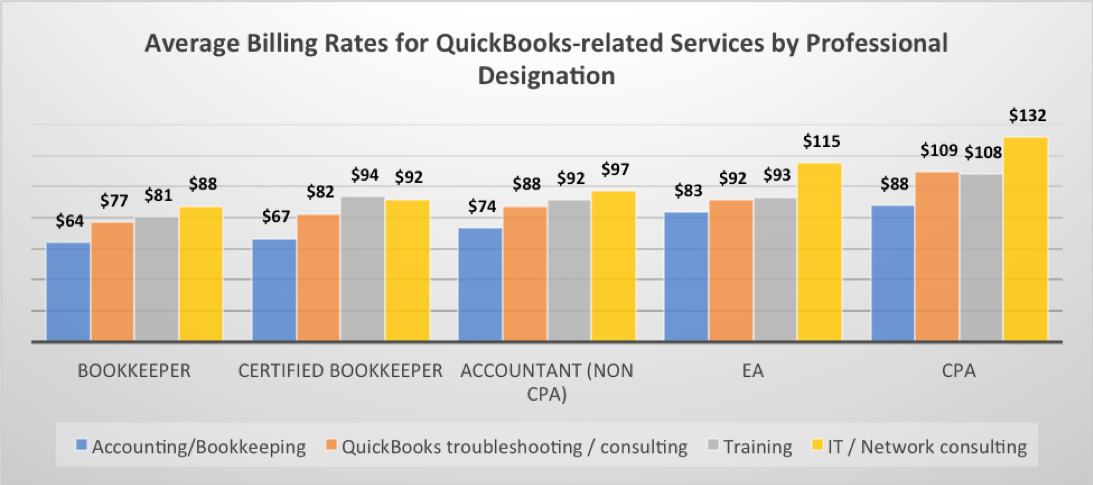

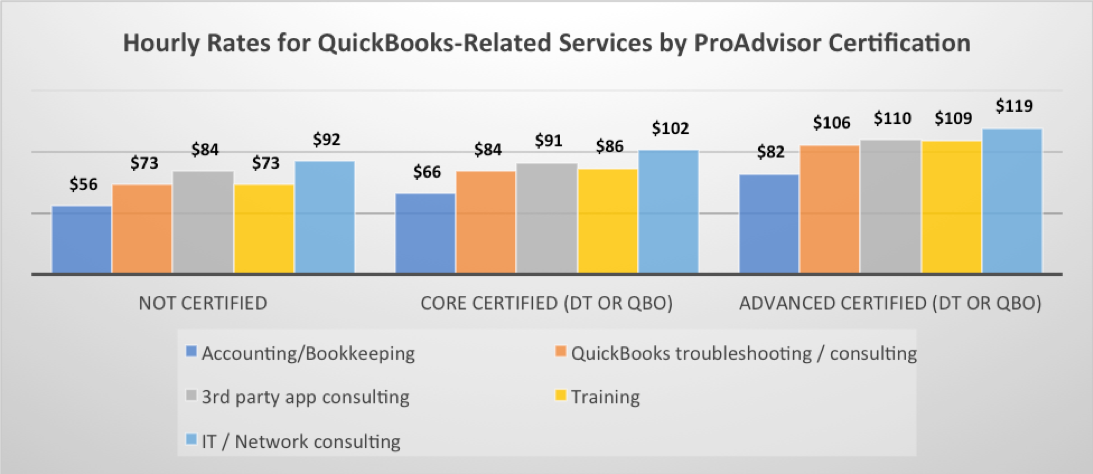

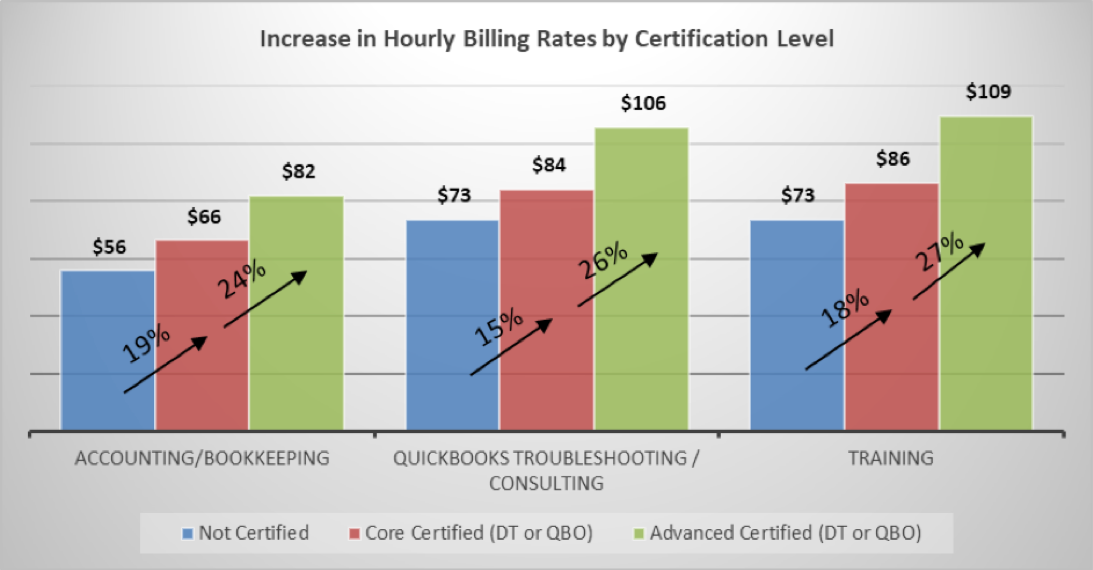

The average hourly rates reported clearly show that the more you invest in your education and certifications, the higher the fee you can command for services. We looked at the average hourly billing rates for QuickBooks-related services by professional designation (CPA, CB, EA) and ProAdvisor certification status. In both cases, the higher the certification, the higher the average hourly billing rate reported. In fact, the average hourly rate increase for top three specific QuickBooks-relates services showed an average increase of 17 percent upon achieving Core Certification and another average increase of 25 percent upon achieving Advanced Certification status.

The big takeaway here is to get your certifications! If you’ve haven’t signed up for the QuickBooks ProAdvisor program or gotten certified yet, you can start your journey to certification today.

Comparison to Last Survey

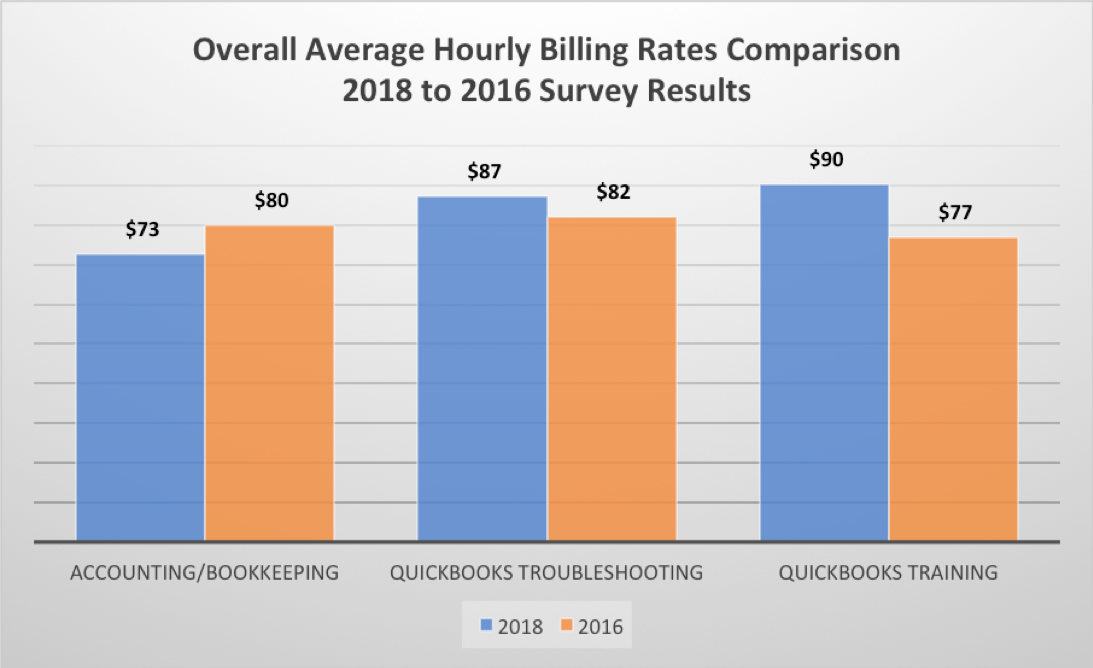

We compared this year’s results to the last time the Intuit Rate Survey was conducted in fall 2016. While there was a slight dip in the average rates for bookkeeping and accounting services ($73 in 2018 compared to $80 in 2016), average rates increased for QuickBooks troubleshooting ($87 in 2018 compared to $82 in 2016) and training services ($90 in 2018 compared to $77 in 2016). We also learned from the 2016 survey that many practitioners use different billing methods for different types of services, so this year we dug a bit deeper by asking which billing methods accounting professionals are using by service type. This will give us insight into how and why different methods are used for different types of services.

It should be noted that there was a change in how we worded certain questions and how people could respond in this year’s survey. For example, in the 2016 survey, respondents were asked to select a single billing method for each type of service they offered, but in 2018, we allowed them to select all methods that applied to them – for example, respondents could select hourly billing and value pricing for the same service. This explains why the total percentages in many of the charts do not total 100 percent.

Once busy season winds down, it’s a great time to evaluate what went well for your firm and identify areas where you can improve you own business practices including your billing methods and rates. Take the time to look back at the accomplishments that you and your team have achieved over the past year; maybe you earned a new certification or other skill that brings additional value to your clients? If so, consider raising your billing rates accordingly.

If you’re still billing hourly, consider exploring other pricing options such as value pricing that can help you boost your profitability as your firm processes become more efficient and automated.

Heather has been an Intuit Certified QuickBooks ProAdvisor® since 1999, achieved her QB Advanced certification in 2007 and her QuickBooks® Enterprise Solutions certification in 2010. She heads up Satterley Training & Consulting and is an Enrolled Agent permitted to practice before the IRS.

Michelle Long, CPA, is the owner of Long for Success, LLC . She is an international speaker for Intuit, co-host of QB Power Hour and Ultimate Accounting vCon, and author of five books, including How to Start a Home-Based Bookkeeping Business & QuickBooks Practice Set. . She has been recognized as one of the Most Powerful Women in Public Accounting, Top 10 QuickBooks ProAdvisors (Top QuickBooks Trainer/Writer and Social Media Leader) and more.

October , 2018

By accessing and using this site, you agree to these Terms of Use for the Marketing Hub.