Simple, smart sole trader accounting software that gives you complete control of your finances.

Capterra

4.3/5

GetApp

4.3/5

Join over

7 million

QuickBooks Customers Worldwide

Google Play

4.3/5

App Store

4.7/5

At home, in the office or on the go.

Your business wherever you are.

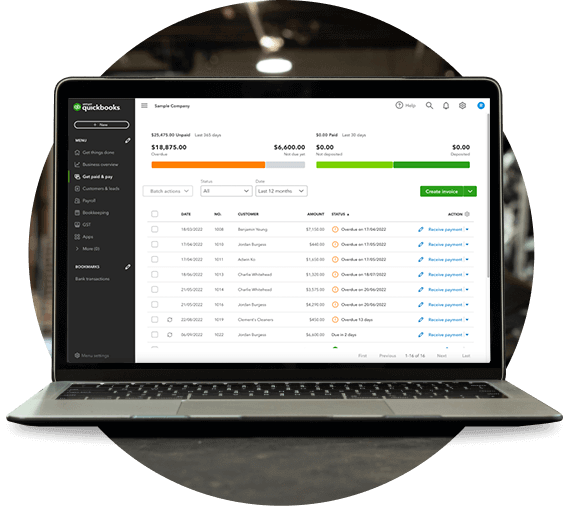

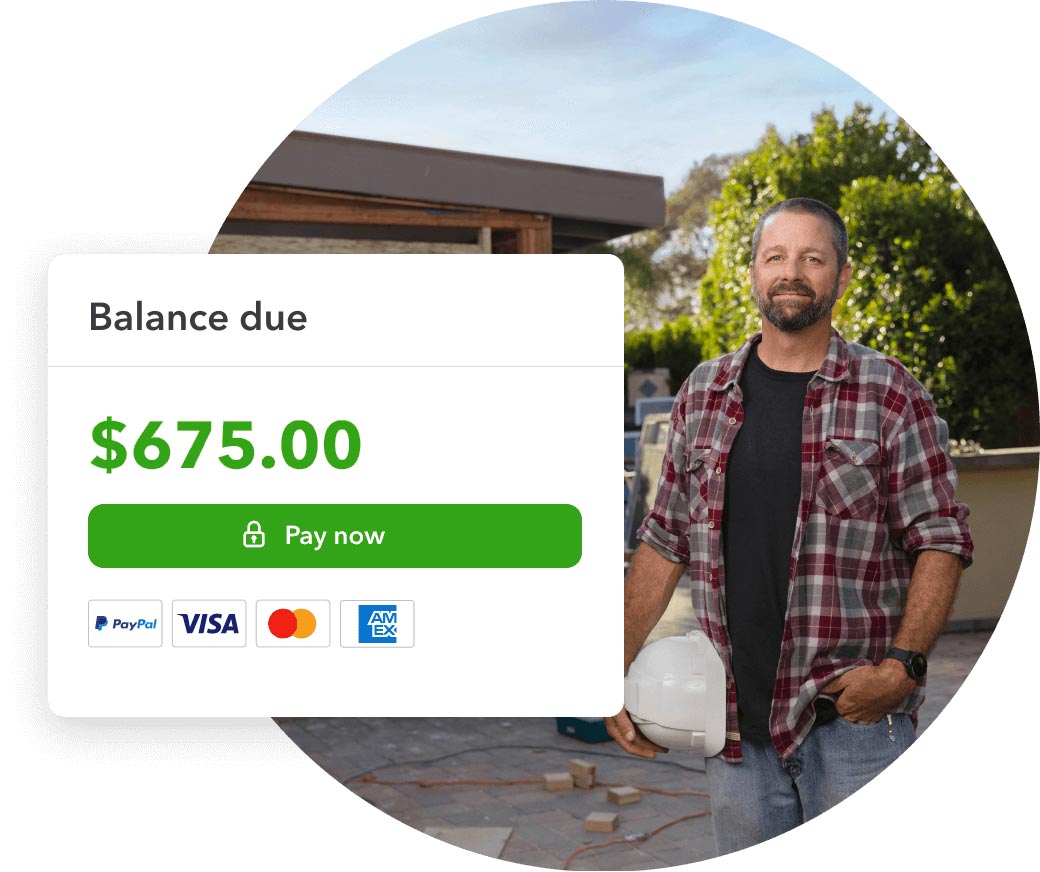

Get paid faster with effortless invoicing

Create and send professional invoices in seconds. See who’s paid and who hasn’t, and follow up with an automatic reminder.

Snap and store receipts

We pull the details right from your receipts, match them to a transaction and categorise it—so you're always ready for tax time. Giving you more time to manage your contracting business.

Never touch a logbook again

Auto track your kilometres and categorise as business or personal. Every 1,000 KMs = $850 in tax deductions*.

Track all income and expenses

Connect your bank accounts, credit cards, PayPal, and more to pull in all income and expenses automatically.

QuickBooks is ideal for Aussie entrepreneurs

Quickbooks is the perfect choice of accounting software for sole traders, freelancers and contractors in Australia. Our software has been designed with small Aussie businesses in mind, so you can rest easy knowing we’re looking out for you.

Not only can quickbooks track your expenses, manage your income and help you get paid, we also make it simple to manage your incoming and outgoing GST. Plus, you can e-lodge your BAS in just a few simple steps. And if you need some extra help, our support team is here for you every day of the week.

Want the best freelancer, contractor and sole trader accounting software in Australia? QuickBooks has you sorted.

Accounting software for self-employed sole traders on the go

Learn how to use QuickBooks for self-employed sole traders with our free self-employed video tutorials.

Start today with no obligations

Find a plan that’s right for you

Free unlimited support

No contract, cancel anytime

The QuickBooks mobile app is free to download

Accounting software for sole traders in all industries

QuickBooks accounting software is used by sole traders, freelancers and contractors across different industries. Learn how QuickBooks features help self-employed business owners manage their bookkeeping and stay on top of their business finances.

Get paid

3

days faster

Insight

Get invoices paid 3 days faster with the QuickBooks mobile app.

*"Get invoices paid three days faster" based on QuickBooks Online users in Australia sending invoices from the QuickBooks mobile app compared to QuickBooks Online web in 2023. QuickBooks users were customers for the full duration of 2023.

Customer success stories

Customer success stories

“QuickBooks helps a lot. It doesn’t matter where I am, I can keep an eye on what’s going on. We’ve integrated it with the ATO, which makes my life so much easier. It gives me so much confidence that now when I am overseas I can actually take time to rest”