For accounting professionals. Not an accountant?

QuickBooks Online Accountant Pro Tax

File taxes faster online

Fly through tax season with Pro Tax built into QuickBooks Online Accountant. Manage your books, run reports, and file returns all in one place.

Connect with us at 1-800-250-9845

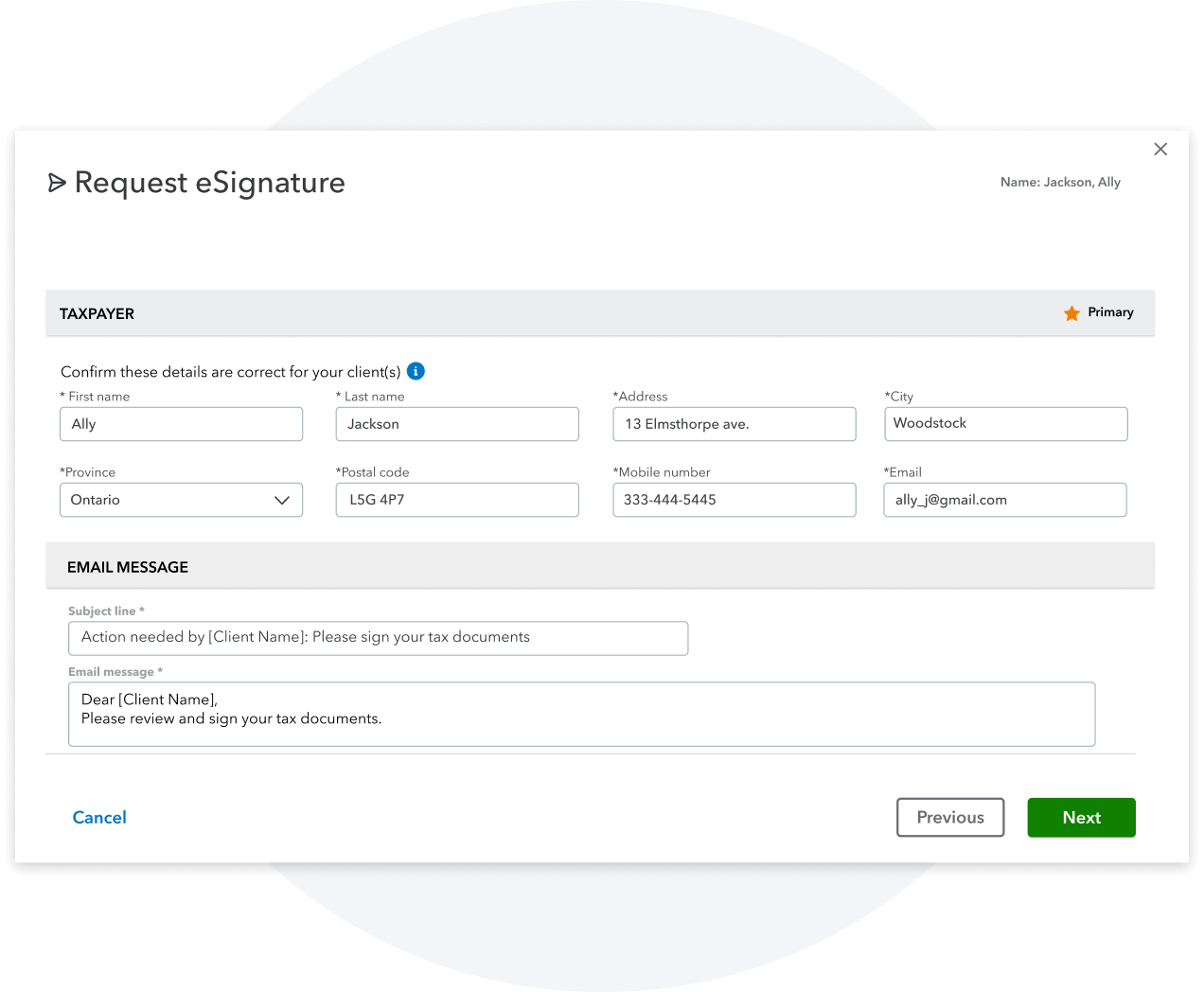

Collect unlimited digital signatures in Pro Tax

Use Intuit Sign in Pro Tax at no additional cost

- Collect unlimited digital signatures on documents, right from Pro Tax. See the full list of supported documents.

- Stay compliant with the CRA—we’ll add a date and timestamp to every signature and store your documents for seven years.

- Track signature requests with real-time updates when docs are opened and signed, and send reminders to clients when signatures are due.

- Request multiple signatures on a single document for the T1032 form.

- Attach up to five documents in a single request to streamline the e-signature process with your clients.

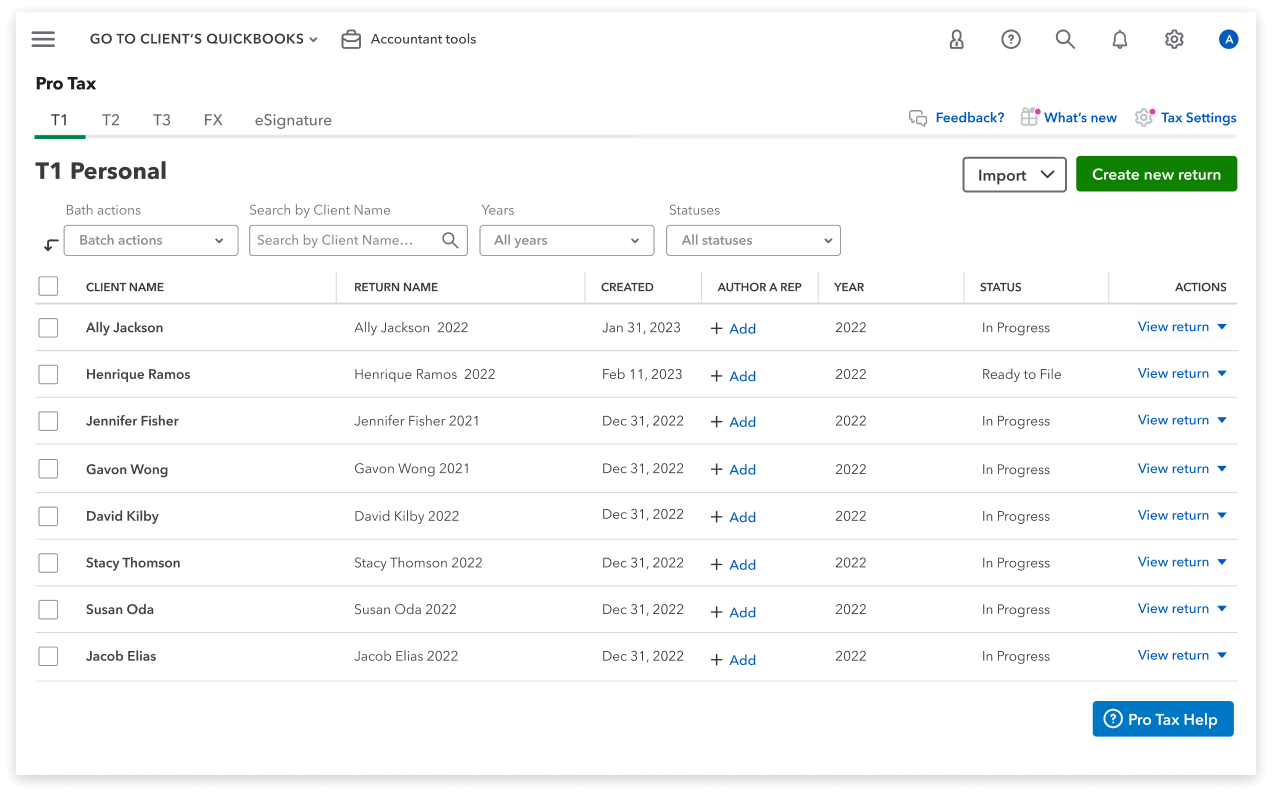

Streamline year-end tax preparation and filing

Handle virtually any tax scenario with a full suite of tax software

With Pro Tax you can:

- Easily and accurately file unlimited returns in one place1

- Enjoy peace of mind with automatic cloud backup1

- Allow your team to access, update, and share information anytime, anywhere

- Streamline every client’s taxes – even if they aren’t in QuickBooks Online

- Access, store, and file unlimited forms, slips, and worksheets with Forms Expert (FX)

- Year-round free product support4

Pro Tax features

Built-in auditor

The Active Auditor marks issues as you work and consolidates warnings, sign-offs and issues for easy reviewing.

Full form sets for English Canada

You’re prepared for virtually all T1, T2, and T3 returns so you can support every client and scenario.

Comprehensive search tool

Easily find forms, features, and help resources fast within Pro Tax.

Customizable printing

Print, export, and send tax return PDFs in the format that works best for you.

Easy client letters

Create customizable client letters and populate with data imported from QuickBooks and Pro Tax.

Return link sharing

Easily share a secure link to tax returns with members of your team.

Save time and money filing taxes

- Unlimited digital signatures, T1 returns and EFILEs

- Auto-fill my return

- T1 express data-entry

- Unlimited digital signatures, T2 returns and EFILEs

- Built-in auditor

- Year-over-year carryforward

- Unlimited digital signatures, T3 returns and EFILEs

- Comprehensive forms available (EN)

- File faster with T3 express

- Comprehensive forms and worksheets (EN)

- Import T4 data from Excel

- Charity Returns, NR4, T4/T4A, and more

Québec forms are not included

You will need a free QuickBooks Online Accountant login to access Pro Tax

Québec forms are not included

You will need a free QuickBooks Online Accountant login to access Pro Tax

Québec forms are not included

You will need a free QuickBooks Online Accountant login to access Pro Tax

Need to file just one return?

OnePay lets you purchase a single return when you're ready to file.

T1: $50/return

T2: $300/return

T3: $160/return

OnePay is not available with Forms Expert.

Our customers share their experiences

“My favourite feature has got to be the auditor. It's super timesaving and allows me to have a work-life balance.”

Dorothy Sela

Director at CFO Inbox

“Being a cloud accounting firm, it's really important for us to have a cloud tax product. It's all right there, easy to access for everyone.”

Helina Patience

CPA, CMA at Entreflow Consulting Group

“It’s the one ecosystem where you know you can trust the data. It flows through from the client's book, all the way to the tax return.”

Jason Hastie

Founder & CEO at TenjaGo