Hello there, Barb.

To handle after-tax deductions like employee repayments, you can create a New Payroll item and map it to a specific account. Here's how:

- Go to the Payroll tab, then select Employees.

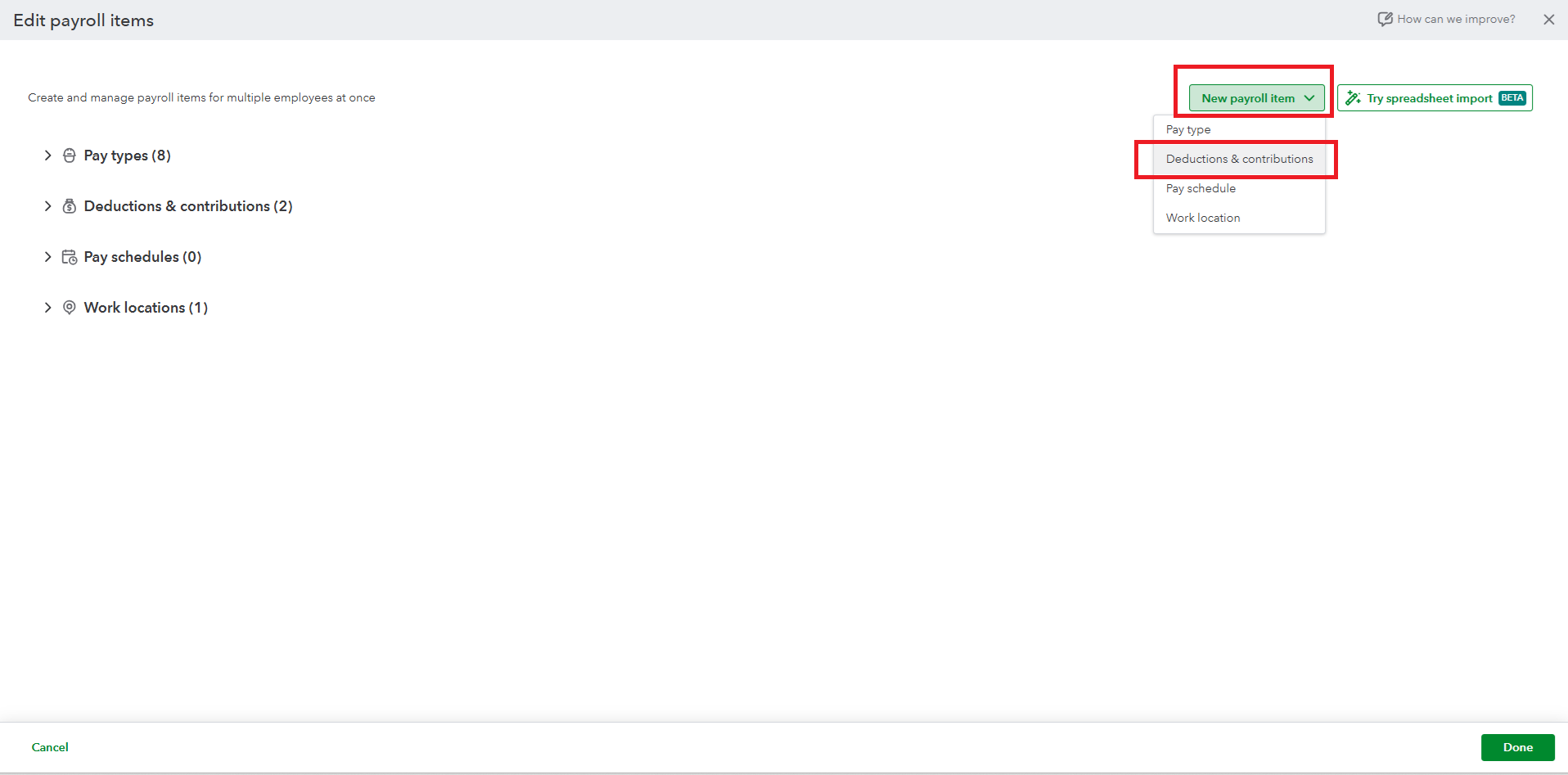

- Click Edit payroll items.

- Hit the New payroll item dropdown.

- Select Deductions & contributions.

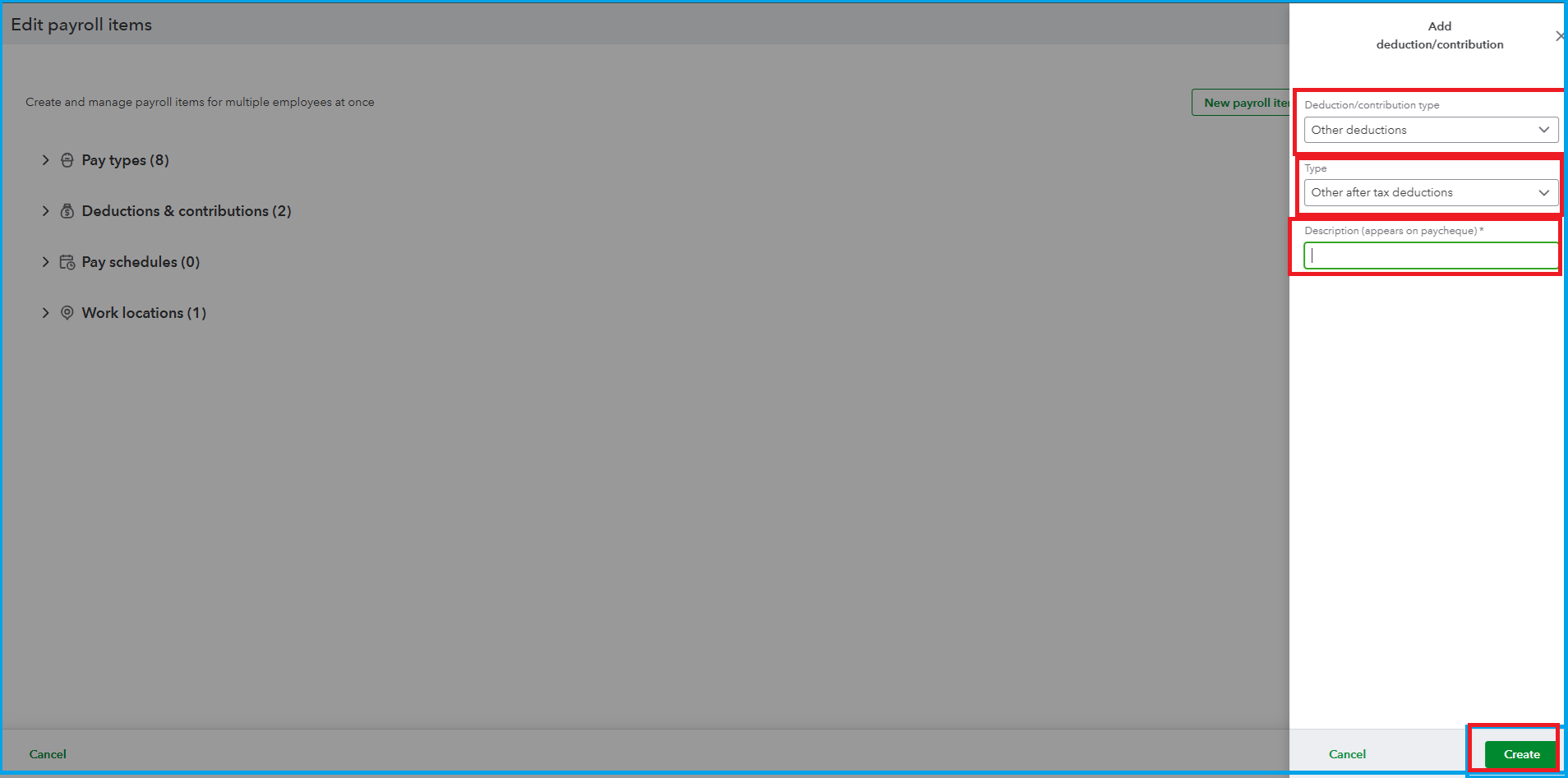

- For the Deduction/contribution type, choose Other deductions.

- And for the Type, select Other after tax deductions.

- Enter the Description, then click Create.

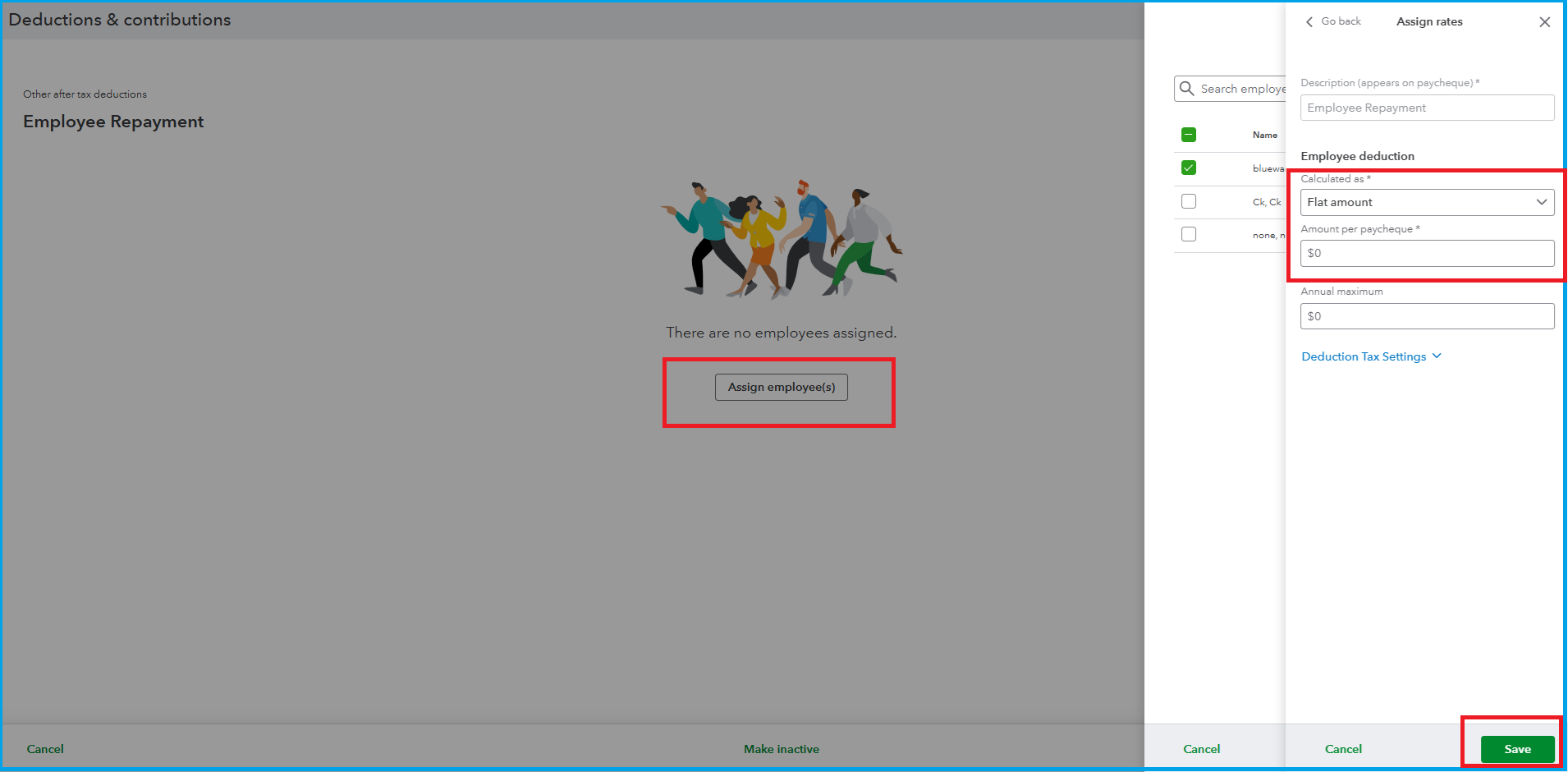

Once done, you'll need to assign the created payroll item to the specific employee. Here's how:

- Select Assign employee and hit Next.

- Enter the deduction amount.

- Click Save.

To track the money they repay, create a specific asset account in your Chart of Accounts.

If you have any further questions, please use the Reply button below. We are always here to assist you.