Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

QBO automatically created a record of payment noted as paid outside of QBO, but I don't know how to match my bank transactions to it. They are multiple, and include processing fees so don't exactly match up with the tax payment. When I try to 'match' , the tax payment from qbo system doesn't appear.

Matching transactions is a critical part because it ensures that the financial data in your books aligns with the actual activity in your bank account, David.

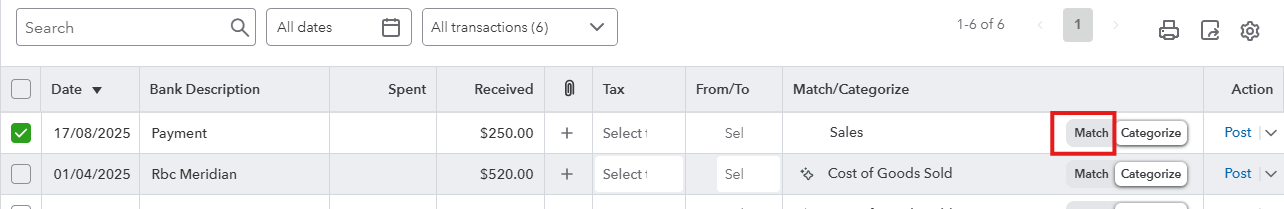

If this record of payment is the tax payment that includes fee and which gives you hard time when matching transactions, this should show up on the list of your transactions once you have already entered it in QuickBooks. If found, click Match in the Bank transactions page.

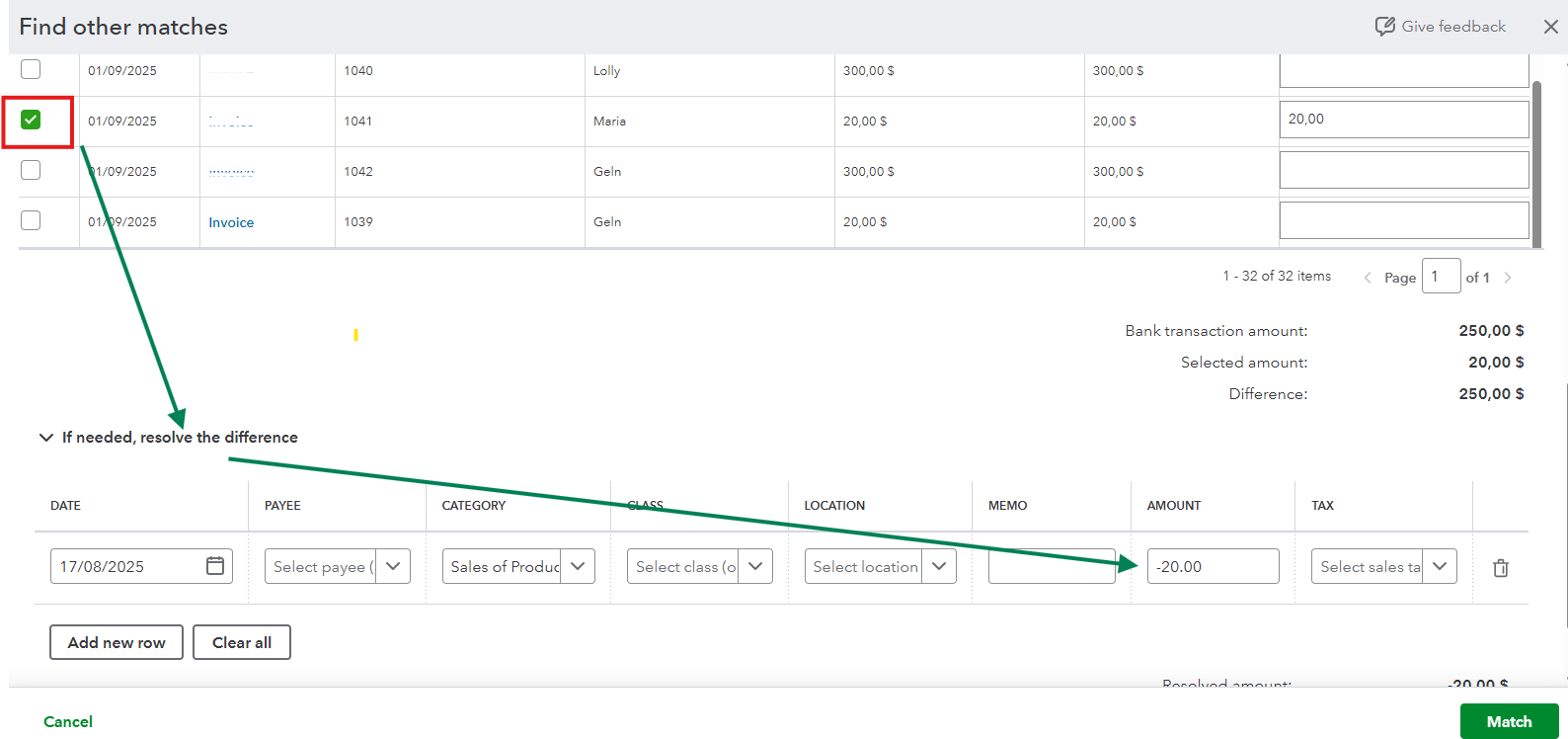

Next, go to the If needed, resolve the difference section and enter the fee as negative amount, then click Match.

This will now fix the payment difference until it equals to zero.

To learn more on how to review and undo matches, check out this article for your reference: Match your bank and credit card transactions.

If you need further help when matching payroll tax payments, always remember that we're always right here for your. Just let us know so we can assist you.

Hi Maria,

Thanks for getting back to me. My issue is that the payroll tax transaction (accessible via payroll > payroll tax > tax payment history), which is marked by QBO as paid out manually, does not appear in the page shown in your second screenshot.

Thanks

I appreciate you getting back to the thread and following the steps provided by my colleague, David.

To begin with, to ensure the payroll tax payment can be matched correctly, you need to ensure that you're selecting the bank account that you used to pay the actual payment. Also, make sure to filter the date when matching by the date the tax was paid.

It's also important to confirm that the bank account used to record the payment in QuickBooks matches the one used for the actual payment. If they don't align, QuickBooks won't be able to find a match. To ensure they match, you can delete and record the payment again and use the correct bank account.

Here's how:

Deleting and re-creating the payment won't result in a duplicate; it's simply for record-keeping purposes. Once this is done, you should be able to go back to the banking menu and match it successfully.

If you have any follow-up questions, feel free to click the reply button.

Hi,

I followed your instructions but again was not shown the option to match the transaction.

Thanks

Thank you for following the instructions provided by my colleague above, David.

Since you've tried all the above steps and the option to match the transactions is not appearing, I recommend reaching out to QBO Support directly. They will be able to identify the cause of the issue and provide a resolution.

Here's how to do it:

You can start a live chat with a support expert Monday through Friday from 8:00 AM to 9:00 PM ET, and Saturday from 9:00 AM to 6:00 PM ET. Also, you can either request an immediate callback or schedule an appointment for a specific time. English-speaking support is available for callbacks and appointments Monday through Friday from 9:00 AM to 8:00 PM ET, while French-speaking support is offered Monday through Friday from 9:00 AM to 6:00 PM ET.

Please leave us a response if you have any other questions or need further assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here