You can review the sales tax for expenses and revenue in QuickBooks Online by generating a Balance Sheet report, @sfaraz-husain.

Sales tax doesn't appear directly in the Profit and Loss report as it is classified as a Liability type. But, if you really want to see them in a Profit and Loss report, there is a workaround to see the sales tax. Follow the steps below:

- Open the Profit and Loss report.

- Drill down into the transaction by clicking the amount in the Expense section.

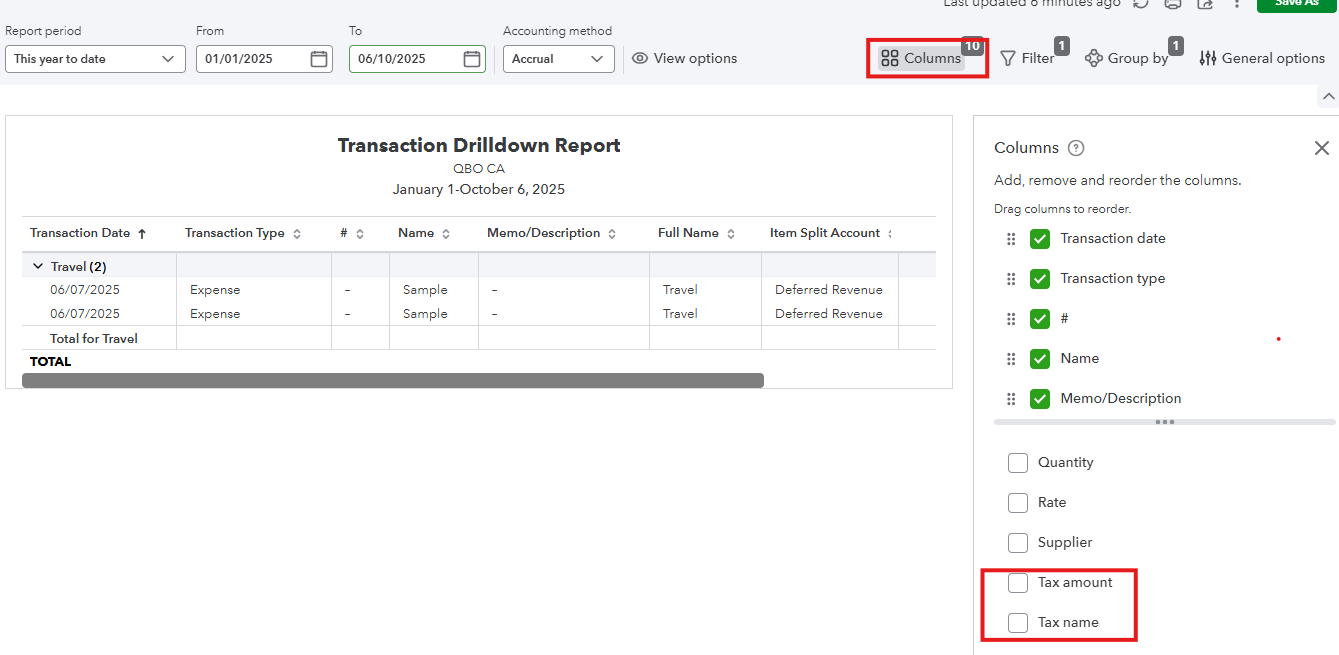

- Click the Columns button and the Tax amount and Tax name by ticking the check boxes.

The Profit and Loss statement should now reflect the sales tax when you drill down into the transaction.

Leave a comment below if you have any additional questions about the Profit and Loss report in QuickBooks Online.