Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Can you please give me a journal entry to post so that I can clear a fixed asset off of the Balance Sheet? There was an old truck that was parted out but still shows on the balance sheet and I need to clear it off. Im not sure which account to use for the journal entry. Thank you.

Hi Milo123,

Making sure you take care of these sorts of situations is an essential part of bookkeeping. To determine which accounts you need to pick for your journal entry, I recommend consulting an accountant. That way, you can be sure you're picking the ones you need to correctly remove this from your balance sheet.

There are a number of accountant users in this community that may be able to give insight on this situation. QuickBooks can also help you find an accountant familiar with the program through our Find a ProAdvisor website. Simply type in your postal code, hit the Find a ProAdvisor button, and then use begin your search. There are also filtering options that can help you narrow down the results you're seeing.

Enjoy your day!

Has the truck been disposed of? If so, was the sale of the truck, in whole or in parts, recorded as a sale against the asset? If this is so, you would do the following with the remaining balance:

1. If the balance in the vehicle asset account is positive (meaning you sold the asset for less than it's book value):

DR Gain/Loss on Sale of Fixed Assets (set up as an Other Income account in your GL)

CR Vehicles (asset account where original purchase of vehicle was recorded)

2. If the balance in the vehicle asset account is negative (meaning you sold the asset for more than it's book value):

DR Vehicles

CR Gain/Loss on Sale of Fixed Assets (set up as an Other Income account in your GL)

Usually, by the time an asset has been sold or disposed of, the sale yields more than the depreciated book value of the asset so scenario number two would be the most common. For this reason, I set up my Gain/Loss on Sale of Fixed Assets as an Other Income account. You would have to be okay with seeing a negative number on the other income account if you had sustained a loss rather than a gain on the sale of the asset.

However, there would be nothing preventing you from setting up two accounts; 1) Other Income acct for Gain on Sale of Fixed Assets and 2) Other Expense acct for Loss on Sale of Fixed Assets, and using them accordingly, depending on whether the sale of the asset has netted a gain or a loss.

I will try this thank you.

I have tried this, but the asset still shows up in the balance sheet with $0. Here is what I did:

In quickbook 2016, trying to record a sales loss

- Created an account "asset profit", type "other income", tax line "not tax related"

- GL entry for car account, decrease $1737 with account "asset profit"

This decreased the account for car to $0, but it didn't take it off of the balance sheet

Hello, @Jim003.

Let me have the pleasure to help check your entry further.

If the fixed asset is already showing up in the balance sheet with $0.00, it means that the account is no longer have an existing balance.

If you wish to exclude the account (with zero balance) on the Balance Sheet report, you can manually deselect the account when running the report.

I'd also suggest checking with a professional accountant to help record your transactions accordingly.

In case you have any other QuickBooks concerns in the future, you can always check our help articles: Help articles for QuickBooks Desktop.

Keep in touch if you have any other questions, I'm always available to help!

As soon as the balance in the vehicle asset account is at $0.00, it should no longer show up on your balance sheet. Note, here is a balance sheet as of 07/31/19 showing two Fixed Assets accounts with balances:

Journal Entry to post sale of computer asset on 08/26/19:

Balance Sheet as of Aug 26/19 (after above JE has been posted):

Note that the Computers are not present on the balance sheet after the JE that effectively reduced the asset's balance to NIL.

I'm not quite sure why you would still be seeing the asset on the Balance Sheet if your entry has been made correctly. Keep in mind that all QB reports are date driven; not sure if that has anything to do with it or not. As a check and a balance, also check out your Fixed Asset account register to make sure all is well there:

If you are at all concerned with complying with generally accepted accounting principles or IFRS, I suggest you change the name of your "asset profit" account to "Gain on Sale of Fixed Assets". It will just make your financials easier to read by an outside bank or accounting firm, if or when necessary.

I hope this helps somewhat. I believe your account should come off the Balance Sheet once it is truly reduced to $0.00, but if it doesn't, something is causing it and you might have to dig a little deeper into your entries to find out why. If all else fails, until you find a solution, you can do what the previous poster suggested and de-select that account in your reporting account filters, or inactivate the account altogether.

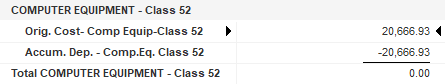

One other reason I can think of which would keep your assets on the Balance Sheet when the account is $0.00 is if you're using a contra-account for Depreciation under the main Asset heading as below:

I soled a vehicle.I record the sale of vehicle, but could not select the vehicle from the list of vehicle.

I'm having the same issue. All of my asset accounts have Accum Deprec and Cost accounts as sub-accounts, but even when they are set to inactive they still print on the Balance Sheet. I attempted the method described by Angelyn_T to filter the report via Multiple accounts, but that method does not allow me to choose the Net Income and Retained Earnings which are needed in my case. Well, it allows me to choose Retained Earnings, but will not print it on the report even though it's selected. Net Income is not in the list to choose and also does not print on the report.

The accumulated depreciation and cost sub-accounts are how I was taught. It sounds like that is not correct anymore?

What is the simplest way to change current from contra account?

Hi 19QBSiebert.

Finding the best and easiest way to change accounts is a great idea. I'd be happy to point you in the right direction for this.

I recommend consulting your accountant on how what is the best way to switch accounts. This way, you can be sure you're picking the right one for your needs.

There are a lot of accountant users in this community that may be able to give information on this. You can also find an accountant familiar with the program through our Find a ProAdvisor website. Simply type in your postal code, hit the Find a ProAdvisor button to search for one in your area. There is also a filtering options that can help you narrow down the results you're seeing.

If you have any questions let us know and we'd be happy to help.

Hello @Anonymous ,

The reason they are still printing on your balance sheet is because although the main asset account is at a $0.00 balance, the contra accounts are not. They would have to be brought to $0.00 to get them to stop printing on reports. I suggest that you create a clearing account, if you haven't already. I use a bank account type and call it Internal Clearing. Clear out the contra accounts with the internal clearing account. This removes the positive and negative balance from your asset contra accounts and nets to $0.00 also in the internal clearing account.

Net result is that all three accounts (two contra accounts and internal clearing account) will all be $0.00 balances and none will print on your reports going forward. Because it is a $0.00 transaction across the board, it wouldn't really matter when you date the transaction, but presumably, of course, after the last entry in the contra accounts for depreciation.

Hope that helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here