Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Limited time only. 90% off QuickBooks for 6 months.

xyzHi there, @yessicka-liznick. I can guide you on how to record a GST/HST refund from a previous year in QuickBooks Online (QBO).

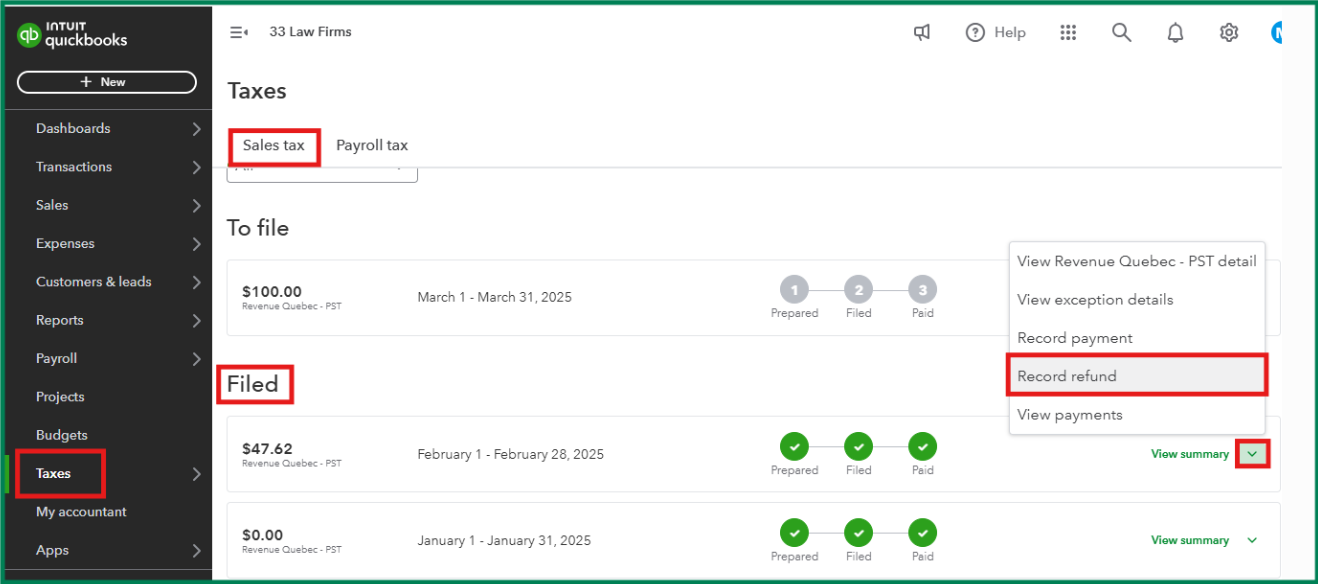

In QuickBooks, you can record the refund through the Taxes page.

Here's how:

Click the drop-down arrow to the far right and select Record refund.

Enter the Amount, Date, and Bank account then click Record refund to save.

For more tips about handling your sales taxes in QBO, you can open this article: File sales tax.

Feel free to leave a comment below if you have any other questions about tracking your GST/HST refund. I'm just a few clicks away to provide additional assistance. Wishing you a good one!

I don't see any previously filed tax returns in my account. How do I input that I received the gst and qst refund from a previous year?

did you get the answer?

Are you looking to record a GST/HST refund from a previous year that hasn't been tracked in QuickBooks Online (QBO), @JW360? If so, I'll guide you through the steps below to help you get it sorted.

Here's how:

Also, you can check out this article for more details: File sales tax in QuickBooks Online.

If you need a report that lists the transactions included in each box on the GST/QST combined return in QuickBooks, you can run the GST/QST Detail Report or GST/HST Detail Report. Check out this article for guidance: Run a report in QuickBooks Online.

Feel free to post a comment below if you have any other questions or clarification about tracking your GST/HST refund. We're just a few clicks away to provide additional assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here