Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have to post a general journal entry - and break out the hst included in the price.

Fuel 86.96 (D)

HST 13.04(D)

Owners Draw 100.00 (C)

But when I post it, I don't see it in the HST collected report.

I can't do it in the Enter a bill section, as the payment method is owners draw - I am just filling in for the bookkeeper who is sick, and I was instructed not to change anything. ie adding another payment method)

Hi dutchy1,

Welcome to Community! It's important that the applicable sales tax is posting correctly in your QuickBooks Desktop account. I'd be happy to provide more insight here, so you're on the right track with your QuickBooks goals!

When creating a general journal entry it's important to add the sales tax to the item and not as a separate line item. This prevents it from showing on the reports because it's not applied to a specific item.

If you require additional assistance to ensure you're back to business as soon as possible, please don't hesitate to contact us. Your success is our number one priority and we'd be glad to assist!

Feel free to reach back out if you have other questions. We're here for you!

So if I am reading your reply correctly, I would post 100.00 to fuel and not break out the HST. And trust the system to break it out?????

Just to confirm, dutchy1. When you run the report, is it in accrual basis or cash basis? The reason I ask is that the report amounts can report differently due to the accounting method, I recommend verifying the method you're using on your report. You can change this setting while running your reports by selecting the Cash or Accrual radio buttons under Accounting method.

I am using accrual

I see what's happening. In order for you to see the amount on the report in question, you'll have to add the taxes in your journal entry as you normally would instead of breaking it down as line item. This helps make sure your tax transactions are recognized by the tax module in QuickBooks which is where the tax data on reports is derived from.

My accountant gave adjusting entries for the HST account but by posting them as a journal directly to the HST account I do not see it reflected in the HST detail report . How do I put them in so that my report shows it ?

Thanks for joining the thread, @C-C1.

I just want to confirm if your accountant have attached the sales tax item on the journal entry? Also, I would appreciate it if you can send us a screenshot of the JE that was created,

In the meantime, if the accountant followed Trish_T's advise to add a sales tax item, but the report still didn't include the changes, I highly recommend that you check in with our Support Team.

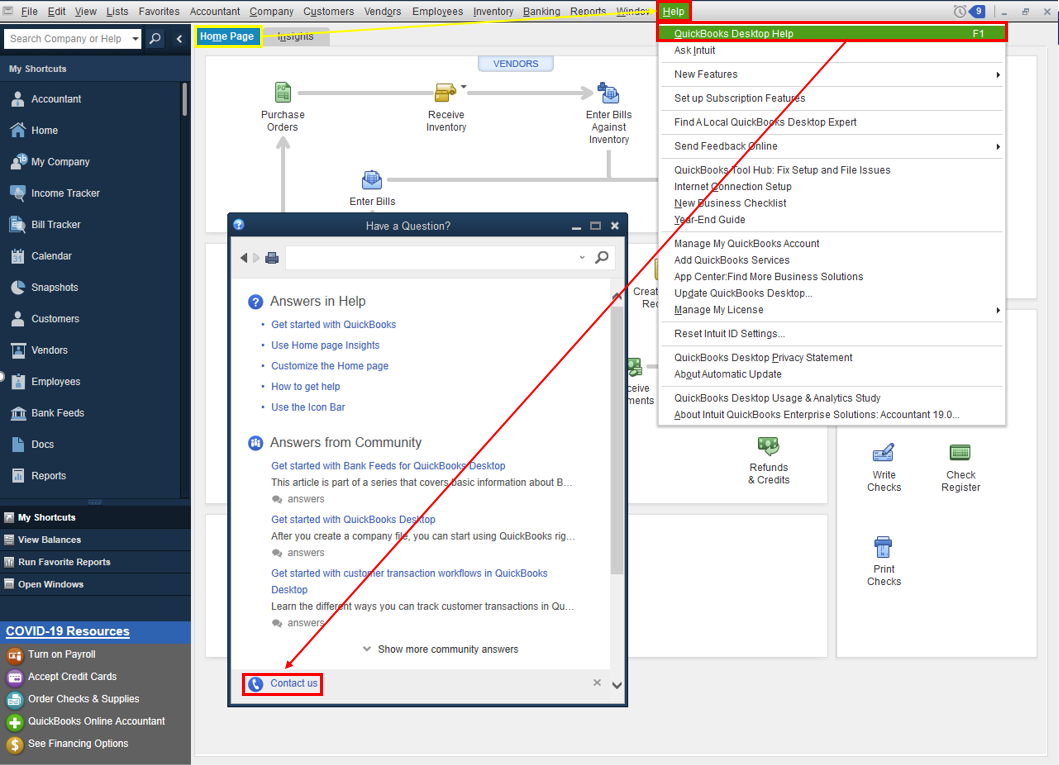

To get in touch with our QuickBooks Support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

Please update this thread for the additional details and updates. I'll be on standby to help you resolve this reporting concern.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here