- Software with you in mind

- QuickBooks for accountantsSupporting you and your clients

- Pricing for accountantsWhatever your practice needs, there's a plan for you

- Client onboardingWe'll get them up and running

- MailchimpThe perfect partners for your practice

- Be found by new clientsIn our Find-a-ProAdvisor directory

- Referral programmeGet £200 in Amazon vouchers

- Switch to QuickBooksMove to us from another solution

Become a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level. - online Accounting for sole traders

- QuickBooks for sole tradersEverything you need to know

- Pricing for sole tradersWhatever your business needs, there's a plan for you

- Onboarding as a sole traderSet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks Self-employedSoftware for sole traders not registered for VAT

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- Connect appsSeamlessly connect 300+ apps to QuickBooks

features for sole traders - Grow your business

- QuickBooks for limited companiesEverything you need to know

- Pricing for limited companiesWhatever your business needs, there's a plan for you

- Onboarding as a limited companySet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- StartupsGrow your business from day one with QuickBooks

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- QuickBooks AdvancedDiscover our most powerful plan yet, made for growing businesses

- Connect appsSeamlessly connect 300+ apps to QuickBooks

- Plans & Pricing

- Talk to us: 0808 168 9533

- How can we help you today

- QuickBooks support hubWe're here to support you through every step

- Getting startedEverything you need to get set up for success

- Desktop to OnlineHow to switch from QuickBooks Desktop to QuickBooks Online

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- Switch to QuickBooksMove to us from another solution

- QuickBooks OnlineOur range of simple, smart accounting software solutions

Invoices & expensesBanking & Payments - Sign in

The QuickBooks guide to

Making Tax Digital

for accountants & bookkeepers

MTD for accountants & bookkeepers

Making Tax Digital rules are changing. Plan ahead with QuickBooks to make sure you and your clients are ready ahead of the April 2022 deadline and beyond.

Explore our bridging software for accountants or continue reading for a timeline on MTD events.

Small business owner? Try the QuickBooks' making tax digital software.

Your personal guide

Answer a few questions to build a customised guide to preparing your practice for Making Tax Digital, based on what matters to you.

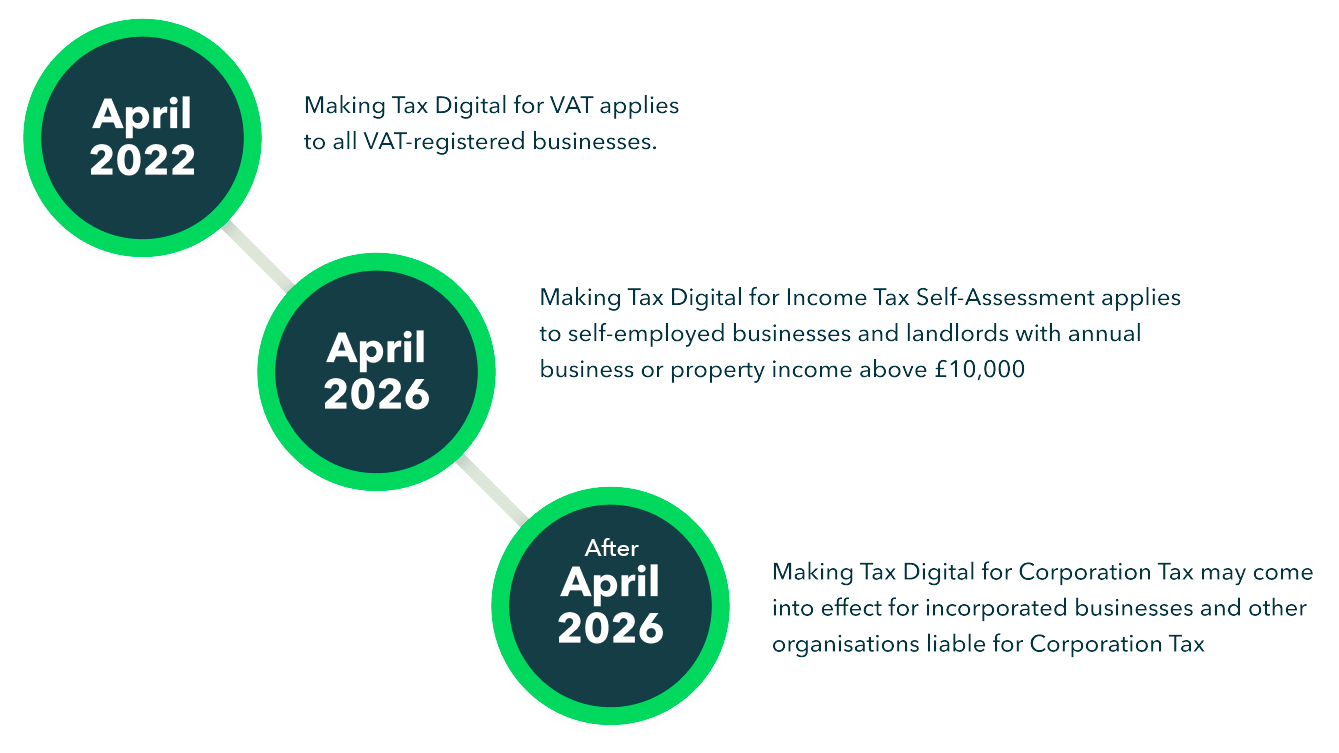

YOUR MTD TIMELINE

What’s happening when?

An accountant’s guide to the key dates for MTD for VAT, MTD for ITSA and MTD for Corporation Tax. With tips for getting your clients ready.

FIRST UP

MTD for VAT

As you’ll know, MTD for VAT is already law for all UK businesses if their annual turnover is more than £85,000.

What’s next?

From 1 April 2022, all VAT-registered businesses will have to comply, regardless of their turnover.

April 2022

MTD for VAT

What does this mean?

It means that HMRC won’t accept manual entries on VAT returns any more. All info will have to be submitted using digital links.

COMING UP IN 2026

MTD for Income Tax Self-Assessment (ITSA)

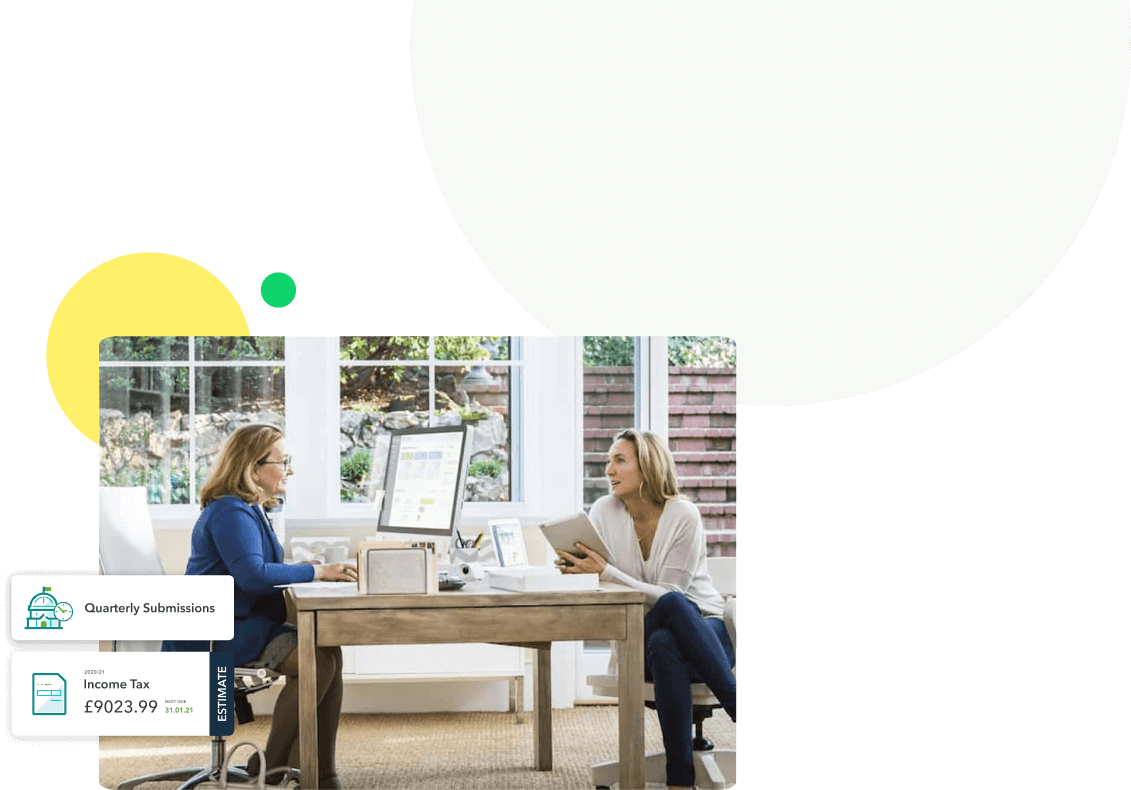

Originally due to take effect in 2023, MTD for ITSA will now launch in 2024. From that date, self-assessment taxpayers will have to make quarterly submissions to HMRC. They can alter these submissions up to the time that the final figures are due.

The idea is to make tax returns more accurate. It should also make them more manageable for you and your clients by avoiding that mad rush in the run-up to 31 January. Another upside is that MTD for ITSA will help business owners predict how much tax they’ll have to pay – and plan accordingly.

April 2026

MTD for Income Tax Self-Assessment

Who’s liable and who’s exempt?

It’s important to understand who will – and who won’t – be affected by MTD for ITSA.

From April 2026, people and organisations liable for MTD for ITSA

will have to:

- Keep electronic accounts and bookkeeping records

- Make quarterly submissions

- Produce an end of period statement using accounting software

This gives you a great opportunity to:

- grow your practice – clients will need support from accountants they see as experts on MTD for ITSA

- spread your work more evenly over the year

- develop your role as an advisor, not just a number cruncher – with piles of paperwork a thing of the past, you’ll have more time to build your client relationships

LOOKING FURTHER AHEAD…

MTD for Corporation Tax

The government has held a consultation on MTD for Corporation tax. No date has been confirmed yet.

After April 2026

MTD for Corporation Tax

Want to know more about the consultation?

The consultation explores how the principles established for Making Tax Digital could be implemented for Corporation Tax.

HMRC consultation updateA WORD ON PENALTIES

Missing a filing deadline

As part of MTD, HMRC has introduced a points-based penalty system for late submissions and payments.

Bear in mind that it’s the client, not their accountant, who’ll be fined for a late submission or payment. So if you miss a deadline on behalf of a client, you won’t be out of pocket, but it may cost you that client.

Penalties

Missing a filing deadline

We’ve set out how all this will work in our blog

The penalties for not complying with Making Tax Digital regulations.

Take me thereTO SUM UP, THEN

Your MTD timeline

To sum up, then

Your MTD timeline

Your MTD questions answered

Ask the expert

Got a question about MTD? Chances are we’ve already answered it. We’ve got accountants responding to your most popular queries - check out the videos now.

Learn moreMTD - your next steps

Support for your practice

Free resources designed to help your clients and practice get up to speed with MTD.

Check them out

Talk to our MTD team

Got a question about QuickBooks for MTD? Provide your details and one of our experts will be in touch.

Get in touchMTD with QuickBooks

Learn how our easy-to-use software can help you and your clients make a seamless transition to MTD.

Find out moreFrequently asked questions

Support for your practice and your clients

Tap into a host of free resources designed to educate your clients, get your team up to speed and support your practice’s growth in the run up to MTD.

Talk to our MTD team

Client handouts

Not sure how to explain Making Tax Digital to clients? Our downloadable client handouts have all the answers you need.

Access the MTD client handouts

Insider's guides to MTD

We've prepared three handy guides that will help you to prepare your practice for MTD. Download one or all three.

Access the Insider's guides

MTD for VAT templates

Easily communicate with your clients to get them up to speed with MTD for VAT requirements using these handy templates.

Download the templates

Create your personal MTD guide

Answer a few questions to build a customized guide to Making Tax Digital.

Understanding the new penalty reform system with HMRC

From April 2022, HMRC will be introducing a new points-based system for all VAT-registered businesses. Watch this webinar to learn more about the new rules around late submissions & late payments, who they apply to and how you can ensure your clients stay compliant.

MTD HMRC penalties for your clients

What penalties could clients face for not following Making Tax Digital regulations? See what they are and how to avoid them in this summary of the HMRC proposal.

MTD bridging software: what is it?

Find out about our Making Tax Digital bridging software in this quick guide for accountants.

MTD - top tips for landlords

Find out how Making Tax Digital will affect landlords registered for VAT and why you should be taking steps now to get ready.

Making Tax Digital compliance

Read our five-point guide to Making Tax Digital compliance. Follow these steps to make sure you're compliant with HMRC legislation.

Why MTD software beats spreadsheets for HMRC

Read QuickBooks UK’s guide to MTD business software and learn why you should ditch the spreadsheets to comply with new HMRC legislation.

Making Tax Digital VAT: are there exemptions?

Not every business has to follow HMRC's new Making Tax Digital VAT rules. See if you are eligible for an exemption with this guide from QuickBooks.

Basis Period Reform

What this means for your practice and your customers

HMRC webinar on Making Tax Digital for VAT

On-demand webinar: MTD for VAT Phase 2. Is your business ready?

What MTD for ITSA means for your clients with HMRC

Watch this interactive webinar with HMRC and discover what MTD for Income Tax Self Assessment means for your clients and how to start preparing your practice now.

Making Tax Digital rules for success

Get ahead of the new Making Tax Digital rules with our four-step guide for accountants.

Penalties for not complying with MTD

Not sure about the penalties for Making Tax Digital regulations? Find out what they are and how to avoid them in this short summary of the HMRC proposal.

Making Tax Digital deadlines for VAT

Discover everything you need to know about the Making Tax Digital deadlines for VAT. From who has to register to digital links - we cover it all.

MTD tools to make tax easy

Looking for tools to help you streamline MTD for your practice? In this guide, we break down how QuickBooks products and programs support your practice.

A guide to bridging software

Learn about how QuickBooks’ bridging software helps spreadsheet users and clients with complex VAT needs keep compliant.

Your MTD for Phase 2 Readiness Plan

Getting ready for MTD now means you and your clients can stay stress-free. Watch this webinar to see how to prepare for Phase 2.

MTD for ITSA: Prepare your practice now for a stress-free 2026

MTD for ITSA will affect your self-employed and landlord clients. Watch this on-demand webinar to learn how to prepare for the 2026 deadline.

Understanding the new rules around 'digital links' with HMRC

We've teamed up with HMRC to explain the new rules around 'digital links'. Watch this webinar to discover what counts as digital data, what qualifies as a digital link and when manual adjustments are allowed.

Understanding Agent Service Accounts with HMRC

Making Tax Digital is expanding and that means spending more time in your HMRC services account. Watch this webinar with HMRC and learn why all advisers need an Agent Services Account, how to set one up and what's next for MTD.

Understanding the new penalty reform system for late VAT returns and payments

Watch this webinar to understand the changes to the default surcharge regime for late VAT returns which has been replaced with the new points-based system from January 2023.

AccountingWEB and QuickBooks: Be MTD ready

Get your practice ready for the next phases of MTD with this step-by-step guide from leading tax expert Rebecca Benneyworth.

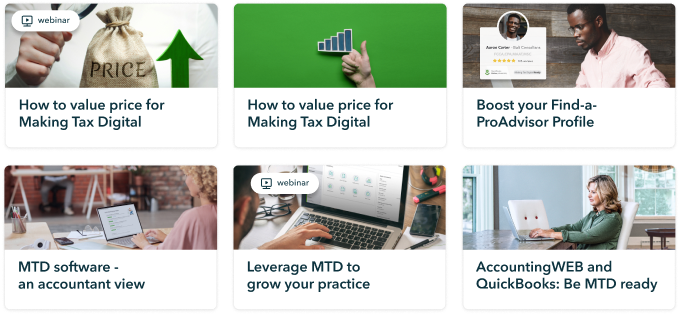

How to value price for Making Tax Digital

Discover value-based pricing for MTD for accounting firms. This useful article from Mark Wickersham will help you get paid what you're worth.

Webinar: How to value price for Making Tax Digital

Mark Wickersham breaks down how to use value pricing for Making Tax Digital in this on-demand webinar.

MTD software - an accountant's view

Accountants are choosing QuickBooks Making Tax Digital software to deliver the best service to their clients. Find out why.

Leverage MTD to grow your practice

Take advantage of the MTD opportunity to grow your client base and optimise your practice. Watch this on-demand webinar to find out how.

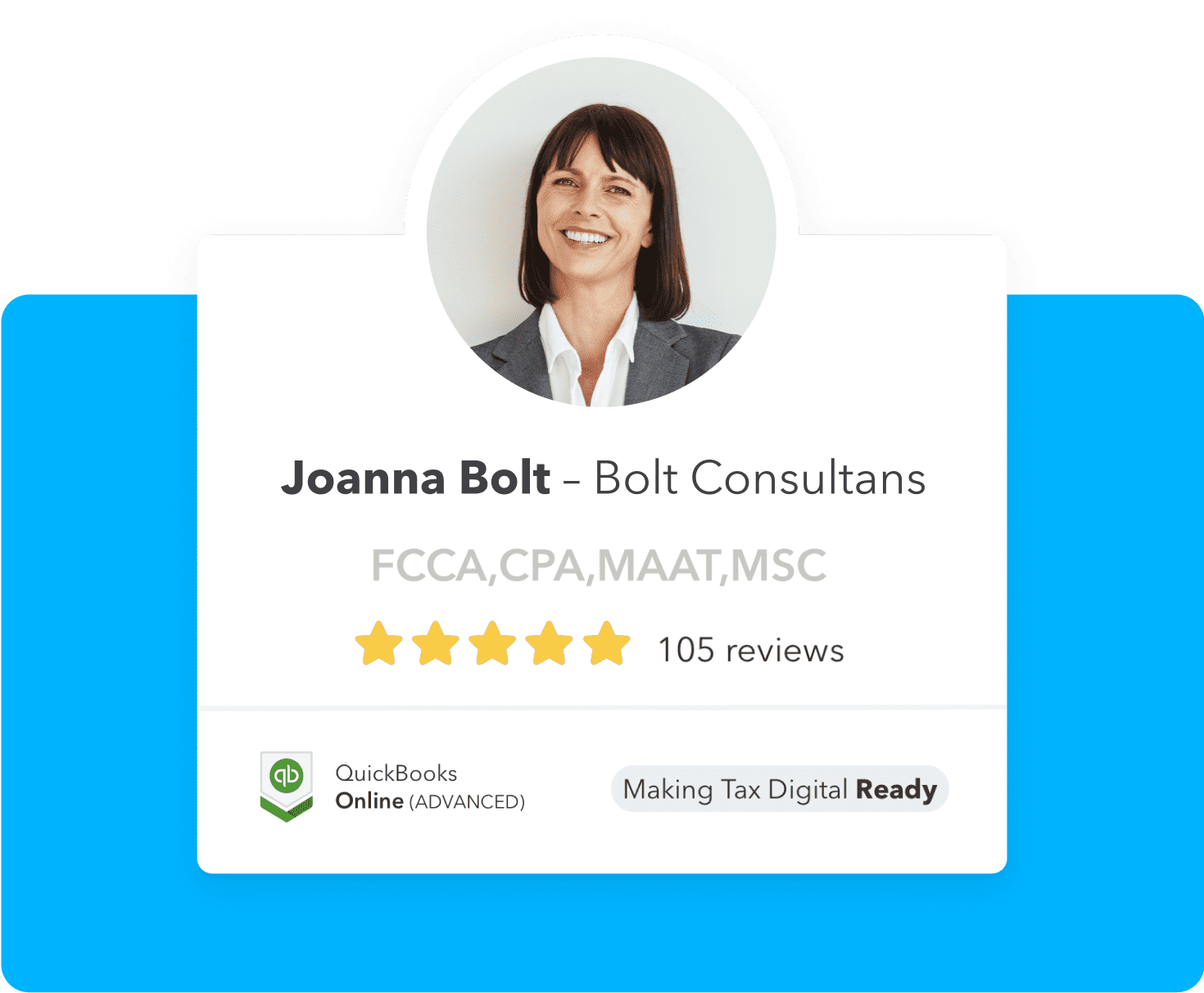

Boost your Find-a-ProAdvisor Profile

The Find-a-ProAdvisor directory connects small businesses with accountants who can help them with MTD. Learn how to boost your profile here.

A seamless transition to MTD for you and your clients

QuickBooks’ easy-to-use software means a stress-free transition to Making Tax Digital.

Find the tools and expertise you need to support all of your clients, from users of outdated accounting software to spreadsheet-based businesses.

Free onboarding support

Get your clients up and running with QuickBooks in no time with our free expert onboarding sessions. It’s the fastest, easiest way to work together efficiently in QuickBooks.

Learn more

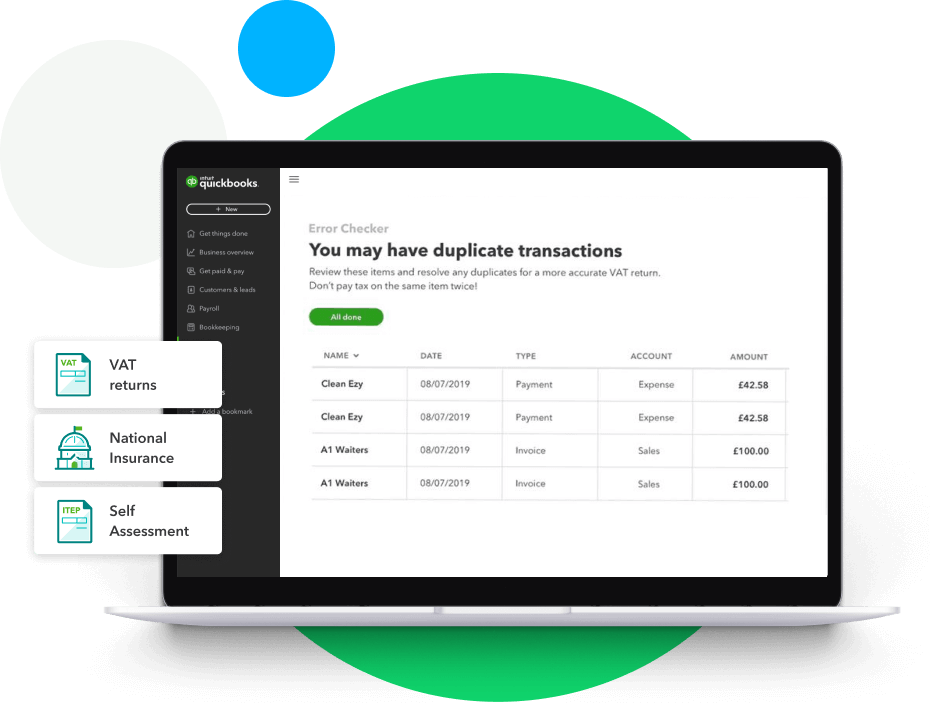

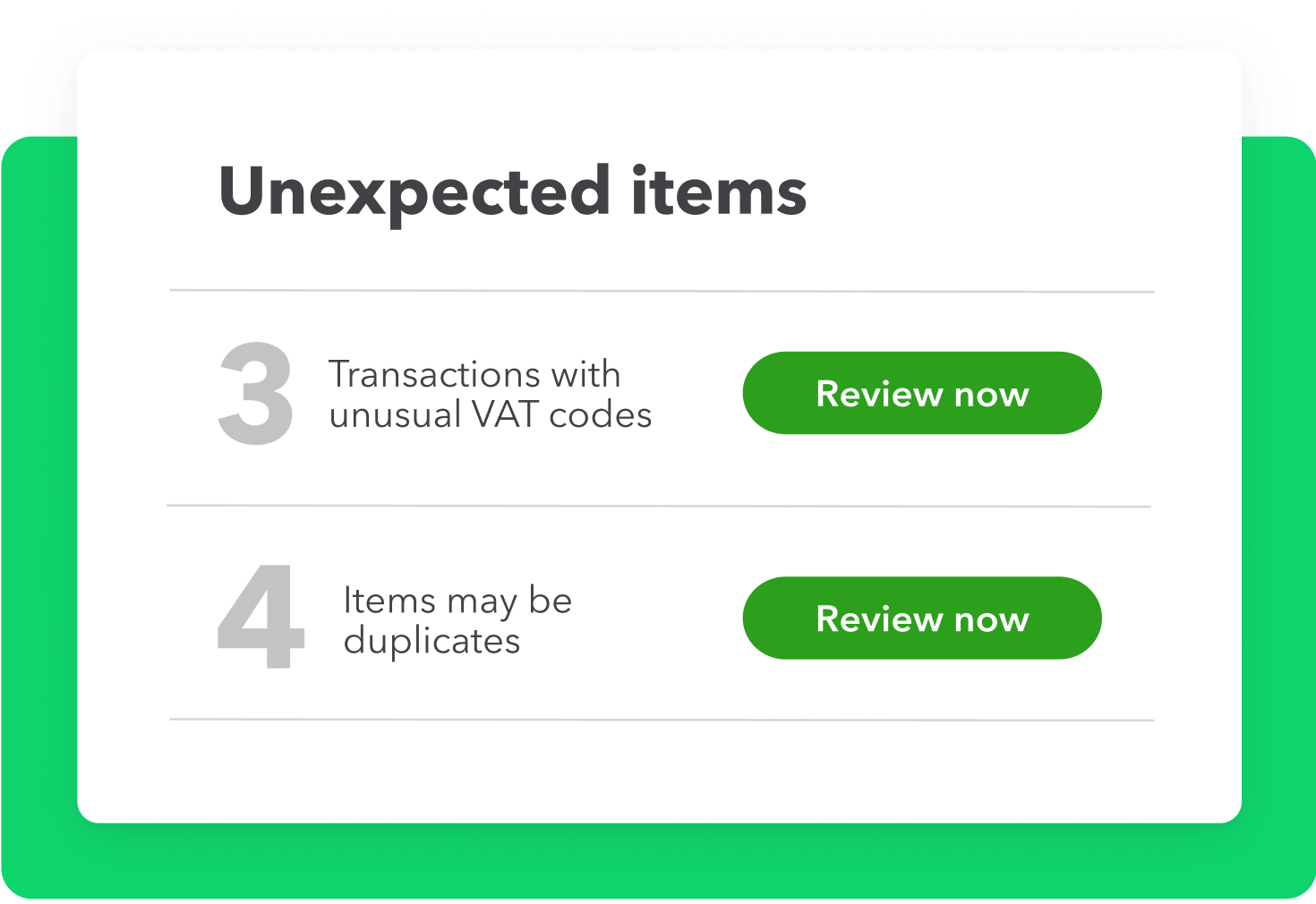

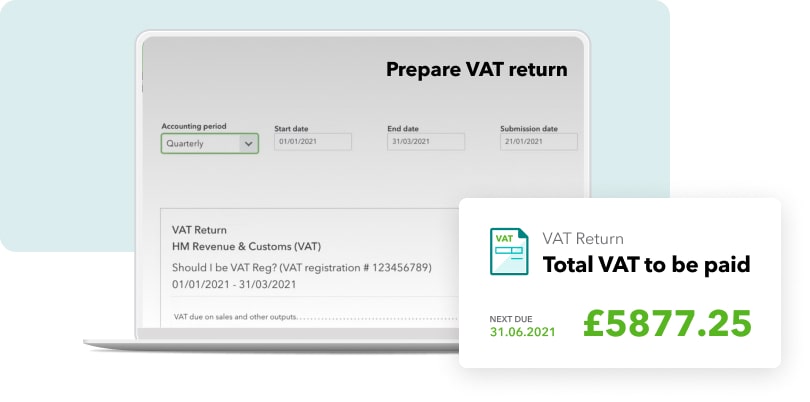

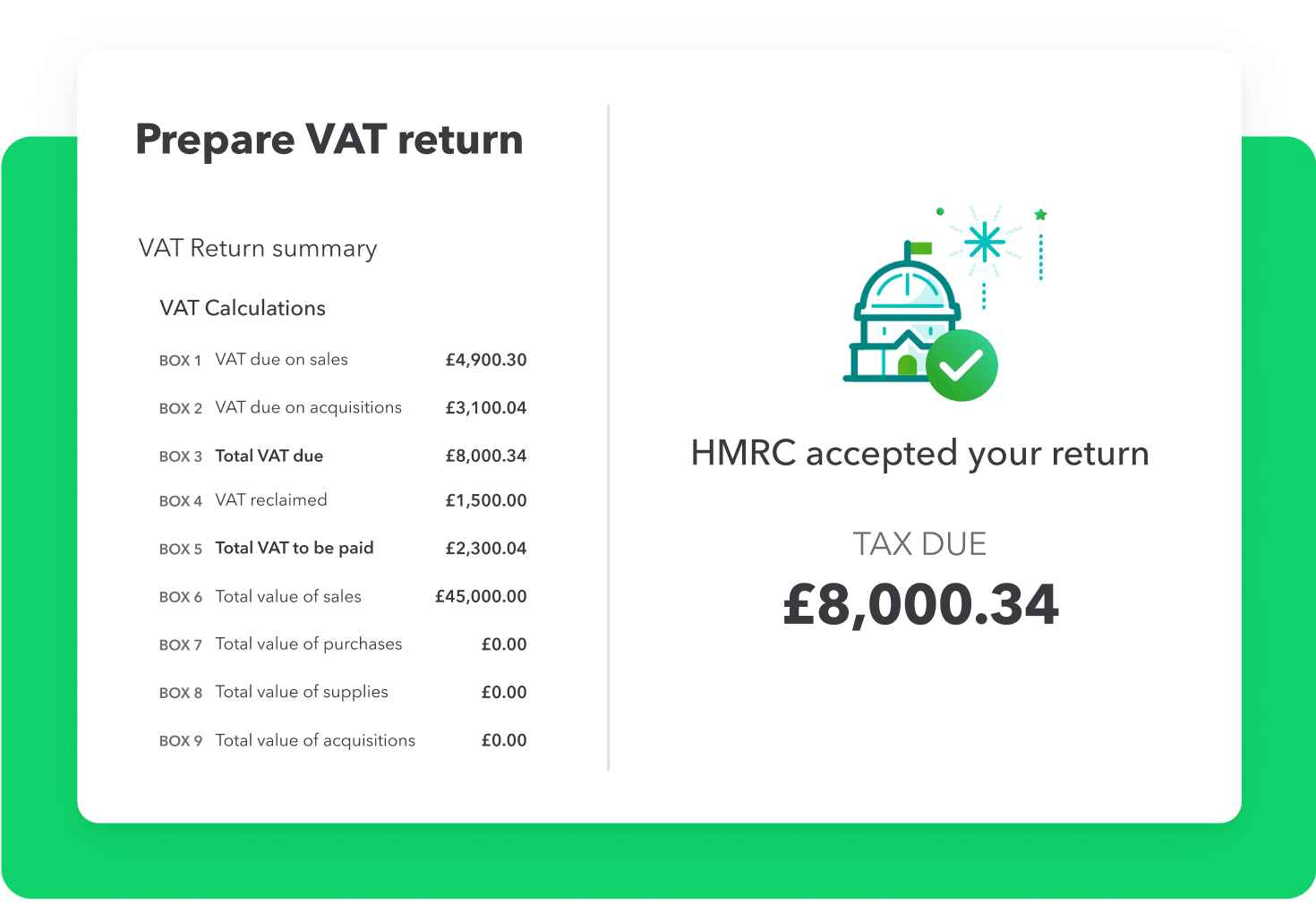

Automatic VAT error checks

Our unique VAT error checker automatically scans your clients’ VAT returns for common errors, duplicates and anomalies. Use it to save time on manual checks for accuracy before filing directly to HMRC.

Learn more about our VAT error checker.

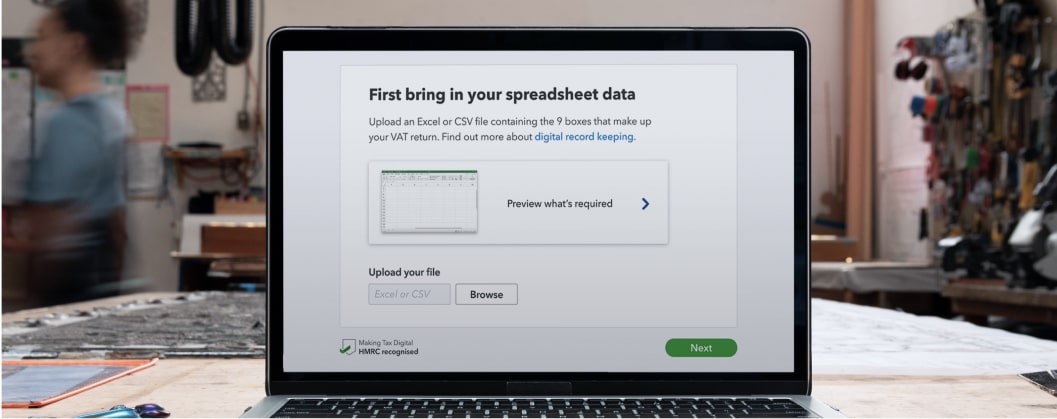

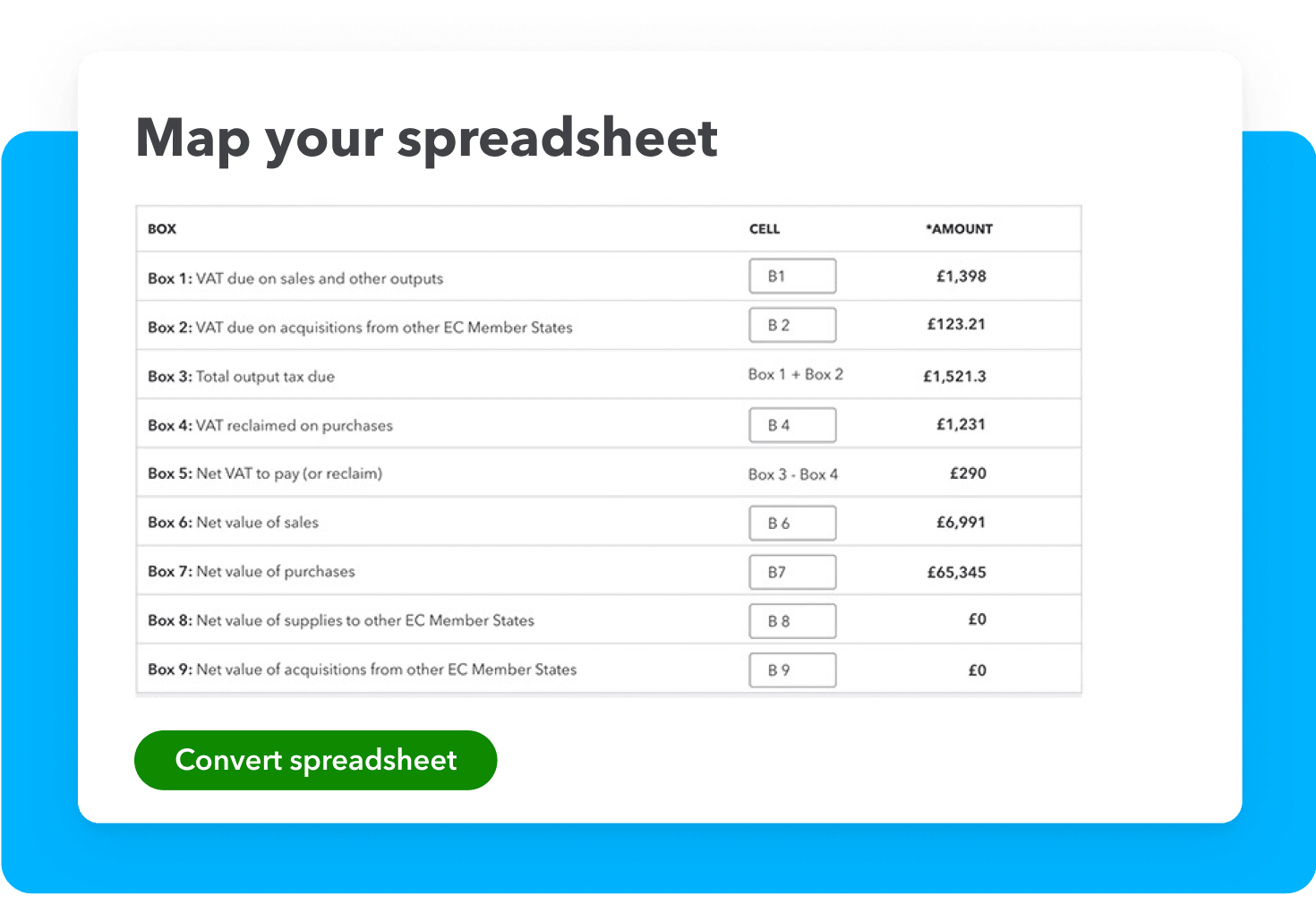

Submit VAT to HMRC with bridging software

Use QuickBooks’ bridging software to help spreadsheet users and clients with complex VAT needs comply with Making Tax Digital without changing the way they manage their VAT.

Submit VAT with QuickBooks

QuickBooks product tour

QuickBooks is HMRC-recognised Making Tax Digital software for keeping digital records and making VAT submissions to HMRC. Take a closer look at why it’s the right choice for your practice and your clients.

QuickBooks for your practice

Whether you’re new to accountancy software or already live with your head in the cloud, it’s easy to get started with QuickBooks. It’s designed from the ground up to be easy to use, and to fit into your current way of working. Discover the key features of QuickBooks for your practice.

Select a topic to get started.

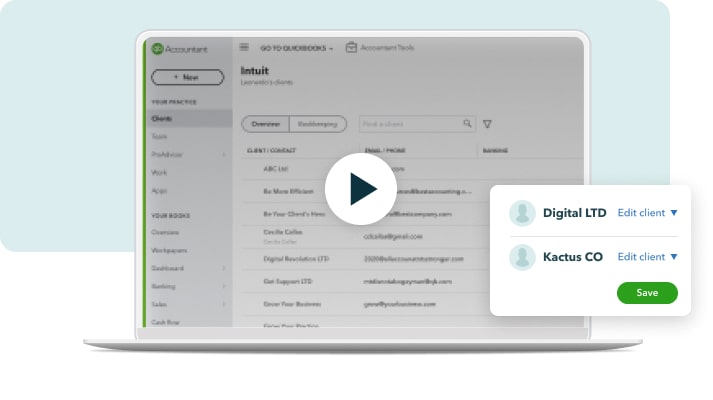

One dashboard for all your clients.

You can easily manage every client from the main dashboard - it's easy to dive into their books at the click of a button.

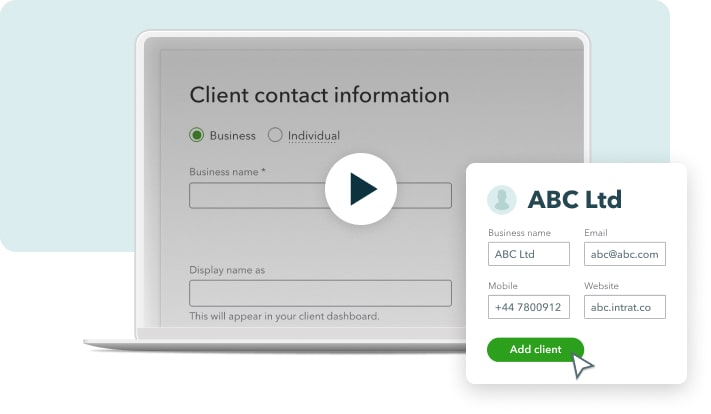

Setting up new clients is a breeze.

Adding your new clients into QuickBooks is quick and easy - so you can get going in no time at all.

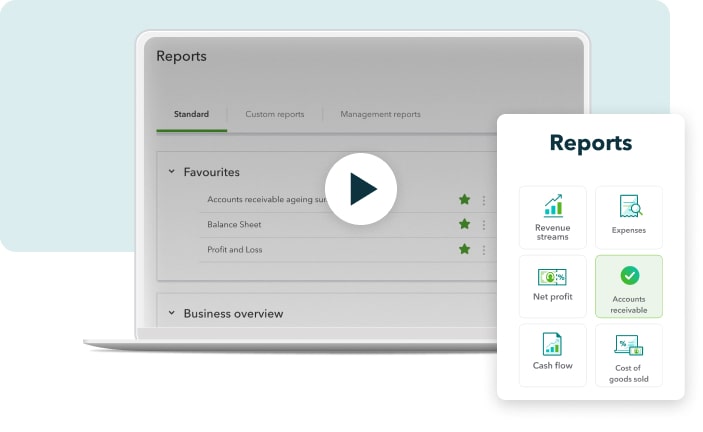

Reports at the double.

A range of pre-built reports gives you the information you need - instantly. You can even tailor them to individual clients.

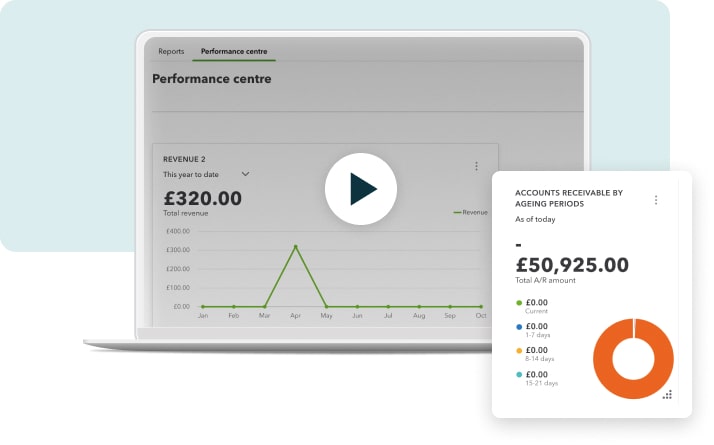

Chart your clients' performance.

The Performance Centre provides up-to-the-minute charts to help you keep on top of each client's business.

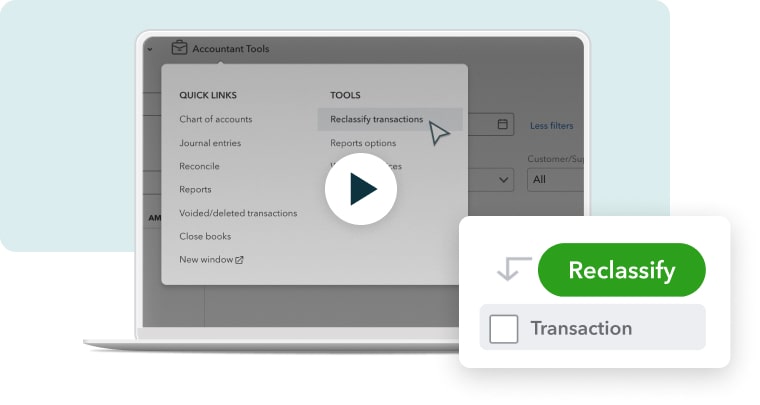

Many wrongs can easily be put right.

We know that sometimes data gets entered incorrectly. No problem. You can reclassify transactions at scale to save time.

Helping your business grow.

Grow your practice through the QuickBooks ProAdvisor programme and find new clients with our Find-a-ProAdvisor directory.

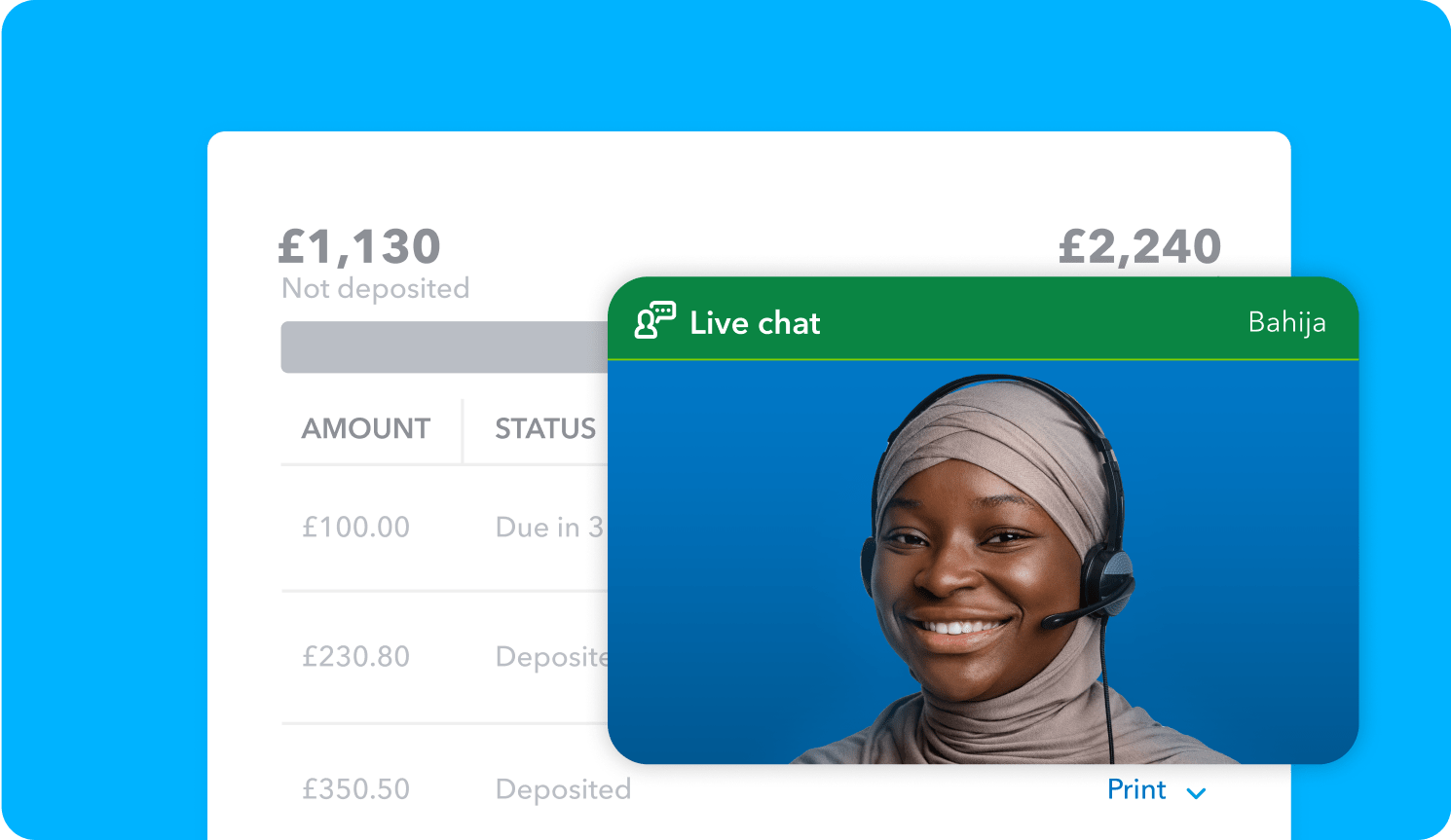

Dedicated QuickBooks support.

All your queries answered in the way you find easiest - from call backs to community forums. Your clients can also access support directly from QuickBooks.

QuickBooks for your clients

QuickBooks makes bookkeeping, tax and financial planning easy for your clients. See just how easy the software is to use for Making Tax Digital and beyond.

Select a topic to get started.

Customer query? We've got it.

Your customers don't have to trouble you for support. They can find it within QuickBooks. Our award-winning customer support is free and easy to access.

VAT. Your clients will always know what they owe.

Your clients can keep track of how much VAT they owe in real time, so that there are no nasty surprises at tax time.

Discounted rates for your clients

Get access to discounted QuickBook Online subscriptions to offer to your clients. Give them the confidence that they can keep digital records and submit their VAT returns in line with Making Tax Digital.

Request a callback from a member of our team to learn more.

Track, check and submit VAT in QuickBooks

Easily migrate your clients’ accounts to QuickBooks from other accounting software. Then prepare and automatically check their VAT return before submitting it directly to HMRC, in line with Making Tax Digital.

MTD training for accountants

We’ve been working closely with HMRC to make sure you have all of the information your practice needs to be ready for the next phase of Making Tax Digital. Take advantage of free QuickBooks training, live webinars and on-demand video sessions.

Watch our webinar to learn how to prepare for MTD for VAT phase 2.

Get set up with QuickBooks

Getting your practice ready for Making Tax Digital is easy with QuickBooks for accountants and bookkeepers. We’ve got your back every step of the way.

Request a callback from a member of our team to learn more.

Introductions to new clients

Get leads through the QuickBooks Find a ProAdvisor directory - for free! Once you’ve passed our free certification training you can publish your profile on our directory of accountants, where thousands of small businesses look for professional support.

Get listed in our directory.

MTD marketing materials

Our free ProAdvisor programme gives you access to the Marketing Hub — a free asset library to help you grow your practice and let clients know that you're up to speed with Making Tax Digital.

Learn more about our ProAdvisor programme.

Join QuickBooks for Accountants

QuickBooks Making Tax Digital software for accountants can help you grow your business, save money, and give you more time to support your clients.

Learn how QuickBooks can help you

Understanding Making Tax Digital

Get to grips with the changes and stay ahead of the deadlines with our MTD overview.

Find out moreSupport for your practice

Free resources designed to help your clients and practice get up to speed with MTD.

Check them outQuickBooks Making Tax Digital for VAT software is available to all QuickBooks Simple Start, Essential, Plus and Advanced subscribers. Use of QuickBooks MTD for VAT software and bridging software must be aligned with HMRC's eligibility requirements and includes additional setup between the small business and HMRC.

QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. QuickBooks Bridging Software supports Standard and Cash schemes. Businesses whose home currency is not GBP are currently not supported.

Receive a 90% discount on the current monthly price for QuickBooks Online Simple Start or 90% discount on the current monthly price for QuickBooks Online Essentials or 90% discount on the current monthly price for QuickBooks Online Plus or 90% discount on the current monthly price for QuickBooks Online Advanced for the first 6 months of service, starting from date of enrolment, followed by the then-current monthly price. Your account will automatically be charged on a monthly basis until you cancel. You must select the Buy Now option and you will not be eligible for a 30-day free trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 168 9533. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice. All prices shown exclude VAT.

Enjoy 90% off for 12 months on the current fees when you pay for your QuickBooks Online subscription on an annual, upfront basis. If you cancel your QuickBooks Online subscription within the pre-paid 12-month period, you will not be eligible for a refund, but will retain full access to your QuickBooks Online subscription for the remainder of the 12-month period. Alternatively if you wish to receive a refund then you need to cancel by calling us on 0808 234 5337 within the pre-paid 12 month period and we will provide a pro-rata refund and deactivate your account. Unless cancelled by you prior, your annual subscription will auto-renew on the 12 month anniversary of your sign-up date using the billing details you have given us. Discounts, prices, terms and conditions are subject to change.

Receive 90% off the current monthly subscription price for QuickBooks Core or QuickBooks Advanced Payroll for the first 6 months of service, starting from the date you subscribe to the service, followed by the then-current monthly price. Your account will automatically be charged on a monthly basis for the subscription fee and for all pay runs processed in the previous month, until you cancel. You must select the Buy Now option, and you will not be eligible for a 30-day free trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 168 9533. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice. All prices shown exclude VAT.

Discount valid until the 7 May 2024.

Receive 90% off the current monthly subscription price for QuickBooks Advanced for the first 6 months of service, starting from the date of enrolment, followed by the then monthly price. Your account will automatically be charged on a monthly basis for the subscription fee and for all pay runs processed in the previous month, until you cancel. You must select the Buy Now option and will not receive a one month trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 239 9692. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice. All prices shown exclude VAT.

QuickBooks Advanced Payroll allows you to automatically submit information to the following pension providers: NEST, The Peoples Pension, Smart Pensions, Aviva and NOW:Pensions

Free onboarding sessions are offered to all newly subscribed customers and trialists, excluding customers on our QuickBooks Self-Employed product. We offer 1 session per customer and reserve the right to remove this offering at anytime. Invitations are sent via email and in-product messaging once signup has been completed. A link will be included in the message for you to book a session using our calendar tool.

Mileage tracking is available on QuickBooks Self-Employed and QuickBooks Online on iOS and Android only.

These terms apply to QuickBooks UK customers only. Bulk-pricing discount offer is valid only if you are signing up for more than one QuickBooks Online subscription with each order. View terms and conditions for multiple accounts pricing here. To inquire further about the bulk-pricing discount offer, please call 0808 168 9533

QuickBooks UK support hours:

- QuickBooks Online Phone – Monday to Friday 8.00 AM to 7.00 PM

- QuickBooks Online Live Messaging – Monday to Friday 8.00 AM to 10.00 PM, Saturday and Sunday 8.00 AM to 6.00 PM

- QuickBooks Self-Employed Live Messaging – Monday to Friday 8.00 AM to 10.00 PM, Saturday and Sunday 8.00 AM to 6.00 PM

'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016.

How can we help?

Talk to sales: 0808 168 9533

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday