How can we help?

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday

Get product support

Contact support Visit support pageJoin over 6.5 million subscribers worldwide

Our range of simple, smart accounting software solutions can help you take your business to the next level. Once you've chosen your plan, there's no hidden fees or charges.

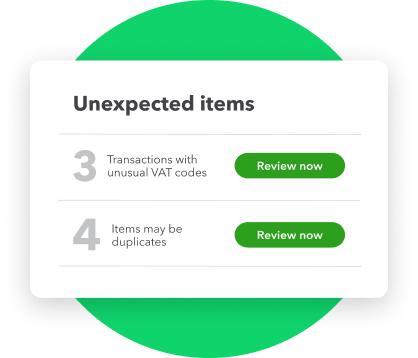

Click and correct VAT errors

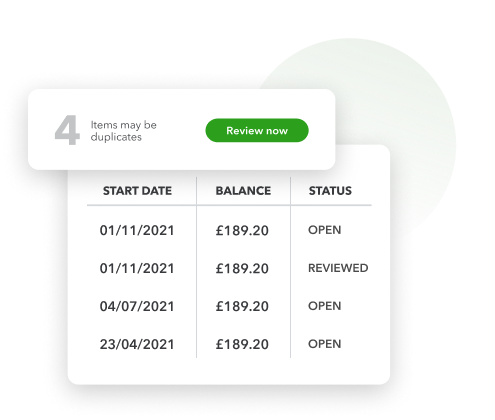

The VAT error checker highlights common errors at the touch of a button. Ditch the duplicates and only pay the VAT you owe. This feature is included in all QuickBooks Online subscriptions at no extra cost.

Stay compliant with HMRC rules

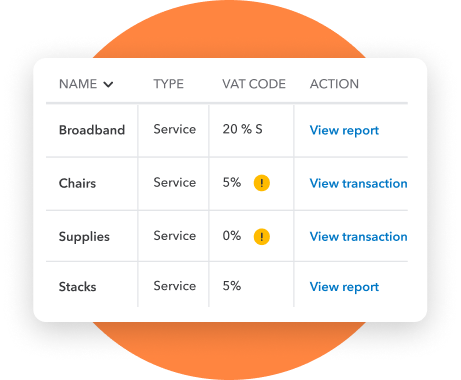

Make sure you're compliant with HMRC Making Tax Digital rules. Use this clever tech to spot costly mistakes on the the VAT error checker dashboard, so you can have confidence in your return.

Spot VAT inconsistencies

Duplicates, inconsistent VAT codes and missing transactions: Our VAT error checker spots them — so you don’t have to.

QuickBooks customers are prepared for tax time

Detailed VAT reports

Get an in-depth picture of what you've paid and what you owe.

HMRC-recognised software

Submit your VAT in line with HMRC's Making Tax Digital rules.