- Software with you in mind

- QuickBooks for accountantsSupporting you and your clients

- Pricing for accountantsWhatever your practice needs, there's a plan for you

- Client onboardingWe'll get them up and running

- MailchimpThe perfect partners for your practice

- Be found by new clientsIn our Find-a-ProAdvisor directory

- Referral programmeGet £200 in Amazon vouchers

- Switch to QuickBooksMove to us from another solution

Become a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level. - online Accounting for sole traders

- QuickBooks for sole tradersEverything you need to know

- Pricing for sole tradersWhatever your business needs, there's a plan for you

- Onboarding as a sole traderSet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks Self-employedSoftware for sole traders not registered for VAT

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- Connect appsSeamlessly connect 300+ apps to QuickBooks

features for sole traders - Grow your business

- QuickBooks for limited companiesEverything you need to know

- Pricing for limited companiesWhatever your business needs, there's a plan for you

- Onboarding as a limited companySet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- StartupsGrow your business from day one with QuickBooks

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- QuickBooks AdvancedDiscover our most powerful plan yet, made for growing businesses

- Connect appsSeamlessly connect 300+ apps to QuickBooks

- Plans & Pricing

- Talk to us: 0808 168 9533

- How can we help you today

- QuickBooks support hubWe're here to support you through every step

- Getting startedEverything you need to get set up for success

- Desktop to OnlineHow to switch from QuickBooks Desktop to QuickBooks Online

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- Switch to QuickBooksMove to us from another solution

- QuickBooks OnlineOur range of simple, smart accounting software solutions

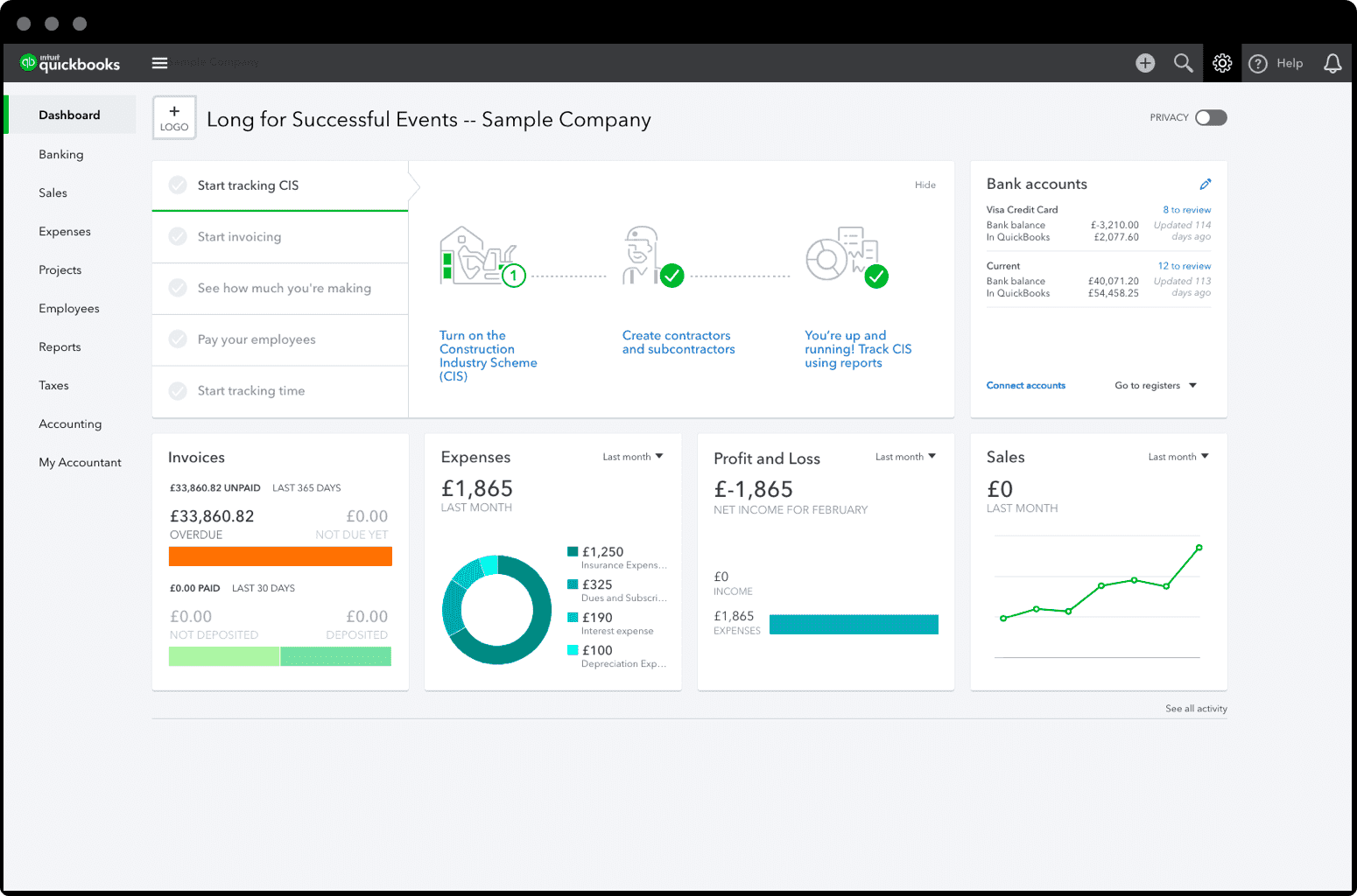

Invoices & expensesBanking & Payments - Sign in

How to file an online VAT return | HMRC Making Tax Digital

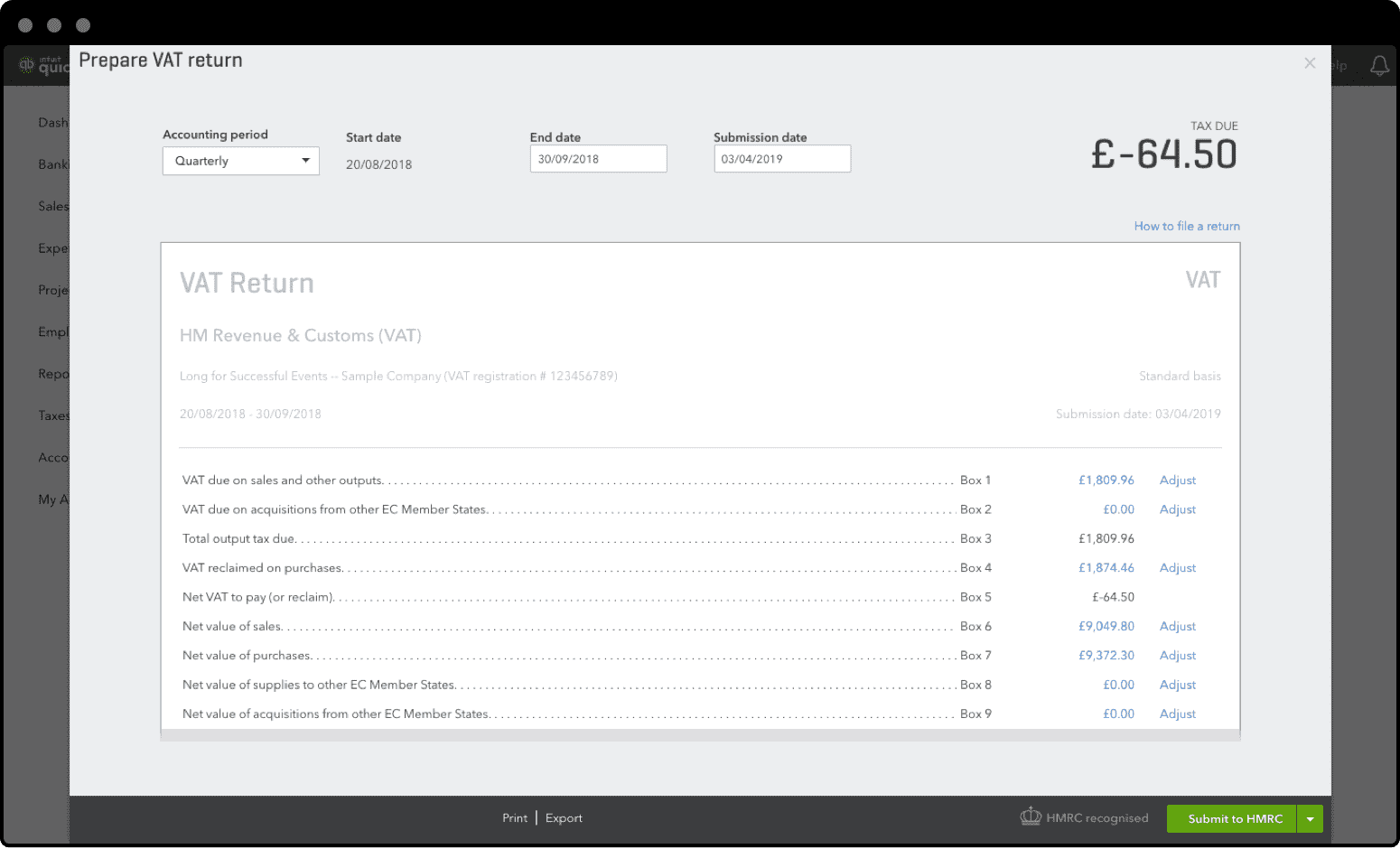

How to submit a VAT Return for HMRC's Making Tax Digital

Learn how to file your VAT in a MTD compliant way directly to HMRC with this VAT return tutorial.

Before you start:

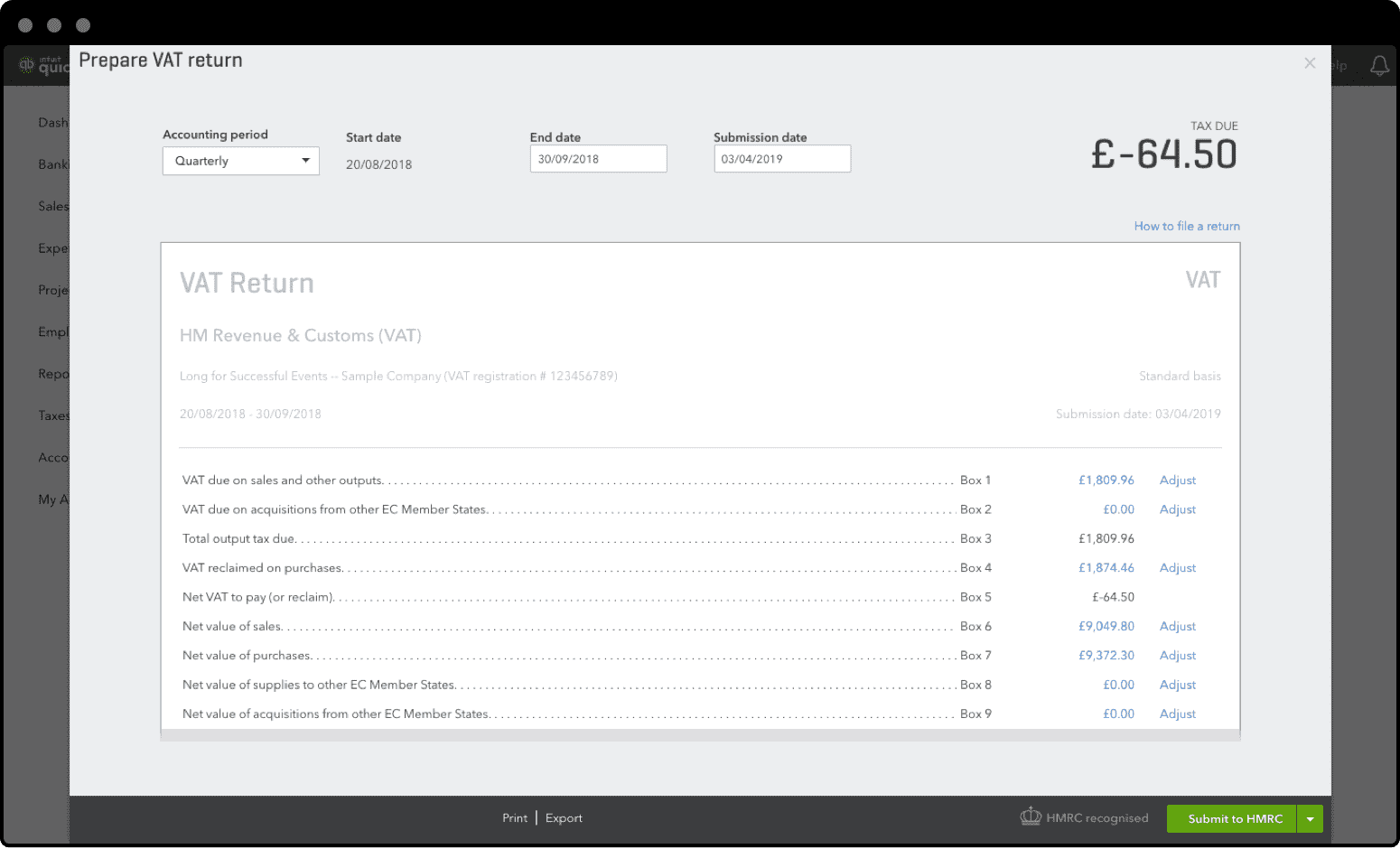

You will need to have turned on MTD in QuickBooks (if MTD is turned on you'll see the MTD logo and green tick in the VAT Centre).

VAT return software benefits include

The regulations that surround the filing of HMRC vat returns can be complex, and each individual case has its own stipulations. That’s why it helps to know how to file a VAT return and navigate these obstacles.

Using software to help you file your VAT software can have massive benefits, allowing you to:

- Easily calculate & file VAT.

- Comply with MTD.

- Improve cost and time efficiency.

- Have all of your documentation in one place.

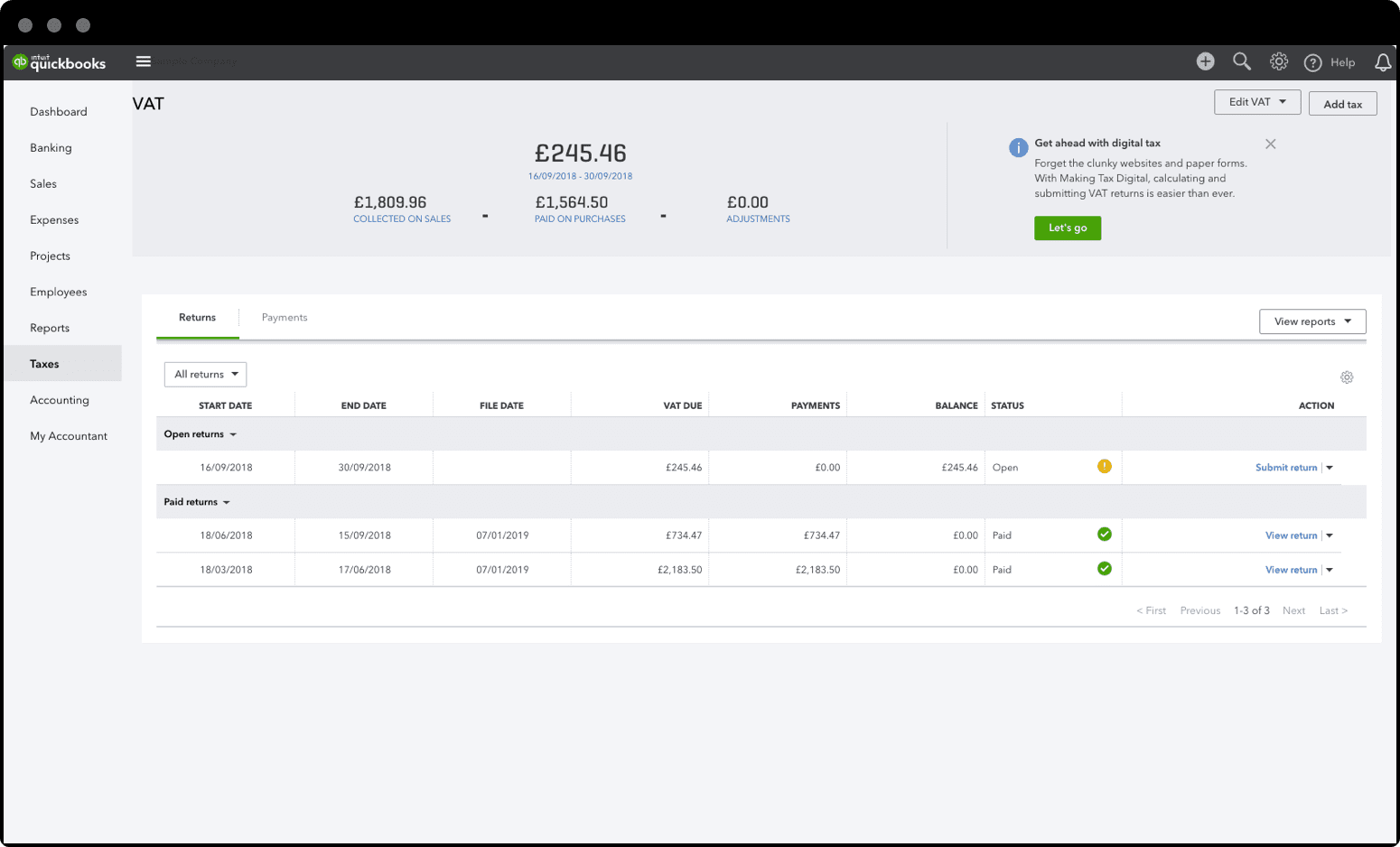

Step 1 of 5

- Select Taxes from the left menu

Step 2 of 5

- In the Open Return click "submit return".

Step 3 of 5

- Review the 9 boxes that make up your VAT return and click Submit to HMRC.

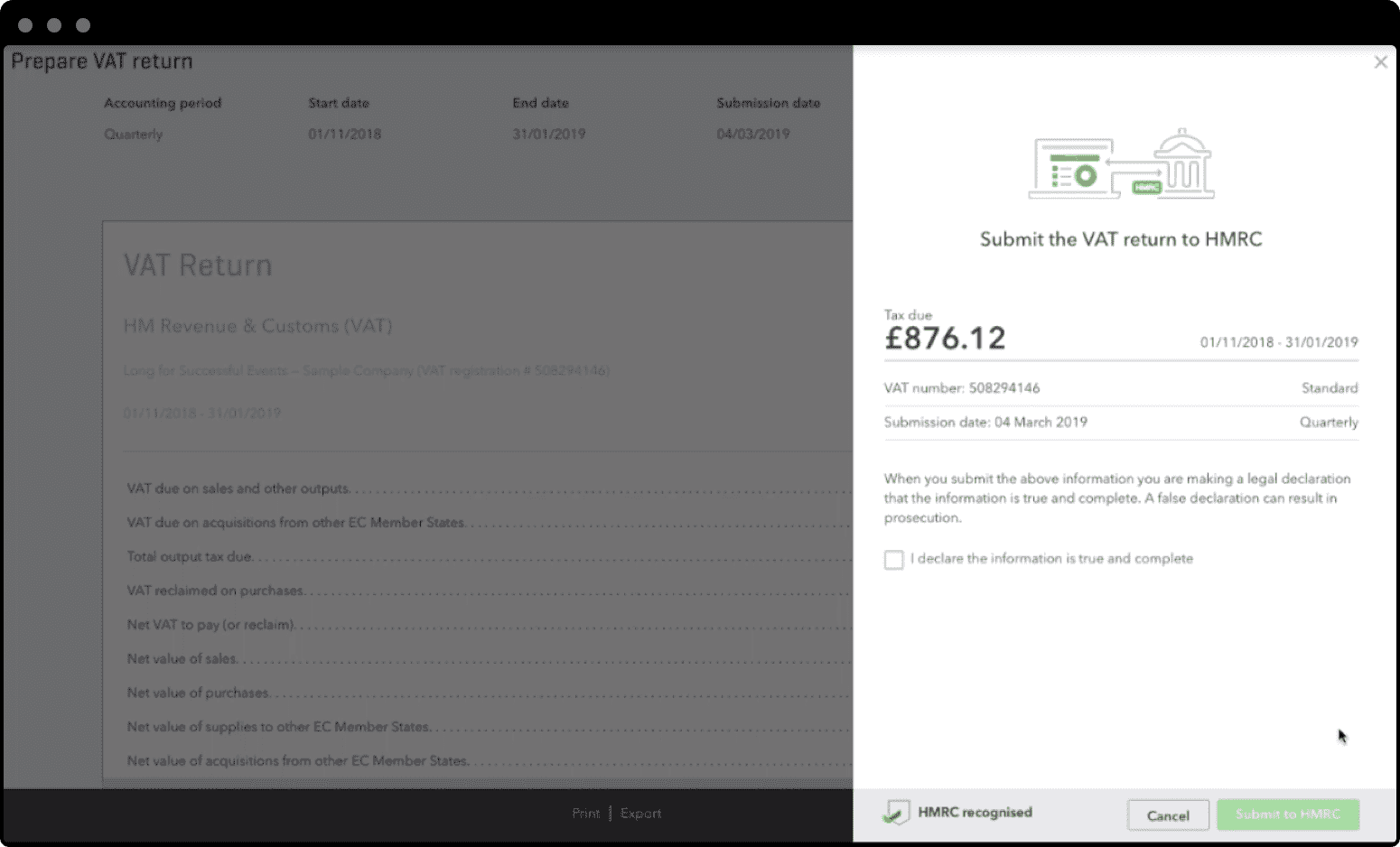

Step 4 of 5

Declare the information is true and complete and click Submit to HMRC.

Step 5 of 5

- Review confirmation page, take note of receipt number and click DONE.

- We’ll also send you an email confirmation.

Related content

About Making Tax Digital

Find out more about HMRC's Making Tax Digital and if you need to comply.

Set up MTD in QuickBooks

Before you submit a VAT Return for MTD, you need to set up MTD in QuickBooks.

File VAT using spreadsheets with Bridging Software

On a complex VAT scheme or need to file quickly? You can submit VAT for MTD using spreadhseets. Start using other QuickBooks features when you're ready.

Need more help?

Use help button

Use the help button from any page within QuickBooks Online to search articles or connect with an expert.

Sign inAsk the community

Get help and links to useful resources from other small businesses using QuickBooks.

Go to communityHow can we help?

Talk to sales: 0808 168 9533

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday