Whether your clients run payroll themselves or need help from the pros, find efficient solutions to help get the job done accurately. Select the accounting product your client uses below to reveal compatible payroll options.

- Call Sales: 800-458-3175Call Sales: 800-458-3175

- Call 800-458-3175HoursMon - Fri, 6:00am - 6:00pm PST

- Sign Up

- Sign in

- Products & SolutionsProducts & Solutions

- Accounting solutions

- For your clientsFor your clients

- More accounting solutionsMore accounting solutions

- QuickBooks Online with PayrollManage payroll, benefits, and HR support for your clients.

- QuickBooks TimeReady-to-use resources to market and grow your practice.

- QuickBooks PaymentsGet clients paid faster and easier.

- QuickBooks Capital

- Workers' compensation insurance

- QuickBooks Apps

- View all Products & Solutions

- Training & CertificationTraining & Certification

- ProAdvisor ProgramProAdvisor Program

- Resources

- News & Community

- Support

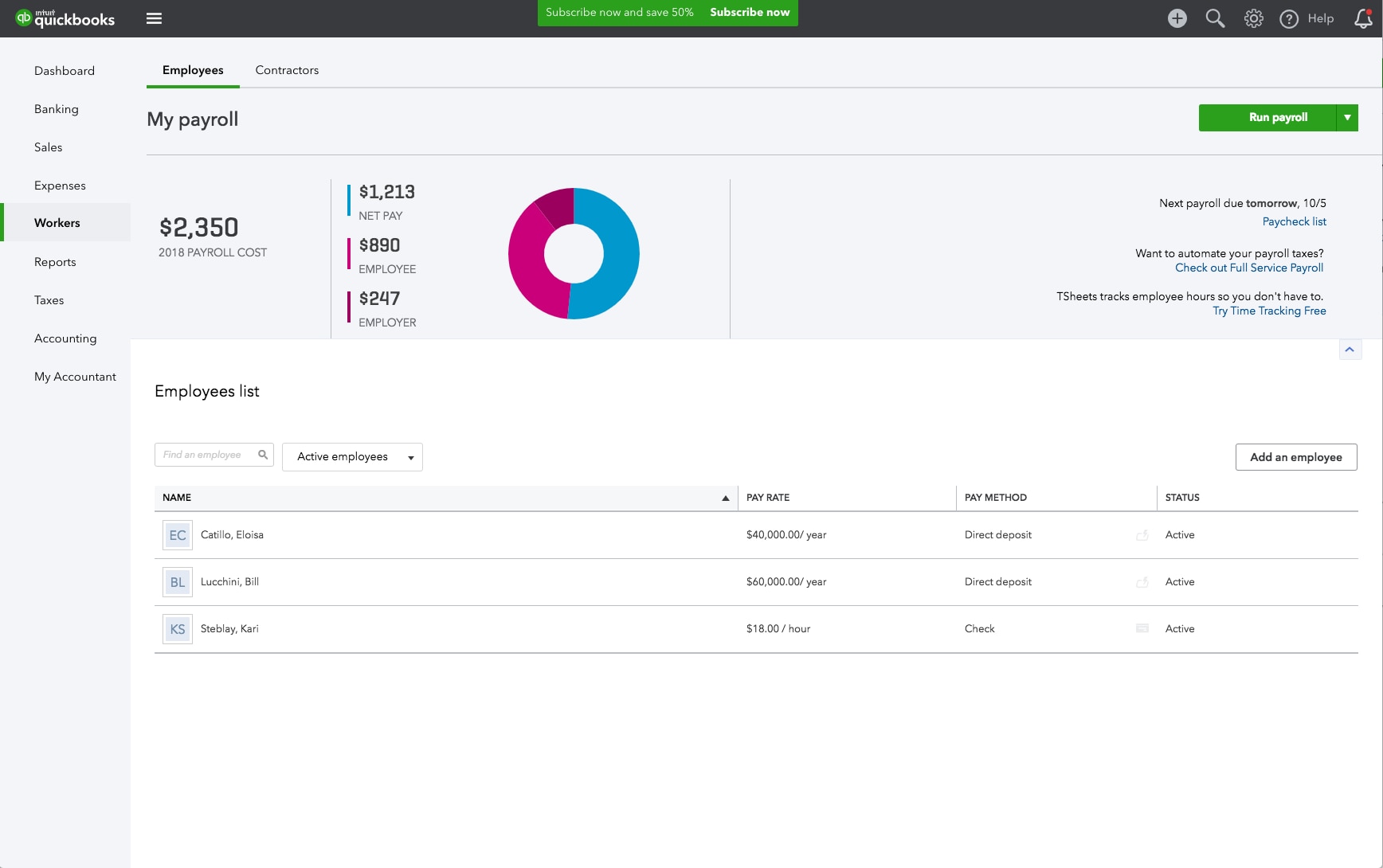

Payroll built into QuickBooks

QuickBooks Online and Online Payroll work together seamlessly, saving time for you and your clients.

Empower clients to conquer payroll with confidence

QuickBooks Online Payroll

More time to do what pays

Spend more time advising and less time on payroll and workforce services with QuickBooks Online Payroll.

- Access integrated tools, expert support5, and get backed by a guarantee2

- Streamline workflow management between accounting, payroll, and HR.

- Know things are done right with real-time QuickBooks connection, automated tax calculations, form filing4, and automated payroll runs1

- Use worker time tracking by QuickBooks Time6 and access HR tools and services powered by Mineral3 now with Premium or Elite

Additional resources

Pricing and promotions

Payroll tax how-tos

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

*MIGRATION ASSISTANCE OFFER TERMS

Free assisted migration from QuickBooks Desktop Pro, Premier, Mac, or Plus (“Desktop”) to QuickBooks Online Simple Start, Essentials, Plus, or Advanced (“QuickBooks Online”) is available to customers who sign up to migrate to QuickBooks Online and subject to capacity. The offer is eligible to Desktop customers that are migrating their Desktop data to QuickBooks Online. Assisted migration is limited to a 1-hour session with a customer success product expert. Intuit reserves the right to limit the number of sessions and the length and scope of each session. Results may vary based on business complexity and file size. Terms and conditions, features, support, pricing, and service options subject to change without notice.

*REVENUE SHARE OFFER TERMS

Eligibility: QuickBooks Online Accountant ("QBOA") firms are eligible to apply to enroll in the "Revenue Share Program" and add and manage only new subscribers through "Add Client" for certain subscriptions ("Revenue Share Subscriptions") and add-ons ("Revenue Share Add-Ons").

Rev Share Subscriptions means the following QuickBooks services: QuickBooks Online Simple Start, Essentials, Plus, and Advanced; and QuickBooks Online Payroll Core, Premium, and Elite. The Rev Share Add-Ons means the per-employee fee and multi-state charge for QuickBooks Online Payroll. The Rev Share Subscriptions and Add-Ons do not include other optional add-on services for which Intuit charges a fee and is not already included in the base fee for the subscription.

Only one (1) QBOA user may enroll the QBOA firm in the Revenue Share Program. Intuit reserves the right to accept or decline any QBOA firm.

Offer Terms: Each Revenue Share Program participant is eligible to receive a 30% revenue share on the Rev Share Subscriptions and 15% revenue share on the Rev Share Add-Ons for the first 12 months of the paid subscription ("Rev Share Payment(s)"), starting from the date the client starts paying for the subscription. The first month of the Revenue Share Subscriptions and Revenue Share Add-Ons, starting from the date of enrollment in the subscription, is free. After the first month of the Rev Share Subscription, a 50% discount is applied to the then-current monthly list price for three (3) months, followed by the then-current list price. After the first month of the subscription, if the client enters their payment details and pays for the subscription, the firm is eligible to receive Rev Share Payments for the subsequent 12 months only. Each Rev Share Subscription must be client-billed, and cannot be paid for by the QBOA firm. Cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable.

Review additional details regarding the Revenue Share Program.

Intuit may terminate these terms or the Revenue Share Program or modify the terms or the Revenue Share Program for any reason and at any time, at Intuit's sole discretion, without notice. Terms, conditions, pricing, special features, and service and support options are subject to change without notice.

Review full ProAdvisor Program terms & conditions.

1. Auto Payroll: Auto payroll is available if setup for employees and the company are complete, all employees are salaried employees, all employees are set up on direct deposit, bank verification, e-services is enabled and the account has not been on hold in the last 6 months.

2. Accuracy Guaranteed available with Core, Premium, & Elite: We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

Tax-Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://quickbooks.intuit.com/payroll/disclosure/

3. HR Services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service. HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

4. Automated tax payments and filings: Available only for state and federal taxes. Enrollment in e-services is required. Local taxes require the user to print the forms and upload it to the necessary local sites. QuickBooks Online Payroll Core does not offer local tax payments and filings. Automatic filings for state new hire paperwork available in QuickBooks Online Payroll Premium and Elite only.

5. Expert product support: Phone and messaging support is included with your paid subscription to QuickBooks Online Payroll. U.S. based support is available Monday through Friday 6 AM to 6 PM PT. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms conditions, features, pricing, service and support are subject to change without notice.

6. Time tracking: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

7. Based on Intuit survey Jan 2022, amongst remunerated QuickBooks Online users who expressed an opinion, when they compared QuickBooks Online to their prior QuickBooks Desktop Pro, Pro Plus, Premier, Premier Plus or Mac Plus products. Survey did not include Enterprise customers.

Call Sales: 1-800-459-5183

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.