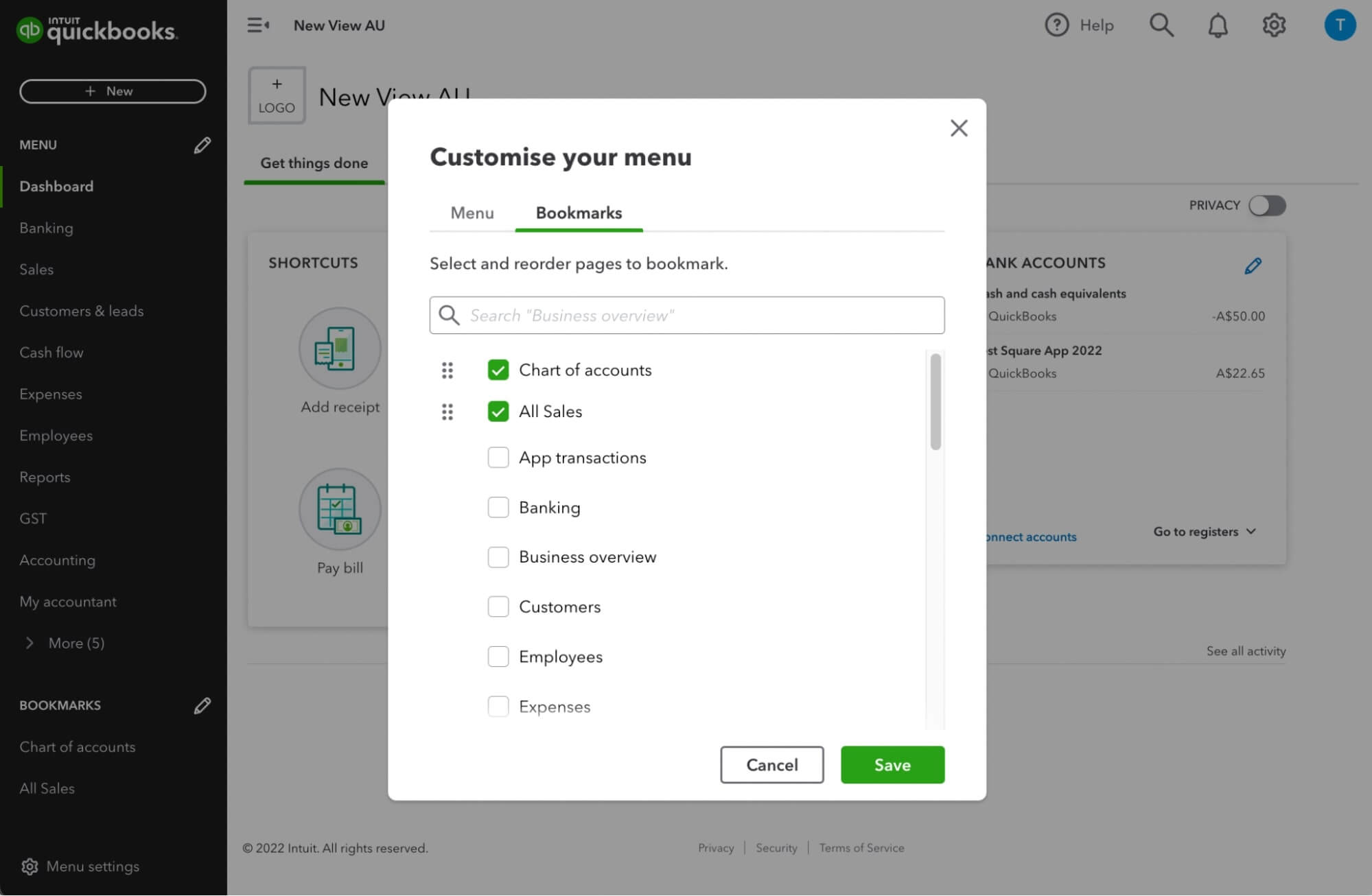

Accountant view menu customisation

QuickBooks Online & QuickBooks Online Accountant

We know that everyone has different needs when it comes to QuickBooks. That’s why we’re making our navigation menu more flexible and customisable—enabling you to tailor your experience so it’s right for you.

Earlier this year, we created the new Business view menu, providing Small Business users with a simplified and intuitive way to navigate QuickBooks Online. We also prioritised customisation through the ability to hide, reorder, and bookmark items in Business view.

Based on your feedback, we will soon introduce the same customisation features for Accountant view in QuickBooks Online and QuickBooks Online Accountant. So no matter what type of user you are, you can easily access the capabilities you need, in the language you use, and stay focused on growing your business.

Learn more about Business view and Accountant view and how to switch between them.