Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a client who had no business bank account or credit card setup and he used his personal accounts for the first year of business.

All of the expense transactions were charged to the payment account "Personal MC" which was set up as a Credit Card account. There are many transactions and I don't know how to reverse tem or close them correctly.

All of the sales transactions were deposited to Undeposited Funds but the owner used the money to pay credit card bills or buy supplies as needed.

How would I go about fixing these? Thankfully there were only two dozen sales and not many more expenses but I'm at a loss how to fix this. I took accounting in college but that was ten years ago and this is my first client so I am very rusty.

I appreciate you sharing details of the situation with your client's financial records, Holly. It's common for business owners to mix personal and business transactions, particularly in the early stages. Let's explore the importance of keeping these expenses distinct and ensuring everything is accurate.

While we don't advise mixing personal and business finances, I understand that it occasionally occurs. When reimbursing a personal expense, you can record it as a cheque or an expense.

Before we proceed with this process, I recommend you set up a business account in the program to separate the transactions.

Once that's in place, let's start by recording the business expense paid for with the personal funds:

When it comes to reimbursement, you have two choices: you can either create a cheque or an expense.

To record the reimbursement as an expense, please follow these steps:

If you want to record it as a cheque, check out this article: Pay for business expenses with personal funds.

Meanwhile, please know that the undeposited funds are an account that temporarily holds cash or checks that a business has received and is yet to deposit into its bank account.

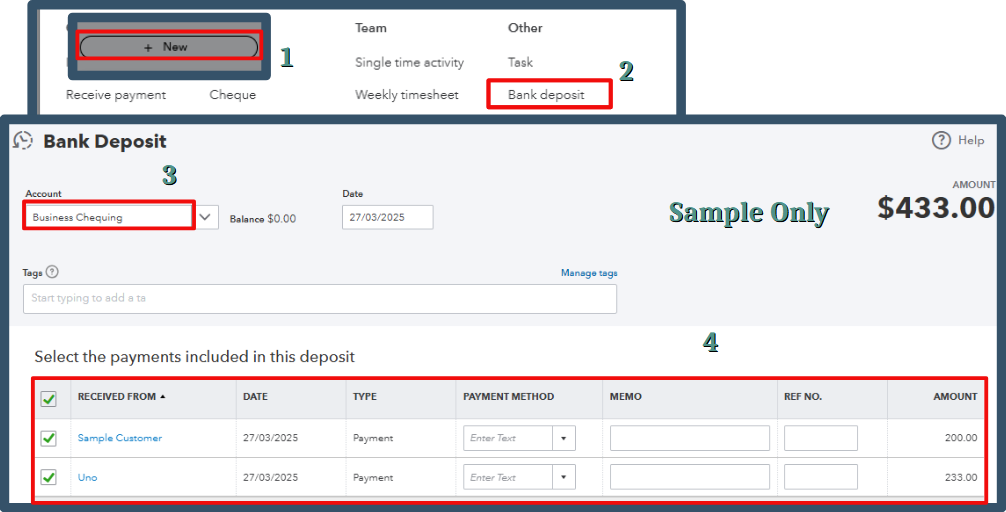

To address the sales transactions deposited as undeposited funds, we can create a bank deposit to correct the account. See the attached screenshot for a visual guide.

For future reference, if you want to gain a deeper understanding of transaction management and account reconciliation in QuickBooks, check out the following articles:

The steps outlined above will effectively guide you in managing your client's financial records and keeping personal and business expenses distinct. We're here to back you up if you have more questions or require additional guidance as you navigate these steps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here