Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageYour Self Assessment is as safe as houses with our landlord accounting software.

From claiming all the right expenses to understanding your cash flow, with QuickBooks Self-Employed you’ve got this - whether you’ve got 1 property or 5.

Join over 6.5 million subscribers worldwide

Our range of simple, smart accounting software solutions can help you take your business to the next level. Once you've chosen your plan, there's no hidden fees or charges.

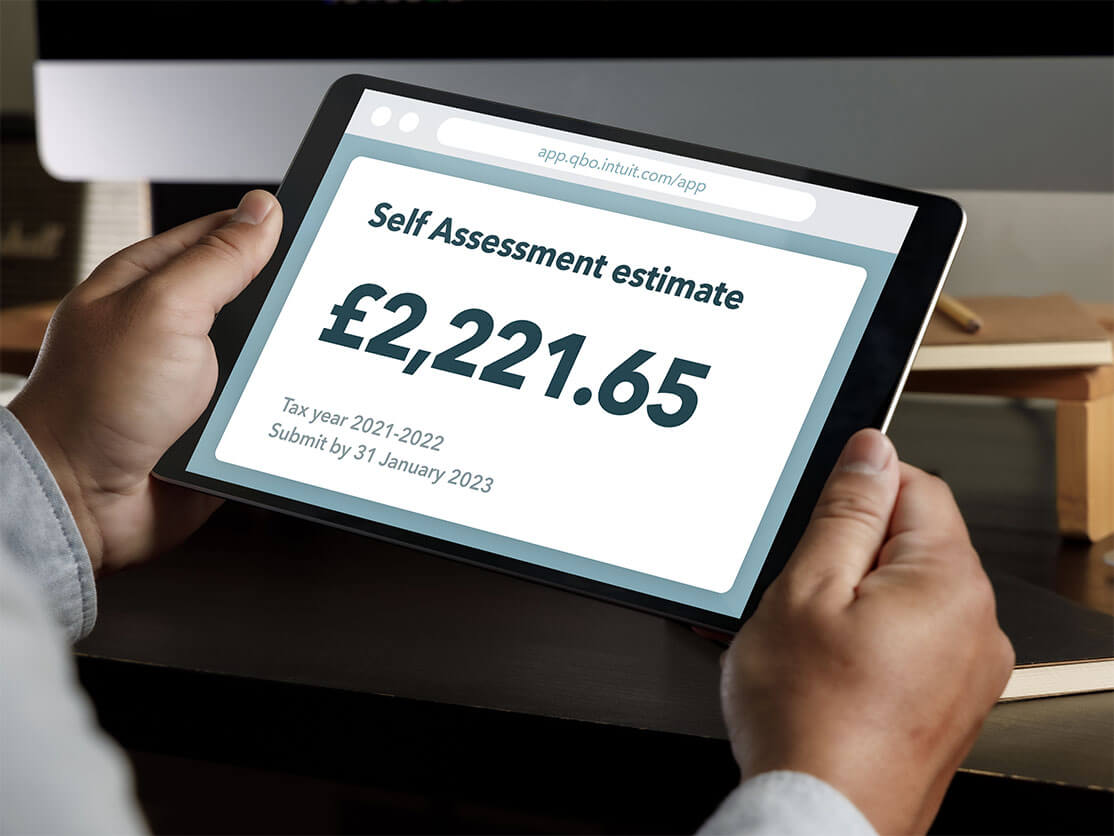

Save time on your Self Assessment admin

Snap photos of your receipts on the go with receipt capture, auto-track your mileage with our mileage tracker, or connect your bank to QuickBooks to capture every transaction. You’ll save hours on landlord Self Assessment admin with us.

Know how your properties are performing

Choosing QuickBooks Self Employed as your landlord accounting software means you can see your cash flow in real-time. With QuickBooks Plus and Advanced, you can track performance across different properties and access reports on the go.

Streamlined bank integration

Get paid quicker with QuickBooks’ open banking. Keep track of tenant payments, and analyse cash flow in and out of your bank account. Give tenants multiple ways to pay, see which properties are most profitable, and make data-based decisions.

Work with your accountant

Give your accountant access to your QuickBooks records and let them review your books and give advice based on up-to-the-minute information. Make your end-of-year accounts easier by sharing your financial records in real-time.

Talk to a real person

Our award-winning experts are here for you, 7 days a week with free live chat. Although we cannot offer tax advice or guidance, we can help you utilise QuickBooks software to your benefit. For example, if you need help with Self Assessment for landlords, ask the QB Assistant in our app questions like 'How much did I earn last year?', 'What tax do I owe?' or practical questions like 'How do I upload a receipt?'

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.