How can we help?

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageOnline VAT management made easy

Submit your VAT returns online with QuickBooks accounting software and stay compliant with HMRC’s Making Tax Digital rules. You can prepare, track and file VAT returns - all in one place. Plus, our error-checking technology checks your VAT for common mistakes.

Value-added software

QuickBooks accounting software calculates the amount of VAT you owe and reminds you when it’s due. Our smart error-checking technology checks for common mistakes and lets you make an online submission directly to HMRC.

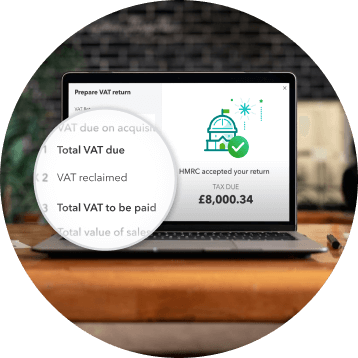

Made for Making Tax Digital

QuickBooks is recognised by HMRC and designed in line with MTD regulations. You can run our error checker to surface common mistakes and make an online submission directly to HMRC. QuickBooks supports standard, cash and flat-rate schemes.

No more data entry

Swap manual data entry for automatic calculations and accurate record keeping. Snap & store receipts, auto-track mileage and easily categorise transactions - all in one place.

Always know how much you owe

Take control of your cash flow and make smarter business decisions. Log in to your account anytime, anywhere using your smartphone, tablet or computer. See exactly what’s due with our real-time dashboard and calculate your VAT-related expenses.

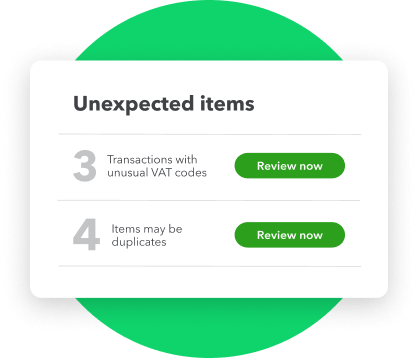

Automatically check your VAT for errors

Our helpful error-checking technology spots common errors, duplicates and anomalies in your VAT. Be more confident when you submit your VAT to HMRC through QuickBooks.