Accounting solutions

Tools to take on anything

No two days are the same for your practice—and no two clients. With our lineup of QuickBooks and ProConnect products, you’ll find versatile solutions to match diverse accounting needs and make each new day the most productive yet.

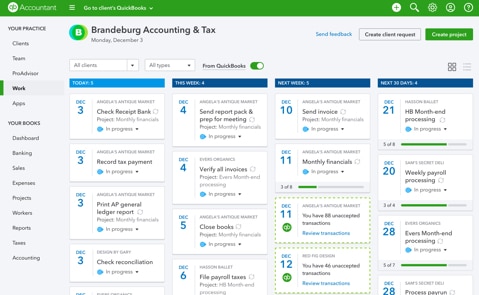

Designed to support your dream practice

Connect your clients, work, and training under one login, and tap into features available only to accounting pros. Signing up is totally free—our way of investing in your success.

- Real-time access to client files anytime, anywhere.

- Secure communication and document sharing from one place.

- Training and marketing resources to grow your firm and expertise.

- Move your Desktop clients online with improved migration assistance,* preferred pricing, and optional revenue share.*

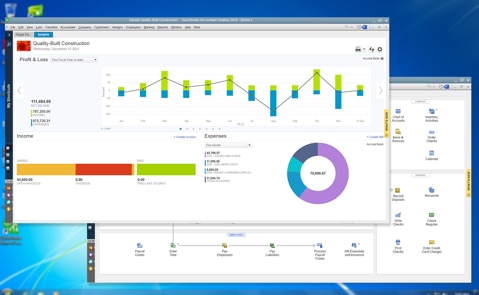

Deliver for your desktop clients

With accountant-only tools and powerful performance, you can do more for your QuickBooks Desktop clients in less time. Available as part of the ProAdvisor Deluxe and Premium memberships.

- Access your Accountant Toolbox from your client's office or in remote and hosted situations.

- Reclassify, delete, and void transactions in bulk.

- Find and fix errors faster with client data review.

- Work in your own copy of your client's files to be productive anytime.

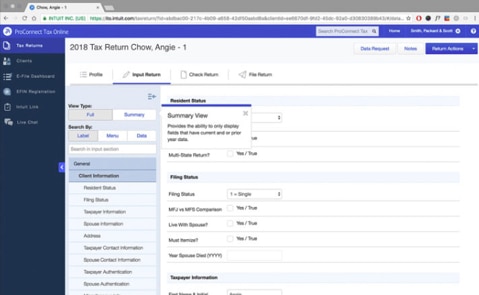

Calm the tax season storm

Enjoy the productivity of traditional tax software with the flexibility of the cloud. Sync your client's data from QuickBooks Online Accountant for faster, more accurate filing.

- Request, share, and manage documents all in one place.

- Automatically import client data with Trial Balance to cut down errors.

- Access more than 5,600 forms and tax returns under one login.

- Automatic updates keep client data secure.

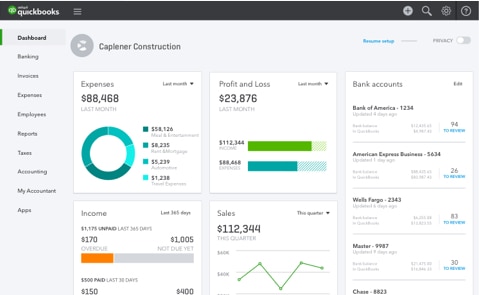

Productivity anytime, anywhere

Manage your clients’ books remotely so you're always in control. Open multiple windows to easily jump between clients, and access your favorite tools without leaving your workflow.

- Real-time access to files anytime, anywhere.

- Work in files at the same time as your clients and team without version-control worries.

- Custom bank feeds automatically sync your clients’ transactions to QuickBooks.

- Accountant-only tools accessible right from your clients’ QuickBooks.

Capabilities as diverse as your clients

QuickBooks Desktop is a one-time purchase installed on your clients’ work computer. We offer multiple versions depending on your clients’ needs—Pro, Premier, and Mac.

QuickBooks Desktop Pro & QuickBooks Desktop Premier:

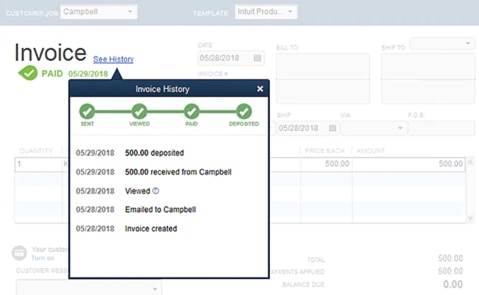

- Track invoice status at a glance.

- Transfer customer credits across jobs.

- Quickly link checks to open bills so books stay accurate.

- Access advanced forecasting tools and industry-specific reports (Premier only).

Mac:

- Share documents on multiple Macs connected through iCloud.

- Identify and reconcile discrepancies between bank statements and QuickBooks records.

- Import sales data from Square quickly and easily.

Big-time power for not-so-small businesses

Go ahead, crank it to 11. With advanced reporting, pricing, and inventory tools applicable across multiple industries, it doesn’t get any more powerful than this.

- 6x the capacity of other QuickBooks editions.

- Up to 30 full-access, simultaneous users.

- Up to 1 million list items, users, and vendors.

- Ideal for wholesalers, contractors, manufacturers, and other clients with advanced accounting needs.