You asked, we delivered

Intuit Bookkeeping Certification

Launch your career by learning fundamental accounting principles.

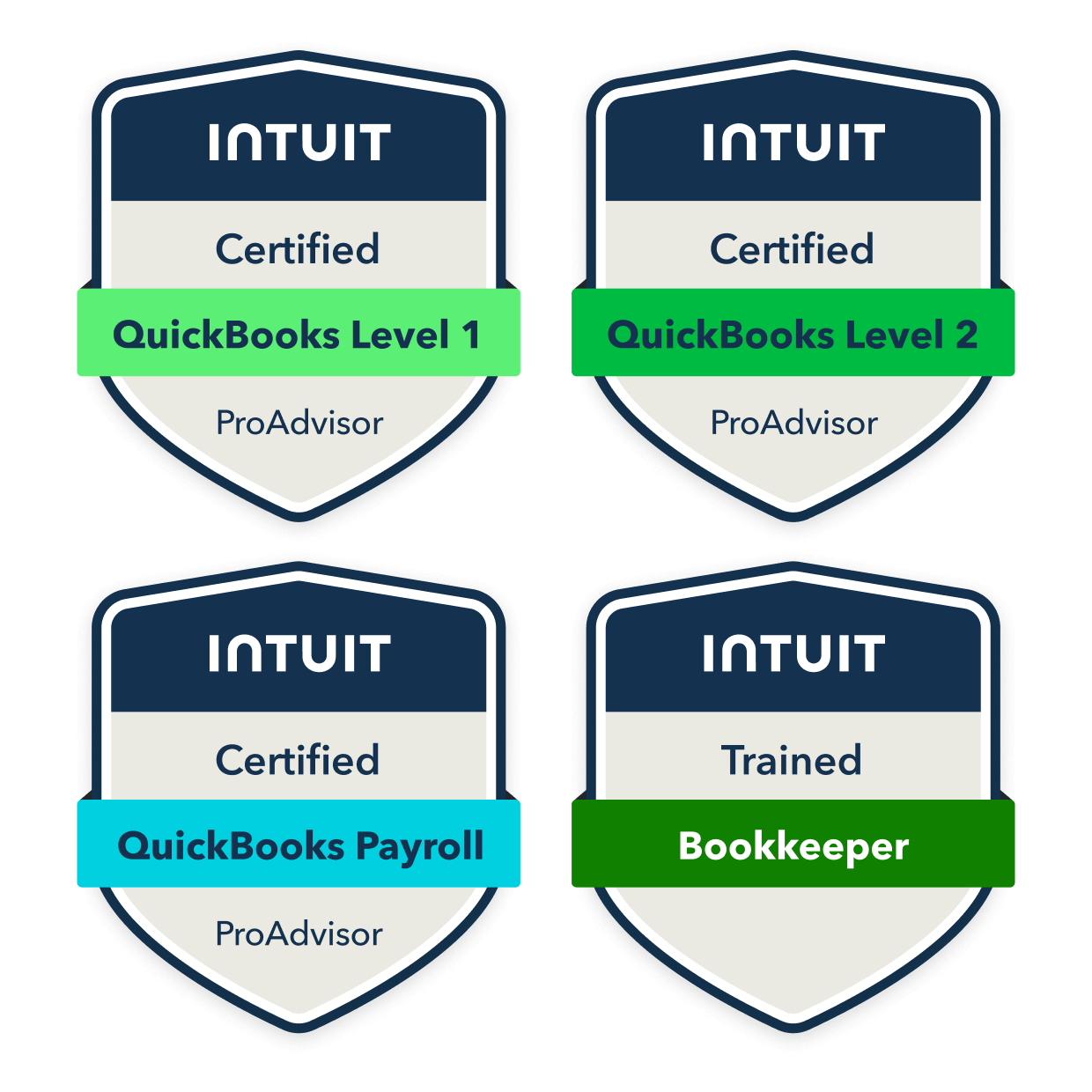

QuickBooks Online product certifications

Drive revenue and increase value with updated generalist and specialist certifications.

Stay in the know

Join a live webinar or catch episodes on demand to learn about our latest innovations.

Get more done for your clients

Access engaging courses, tools, and tutorials through an easy-to-search learning library.

Start strong

Build your foundational knowledge of accounting principles with our bookkeeping program to help launch your career.

Expand your knowledge

Learn how to optimize QuickBooks to deliver powerful accounting workflows with hands-on, media-rich certifications—all in our ProAdvisor Academy.

Keep on learning

Learn from your ProAdvisor peers how to leverage your accounting expertise to deliver valuable advisory insights to your clients.

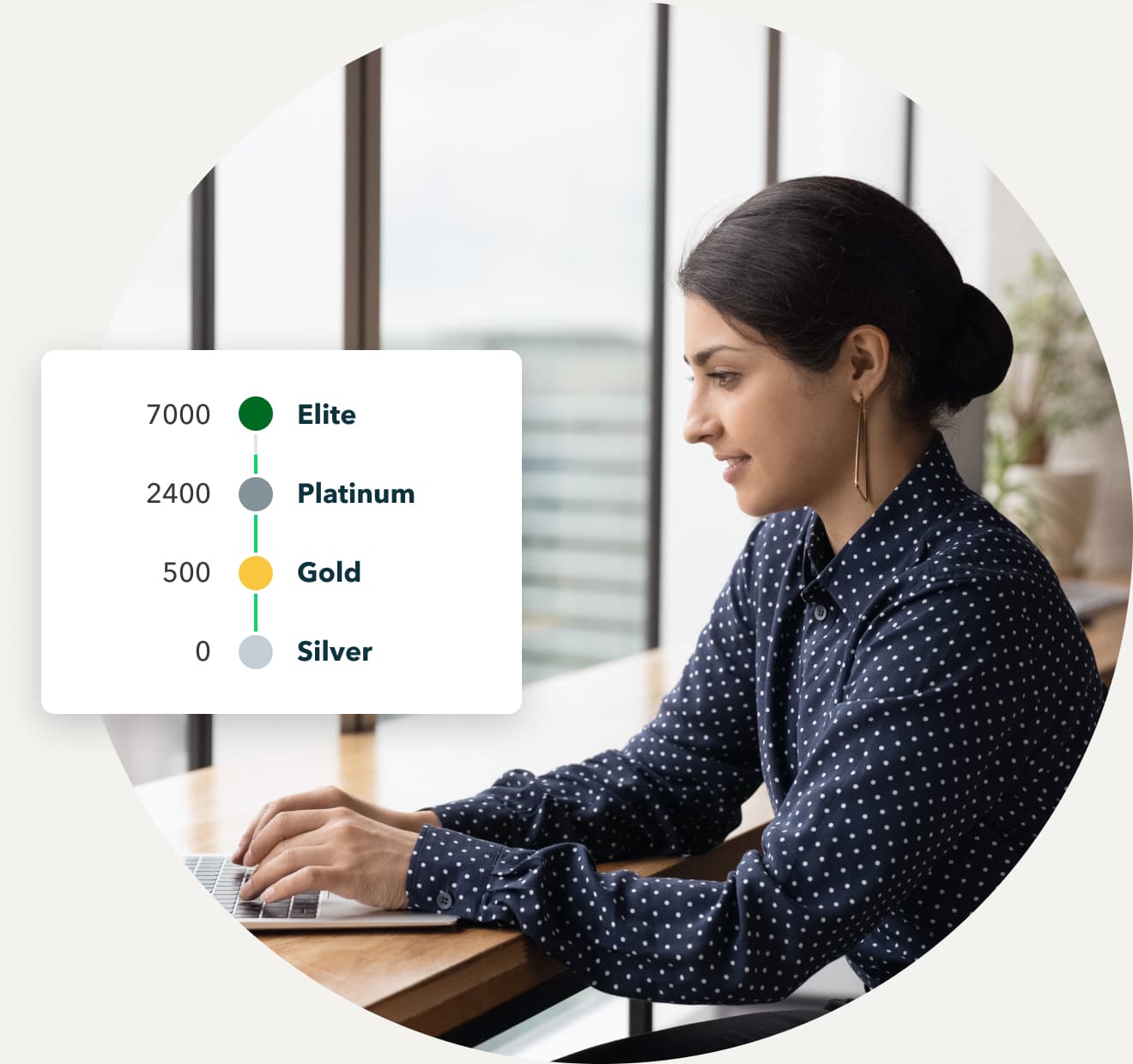

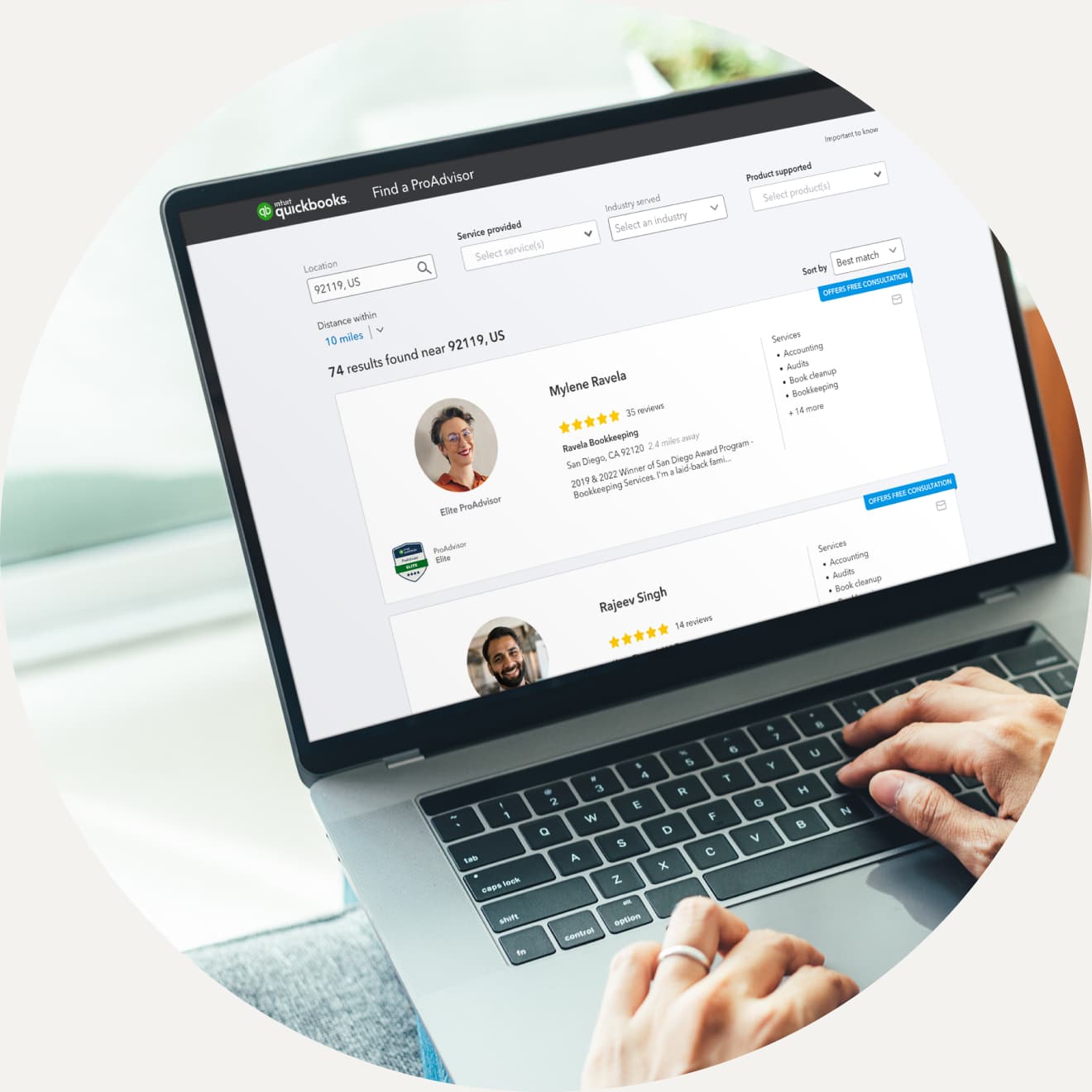

Earn rewards for your expertise

Stand out from the crowd and show prospective clients that you’re an expert by using official ProAdvisor badges on sites, directories, and social profiles.

Earn CPE credits while growing your skills, and provide CPE credits to your team members to help them grow their careers alongside your firm.

Earn points and rewards that can help to grow your firm and support your clients. The more points you collect, the sweeter the perks.

Get a free priority listing on our Find-a-ProAdvisor online directory, showcasing your skills and services to a vast range of potential new clients.

Grow your career and enrich client service

ProAdvisor Academy gives you the tools to get the most out of QuickBooks so you can serve your clients better and grow your firm.

Level up product knowledge

Boost your credibility with specialized certifications from our ProAdvisor Academy that dive deeper into complex services and workflows to help you stand out with clients.

Stay in the know

Learn about the latest updates to QuickBooks so you can keep working efficiently while delivering more value to clients.

Engage top talent

Provide team members with access to our ProAdvisor Academy for professional development, CPE credits, and badges that will help them grow their careers alongside your firm.

Intuit, Inc. is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org. For information regarding refund, complaint resolution and program cancellation policies, please contact our customer support team at 1-888-333-3451.