As a small business owner or solopreneur, there's always a lot to learn. From marketing to customer service to accounting, you have to juggle many tasks and responsibilities. You might also find that you're continuously hearing new terms, such as accounts receivable.

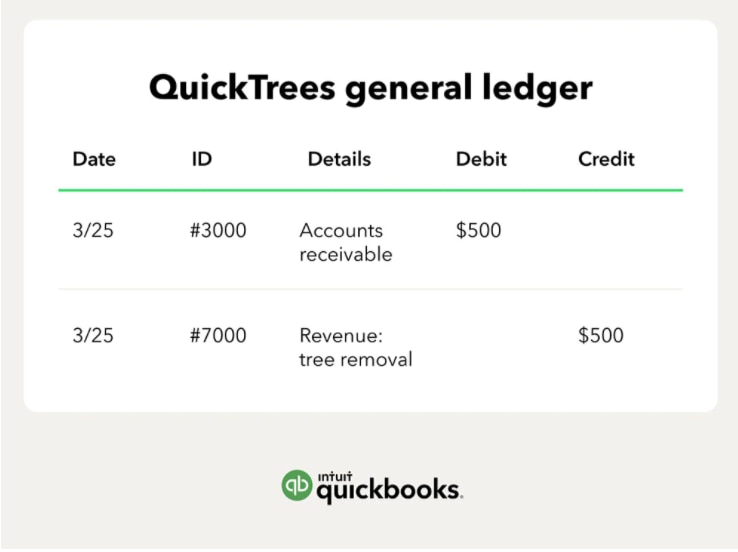

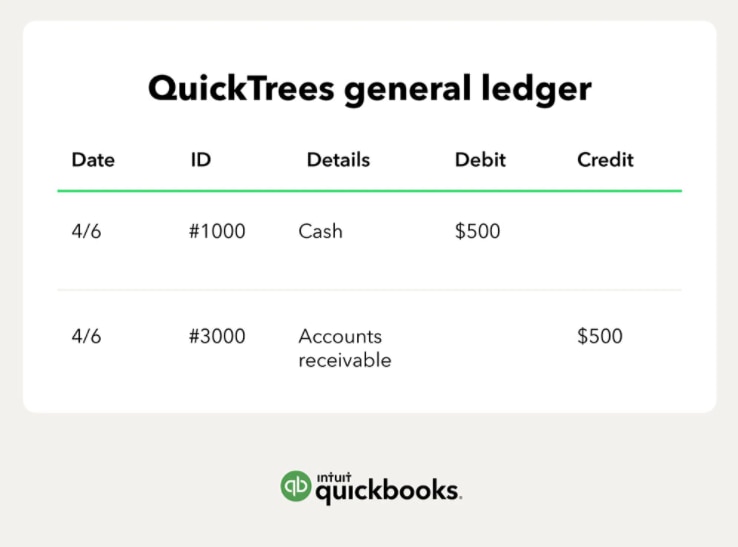

If you're not familiar with accounts receivable, it refers to the money your customers owe for goods or services they have purchased on credit.

This article explains how the accounts receivable process works, and the steps you can take to implement or improve your accounts receivable process.