Even if your small business is running smoothly at the moment, it’s important to be prepared in case something unexpected and out of your control goes wrong.

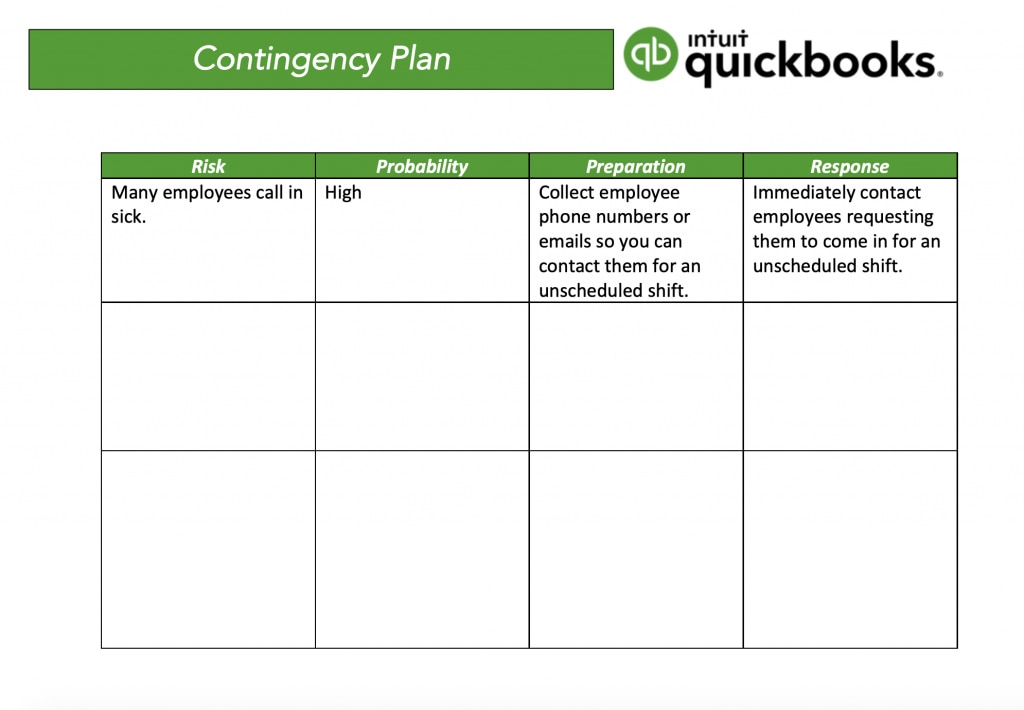

With a business contingency plan in place, you know exactly what to do when disaster strikes. For example, when the computer system at your business breaks down, you know who to contact right away to get the computer system up and running.