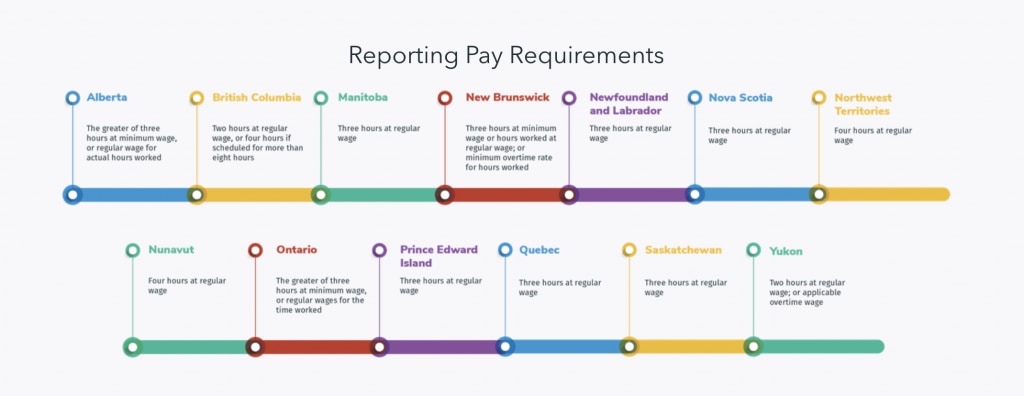

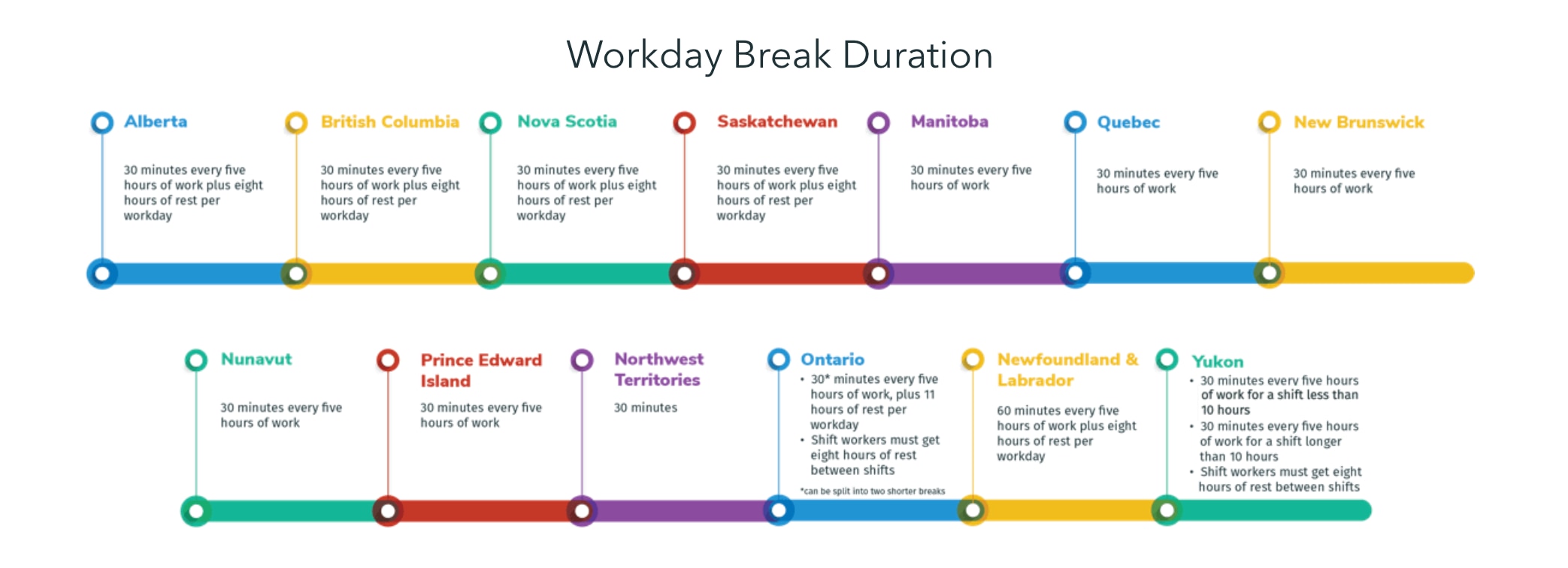

Canada is the second largest country in the world by land mass, but its entire population is equivalent to the single US state of California. With 17.2 million people working across 10 provinces and three territories, much of the employment law falls under regional jurisdictions.

Here’s a comprehensive overview of the nation’s labour laws, exploring minimum employee rights and standards by topic as set forth in the Canada Labour Code, as well as provincial and territorial legislatures.

Learn where the law stands when it comes to minimum wage, overtime rates, averaging hours, and recordkeeping.

Working Hours

Most employees are expected to turn in eight hours daily over a five-day workweek or 10 hours daily over a four-day workweek. The average workweek in Canada is 40 hours long before overtime kicks in. The same is applicable to federally regulated employees.

Most provinces and territories do not limit the number of hours worked past the weekly minimum, as long as the right wage rate is applied and agreed between the employer and the employee. Alberta caps the daily limit at 12 hours, while employees in Quebec can refuse to work more than four hours more than their usual daily hours (e.g. 12 hours per day or 60 hours per week)