How to write off your car as a business expense in Canada

To write off your car as a business expense in Canada, you’ll need to follow these simple steps to ensure your claims are accurate.

Step 1: Track your mileage

First, keep a detailed log of your business and personal kilometres driven. This will help you calculate the percentage of vehicle use that qualifies as a business expense.

In your logbook, include the following details:

- Date

- Destination

- Purpose of the trip

- Number of kilometres you drove

- Starting and ending odometer readings

If you drive to meet with clients or deliver your products, record those trips in your mileage log. Apps and spreadsheets can make tracking effortless.

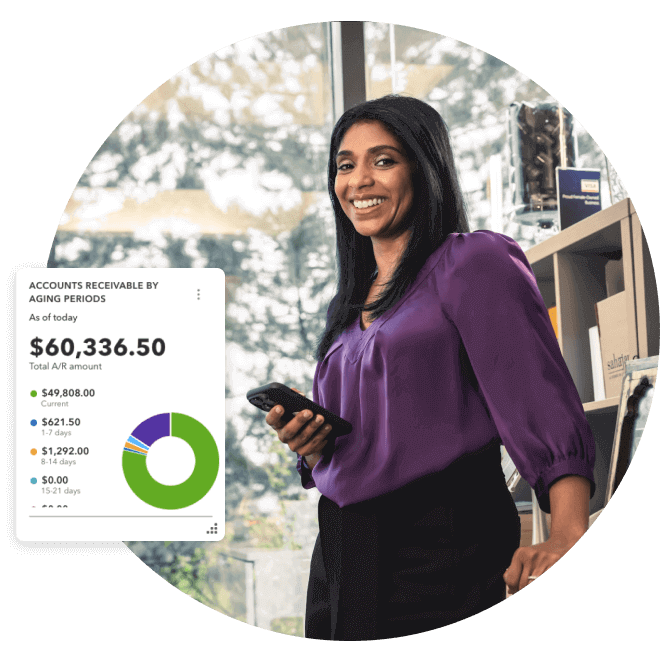

Pro Tip: QuickBooks gives customers the ability to quickly sort their business trips and personal trips, making it easy to categorize them within the app.

Step 2: Determine eligible car expenses

There are many vehicle-related costs you can deduct, including:

- Fuel and oil

- Interest on a car loan

- Auto insurance premiums

- Licensing and registration fees

- Maintenance and repairs

- Car lease payments

- Electricity for zero-emission vehicles

- Depreciation (also known as capital cost allowance, if you own the vehicle)

- Parking fees

For instance, if your annual fuel costs are $5,000 and your business-use percentage is 50%, you can deduct $2,500 ($5,000 x 50% = $2,500).

Step 3: Calculate the business-use portion

You can use your mileage log to determine the business use percentage.

To illustrate, if 60% of your total kilometres driven are for work purposes, you can claim 60% of eligible car expenses.

If your total car expenses are $10,000 for the year and 60% of your mileage was for business, you can deduct $6,000 ($10,000 x 60% = $6,000).

Step 4: File your claim accurately

When filing your taxes, use Form T2125, Statement of Business or Professional Activities for sole proprietors or self-employed individuals.

Based on your scenario, these are the sections you may need to fill out:

- Chart A - Motor vehicle expenses

- Chart B - Available interest expense for (zero-emission) passenger vehicles

- Chart C - Eligible leasing cost for passenger vehicles

Keep your receipts and mileage logs to support your claim. For instance, if you’re a freelance photographer visiting clients or attending industry events, those trips can be included in your deductions if they’re appropriately documented.