Benefits of a Business Budget

The benefits attached to budgeting are immense. As a small business owner, you can reap great rewards from the proper budgeting, as the document provides you with deep financial insight and holds you accountable to your spending habits.

Take advantage of what this document can tell you and gain these benefits of a business budget:

- Properly manage cash flow

- Improve income and profits

- Decrease expenses and fixed costs

- Monitor performance

- Track slow seasons and peak seasons

- Discover industry insight

- Determine your best selling product or service

- Improve decision making

- Prepare for emergencies

Budgeting should not just happen at an owner’s level or with management. Business owners should consider budgeting for employee incentives, too, to improve your worker’s morale and output. Budgeting should always take into account your budget goal, comparing projected numbers of goods sold and variable costs against actual expenses and revenue, covering all aspects of your business.

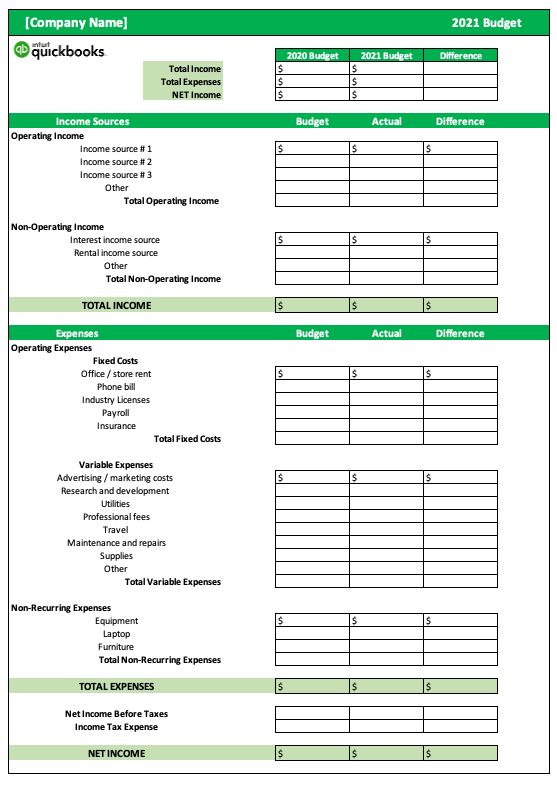

With this in mind, let’s take a look at the business budget template provided below.