Growing your company through the finance function starts with creating a financial strategy custom to your company and the goals you want to achieve. Whether the finance department is just you, you and an accountant or bookkeeper, or a full-fledged team led by a CFO, finance can and should propel your growth, beyond the expected duties of keeping overhead low and providing regular financials. This article will walk through a few ways to get started, what to bear in mind at different stages, and choosing funding options so that you can create a successful financial strategy.

Create a Financial Strategy that Fuels Growth

3 Ways to Leverage the Finance Function for Growth

1. Define financial success

Work with a finance consultant or fractional CFO to determine what financial success looks like for your business and set achievable goals accordingly. Then choose the metrics you’ll use to measure that success, as well as how you will track them, and how often you will review them to make adjustments as needed.

2. Find ways to maximize profit in your budget reviews

As you compare budgeted spend to actual spend for the month or quarter, go deeper and look at how profitable different jobs, marketing campaigns, customers, and products were for the period and why. Adjust your spend to align with profitability where possible.

3. Use invoice funding to deliver more work in less time

By getting invoices paid quickly (instead of waiting for 30, 60, or 90+ days), you’ll be able to take on more work or make more products and sell them in the same time period you would’ve spent waiting for the necessary capital to come in. The improved cash flow also enables you to take on large projects that require more upfront investment than you could normally make, snowballing your company’s growth.

Once you’ve optimized the finance function, you can further tailor your strategy to the stage your company is in today and the stage you want to get to in the future. Here’s what to consider as part of your finance strategy at every stage.

Financial Strategy Considerations for Growth at Every Stage

Startup: Securing the right funding

If you’re in the start-up stage, the right financing can make all the difference in whether your company makes it to profitability. A fractional or consultant CFO can significantly contribute to achieving these goals by recommending funding options specific to your situation, preparing historical financial statements and cash flow projections to show investors, and helping you refine the company strategy.

The finance function at the start-up stage is key to securing the funding your business needs to mature to the point of self- sufficiency.

Growth: Maintaining capital during rapid change

The growth stage is exciting; customers are flocking to your offering and you’re making hires. At this point, hiring a CFO and a controller as the foundation of the finance department might make sense: the financial picture is more complicated since rising costs come with rising growth.

Whether you’ve made hires or are still managing finances on your own, it’s a good idea to align quarterly (or even monthly) with areas of the business that need to spend the most money, like marketing, sales, and product, on budgets, actual spend, ROI, and which products and activities have the best profit margins.

By keeping a close eye on spending and the value created with it, finance can steer the company toward sustainable growth.

Maturity: Optimizing for continued expansion

At this point, the business might feel more stable. Revenue is much more predictable and the rapid growth of the last stage has slowed down.

At this point, you’ll likely have some kind of finance team headed by a Finance Director or CFO. That person should be working with you (the CEO) on ways to continue growth, improve productivity and efficiency, and get involved in how to structure deals from the beginning to find that sweet spot of making them feasible, profitable, and attractive to customers. The team as a whole will continue forecasting sales and cash flow while keeping costs in check.

By having a few ideas for maximizing growth with the finance function and knowing the stage your company is in today, you can choose funding options that make sense for achieving your goals.

Creating your ideal funding mix

No doubt choosing funding sources is key for scaling your business. To maximize the value of your funding it’s important to minimize the cost of your capital as well as your bankruptcy risk.

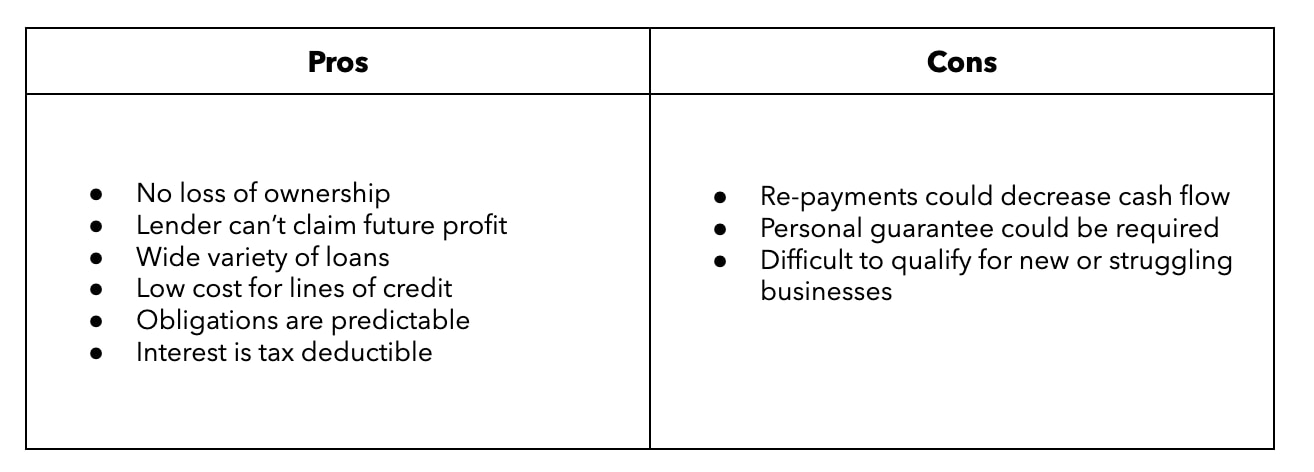

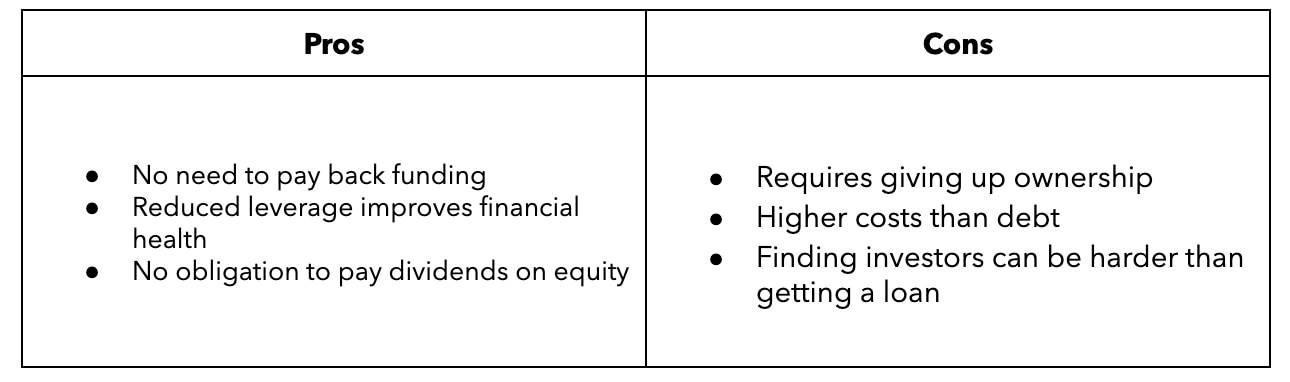

Traditionally, the two types of funding business owners turn to are debt and equity. Debt vehicles include lines of credit, loans, or even credit cards for very small or fledgling businesses. Financing with equity involves selling ownership in exchange for funding. Weigh your options by reviewing the pros and cons of each.

Debt Financing: Pros and Cons

Equity: Equity Pros and Cons

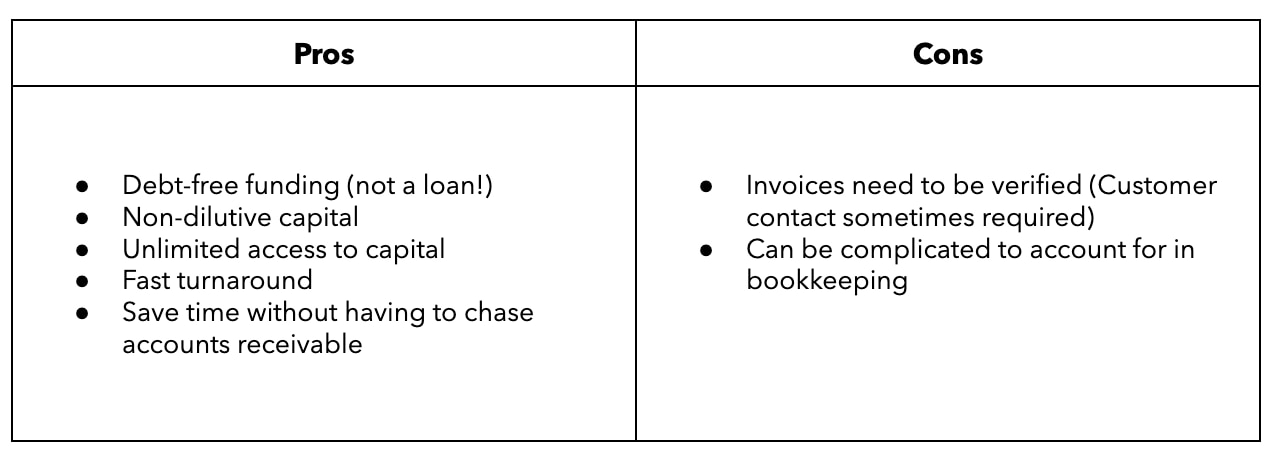

Invoice Funding: the third funding option that's neither debt nor equity

Funding invoices gives small, growing companies the best of both worlds. Financially savvy business owners are looking at ways to fund their companies beyond the traditional. Invoice funding is emerging as a third funding option that provides funding without the drawbacks of debt or equity.

Oftentimes, small business owners have to wait 30, 60, 90 or even 120 days for customers to pay, leading to low cash flow. Invoice funding companies advance the total of your invoice (less fees) way ahead of the payment terms, and the company waits on the payment from your customer. The result is increased cash flow for making payroll, paying suppliers, and taking on large projects.

Invoice Funding: Pros and Cons

Here’s a quick breakdown of the basic invoice factoring process:

- A business owner chooses invoices they want to factor.

- The business owner receives cash for the invoice amount, less a fee, ahead of the payment terms.

- The business owner’s customer pays the invoice amount to the factoring company according to the original payment terms.

(Note: This is different from invoice financing, where a factoring company still gives a business owner cash for their invoice, but the business owner pays back the invoice amount themselves, plus a fee.)

How does invoice funding drive growth?

When you speed up your cash flow, you have enough cash on hand to not only pay regular expenses, but to pay upfront costs for large projects or taking on more customers. This allows you to do more work and generate more revenue in a shorter amount of time instead of waiting to get paid.

About FundThrough

FundThrough is a leading fintech company accelerating cash flow and enabling growth for small and medium businesses. Based in Toronto, FundThrough’s AI-powered invoice funding platform gives B2B businesses fast, customized funding offers to get their invoices paid in a few days - rather than a few months - and get quick access to cash that’s already theirs. For more information, go to http://www.fundthrough.com. To learn about FundThrough’s partnership with Intuit QuickBooks and how you can fund an invoice, click here.