Intuit QuickBooks Small Business Index Annual Report 2023

Small businesses play a pivotal role in the global economy as engines of innovation and job creation. Despite their critical importance, the insights needed to fully understand the health and challenges of small businesses have been in short supply. Until now.

This year marks the inaugural release of the Intuit QuickBooks Small Business Index Annual Report. The report provides a rigorous and comprehensive analysis of the small business landscape in Canada, the US, and the UK, examining why small business employment has declined in 2023 when overall employment levels have been increasing. The answer uncovers small business sensitivity to the effects of inflation and rising interest rates — limiting funding access and growth. The report analysis also delves into the impact of digitization and how small businesses are using digital tools such as software, apps, and e-commerce to manage their business.

Findings draw from a detailed new analysis of official statistics, employment trends from the Intuit QuickBooks Small Business Index, and surveys of more than 5,000 small businesses. The report also builds on new analysis of anonymized expenditure and savings data provided by more than 3 million Intuit QuickBooks customers.

The report was produced in collaboration between Intuit QuickBooks and an international team of economists led by Professor Ufuk Akcigit, the Arnold C. Harberger Professor of Economics at the University of Chicago.

Providing a unique and timely analysis of the current state of small businesses, the report highlights why the future health of the economy depends on small business success today.

Read below for the most important findings from the report and download the full PDF.

Read more about actionable insights for small businesses from this year’s report.

Read more about actionable insights for policymakers from this year’s report.

Read more about actionable insights for accountants from this year’s report.

Key findings

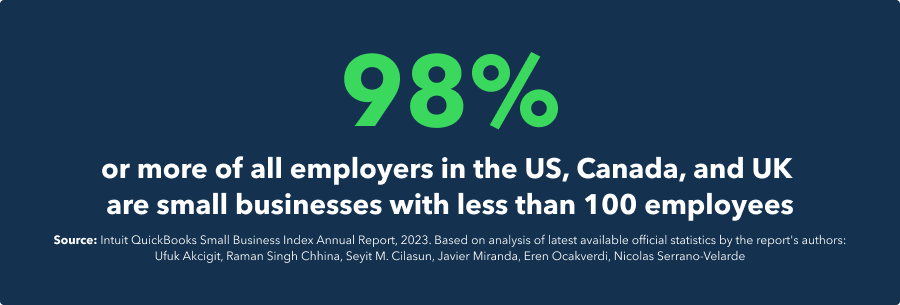

Small businesses play a critical role in Canadian, US, and UK economies

- More than 98% of employers in Canada, the US, and the UK are small businesses.

- Small businesses provide 47% of Canada’s jobs, 36% of US jobs, and 44% of UK jobs.

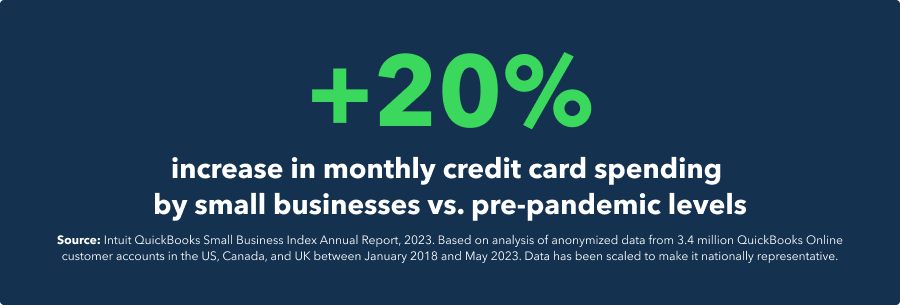

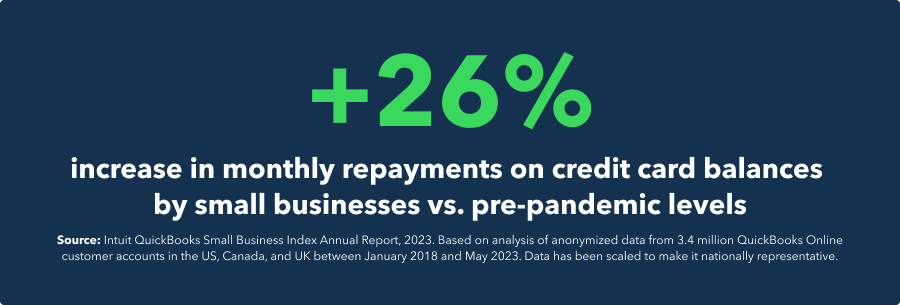

Inflation and interest rates are creating unique challenges for small businesses

- The Intuit QuickBooks Small Business Index shows negative small business employment growth in Canada, the US, and the UK during the first half of 2023 following interest rate increases.

- Compared to pre-pandemic levels, average monthly credit card expenditure is up by an average of 20% — creating potential vulnerabilities.

- At the same time, monthly credit card payments made by small businesses are 26% higher, on average, than before the pandemic.

Funding is a persistent challenge for small businesses

- Roughly half of small business owners surveyed in Canada, the US, and the UK have self-funded their business (51% in Canada, 58% in the US, 48% in the UK) — often by working other jobs.

- Small business owners are almost twice as likely to use their own savings to fund their business — usually from working other jobs — as they are to use loans from banks or other commercial lenders. New small businesses are twice as likely to say "getting funding" is their number one challenge compared to older small businesses.

- Small businesses that applied for credit from banks that were well-financed before recent interest rate rises received more funding than those working with less well-financed banks.

Small businesses making more use of digital tools are more likely to be growing

- Detailed analysis of surveys commissioned by Intuit QuickBooks in Canada, the US, and the UK, reveals a correlation between higher use of digital tools and better business performance.

- For example, Canadian small businesses using 8 or more digital tools to manage different areas of their business are twice as likely to report revenue growth and four times more likely to have expanded their workforce over the 12 months prior to April 2023 than small businesses using just up to 2 digital tools.

- This analysis is based on the full spectrum of digital tools used by small businesses including social media, e-commerce, accounting software, HR and payroll software, email marketing, payments, and sales platforms.

Big data, actionable insights

Powering prosperity for small businesses starts with data—and ends with action.

This year’s Annual Report provides an in-depth look at why the health and success of small businesses is critical to a thriving economy. Their success depends not only on the actions of business owners, but a larger community of drivers and advisors. From the policymakers pushing for better government support to the accountants playing an advisory role, small business stakeholders are crucial partners.

Alongside the report, we’ve published recommendations on how businesses, policymakers, and accountants can take action for small business resilience based on the data.

Read more about actionable insights for small businesses from this year’s report.

Read more about actionable insights for policymakers from this year’s report.

Read more about actionable insights for accountants from this year’s report.