Items to include in your mechanic and car repair invoice

Generally, your service agreement determines what goes into your auto repair and mechanic service invoice, but some items are mandatory. You must inform customers when you’re applying the GST, HST, or QST (if in Quebec) to their purchases.

It’s wise to separate your repair shop services price from any GST, HST, or QST you collect. The Canada Revenue Agency requires that you show the total HST rate if HST applies to the supply, but don’t show the federal and provincial parts of the HST separately.

If you repair vehicles in Ontario, for example, your final invoice must include:

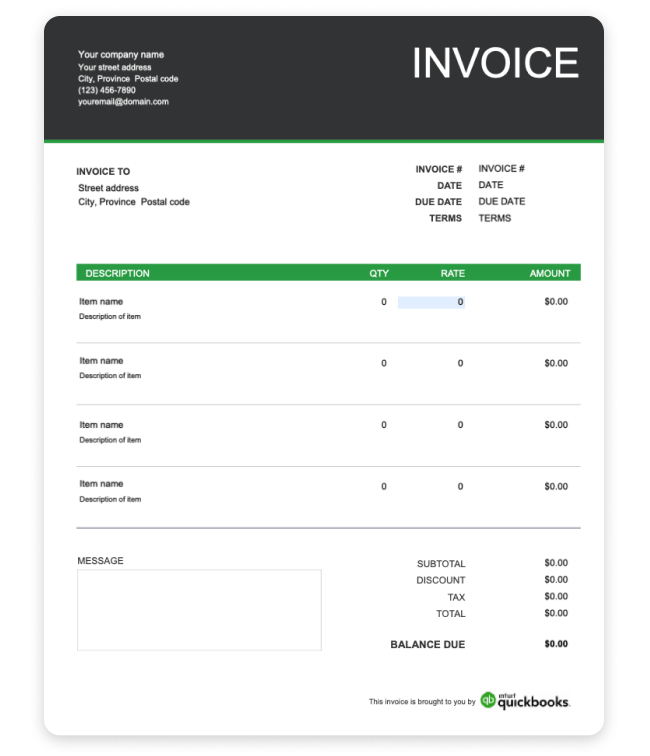

- Customer’s name

- Repair shop name, address, and contact information

- Vehicle make, model, vehicle identification number (VIN), and licence number

- Vehicle odometer readings for when you receive the vehicle and when you return it

- List of the parts you installed and whether the parts are new, used, or reconditioned

- Whether you used parts by the original equipment manufacturer

- Prices of the parts

- Total labour cost and how you calculated it, such as hourly rate, flat rate, or a combination

- Shop supplies beyond normal operating costs if you charge the customer for them

- Terms of the warranty you provide for each part installed and the labour to install it

- Total amount you bill your customer, which can’t be greater than 10% of the estimate, according to Consumer Protection Ontario

If your customer sets a maximum price they’re willing to pay for the repair and you agree, you can’t charge a final cost that is higher than the agreed amount.

Be sure to include an invoice number and keep an itemized list and brief description of all supplies used in the repair work. These details will help you make the total price of the services as concise as possible, so customers know exactly what they're paying for.