When should you send contractor invoices?

The timing of sending an invoice plays a critical role in maintaining cash flow and establishing a professional relationship with your clients. Generally, contractors should issue invoices immediately upon completion of a project or delivery of a service. This practice underscores the promptness and professionalism of your business operations and encourages timely payments.

For longer projects, consider setting up milestone payments, where you invoice for portions of the work at agreed-upon stages. This approach not only helps in managing your cash flow, but also aligns payment expectations with your client to minimize surprises.

In cases where you have an ongoing relationship with a client, you might opt for regular invoicing intervals, such as bi-weekly or monthly, based on the volume of work and prior agreement. The key is clear communication with your client about your invoicing schedule to ensure mutual understanding and avoid potential payment delays.

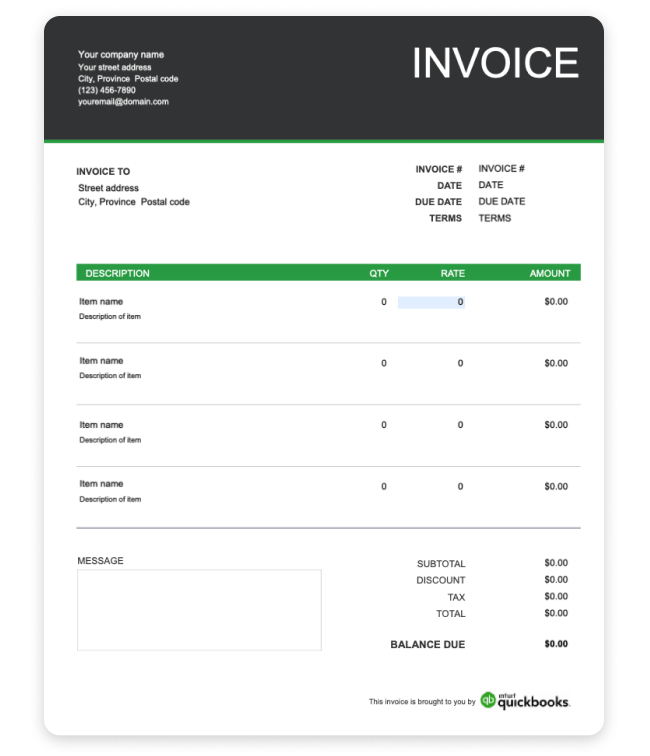

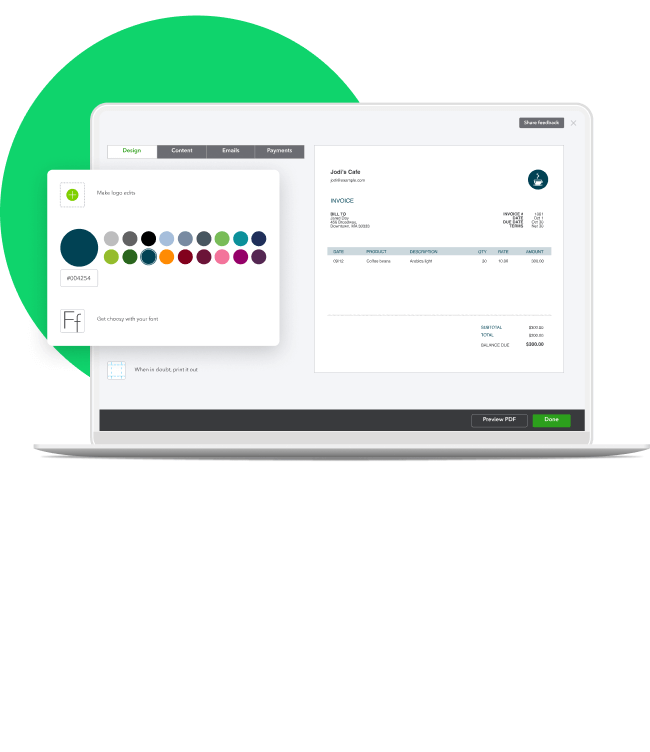

Efficient invoicing is about more than just getting paid — it's about streamlining your operations and reinforcing your professional image. A well-crafted contractor invoice template is a key tool in achieving this. Whether you're looking to refine your current invoicing process or you're starting fresh, QuickBooks provides the solutions you need to manage your finances effectively.

Explore QuickBooks' invoicing solutions today and take the first step towards streamlined billing and improved cash flow.