What to include in your musician invoice

Creating an invoice that hits all the right notes requires attention to detail. Here’s what to include to ensure your invoice is both comprehensive and clear:

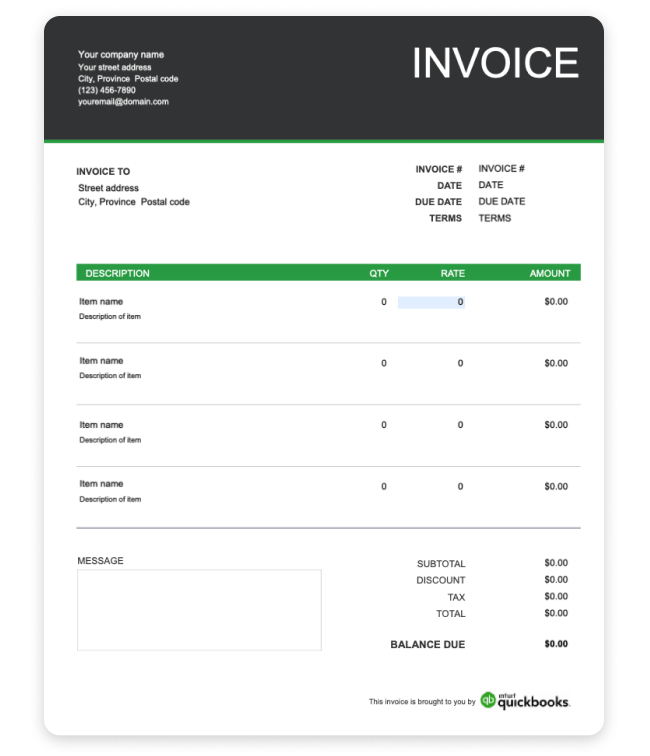

Contact information

Make sure your name (or business name, if applicable) and contact information are displayed clearly on your invoice.

Include your Canada Revenue Agency business number, if you have one.

Note: It's mandatory to include your business number on all your invoices if you're registered to collect GST/HST.

Invoice number

An invoice number acts as a unique identifier for each transaction, making it easier for you to track and reference specific invoices.

Invoices should be numbered sequentially, and unique numbers should only be used once.

Client information

Start with the basics:

- Your client's name

- Address

- Contact details

This not only personalizes the invoice, but also ensures it reaches the right hands if you aren't hand delivering the invoice.

Services rendered

Detail the services provided, whether it's a live performance, studio session, or music lessons.

Be specific with your descriptions to avoid any misunderstandings during payment processing, and make sure you include the date the service was provided.

Pricing and payment terms

Clearly list your fees, including any taxes or additional costs. Outline your payment terms, such as due dates and acceptable payment methods, to make things easy for your clients. A specific due date encourages timely payments and helps maintain a steady income flow.

Additional details

Consider adding any unique elements like discounts for prompt payment or fees for late payments. This can incentivize faster payment and establish clear expectations with your customers.

If you are registered to charge sales taxes, you will need to include tax amounts on a separate line, along with the rate of tax charged.