What is a photography invoice used for?

Photographers and videographers provide their clients with an invoice after completing the job. While a percentage of the payment may be collected upfront, the invoice is meant to finalize the job and typically includes a detailed scope of work.

Some photography jobs that need invoicing include:

- Wedding photography

- Professional head shots

- Baby portraits

- Family photography

- Studio portraits

- Commercial photography

- Stock image licensing

- Photojournalism

- Event photography

- Photo editing

- Pet photography

- Drone operating

- Fashion photography

- Travel photography

- Real estate photography

Any work related to film and photography will usually require a photography invoice. Even if you’re not physically operating a camera, a photography invoice may still be needed for jobs such as photo editing or studio rental.

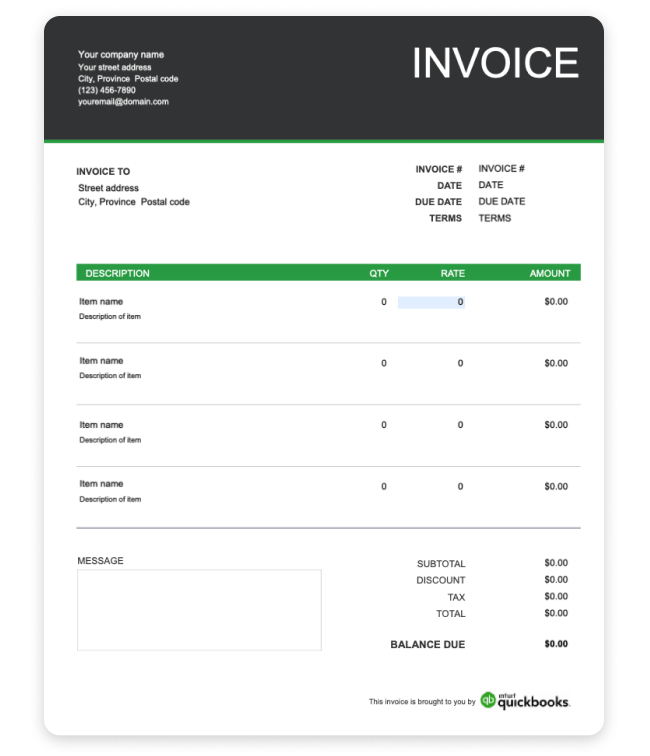

Invoices are essential because they give your customers a detailed breakdown of the work performed, the costs, and the payment terms.