Your plumbing business tackles a variety of jobs, from unblocking drains to installing water lines. With all that work on your team’s plate, the last thing you want to do is spend time chasing down payments and answering questions about bills.

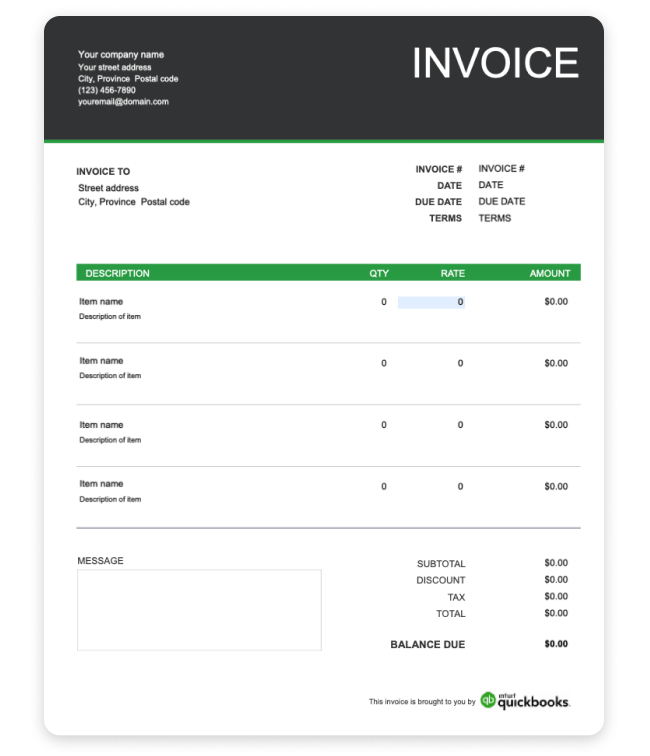

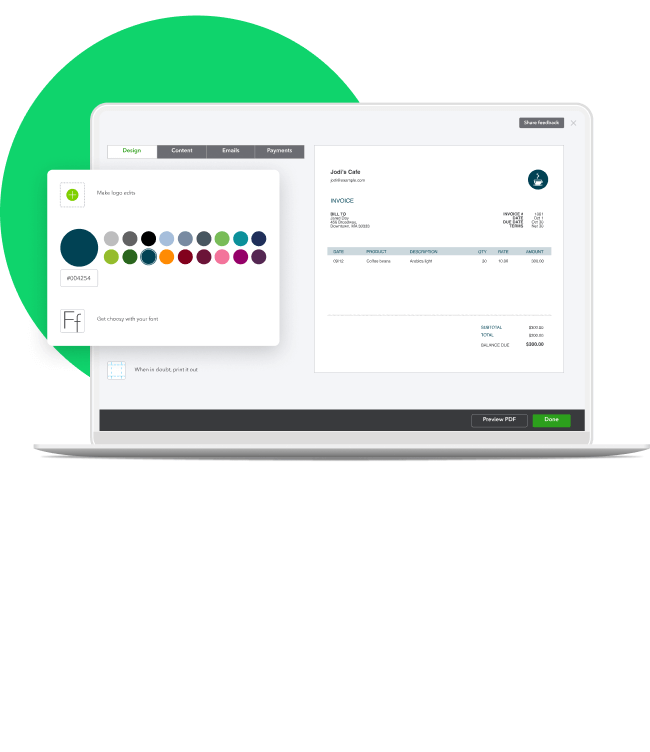

You can use our free invoice template to charge clients for diagnostic fees, estimated work, and completed work for your plumbing business. Using a template makes invoicing faster because you don’t have to rewrite the same information over and over again.

Sending clean and detailed invoices makes it easier to track cash flow and get paid on time. It adds a dose of professionalism to your business, which helps build trust with clients. Having digital records in one place can also help you keep records and prepare for tax season more effectively.