Do you own a second home that you're considering renting out? Or maybe you're taking on a new career as a property manager for a rental complex.

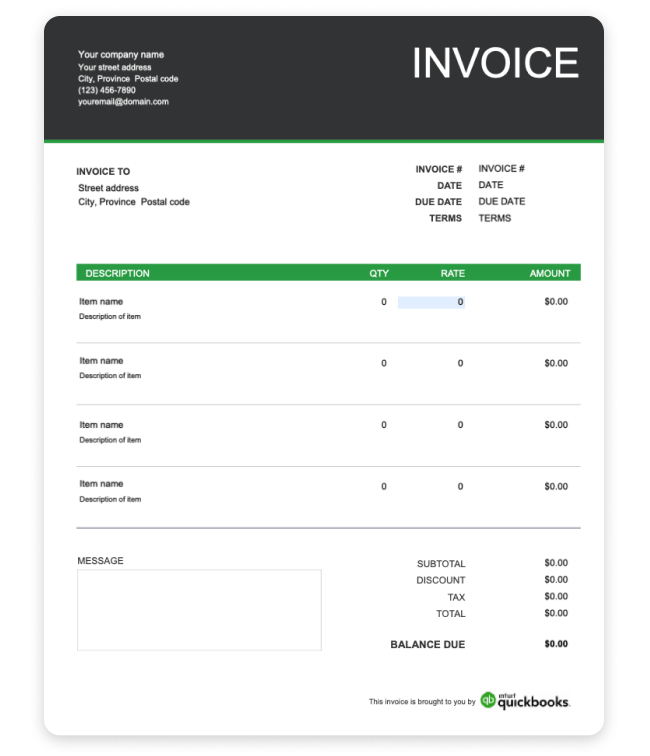

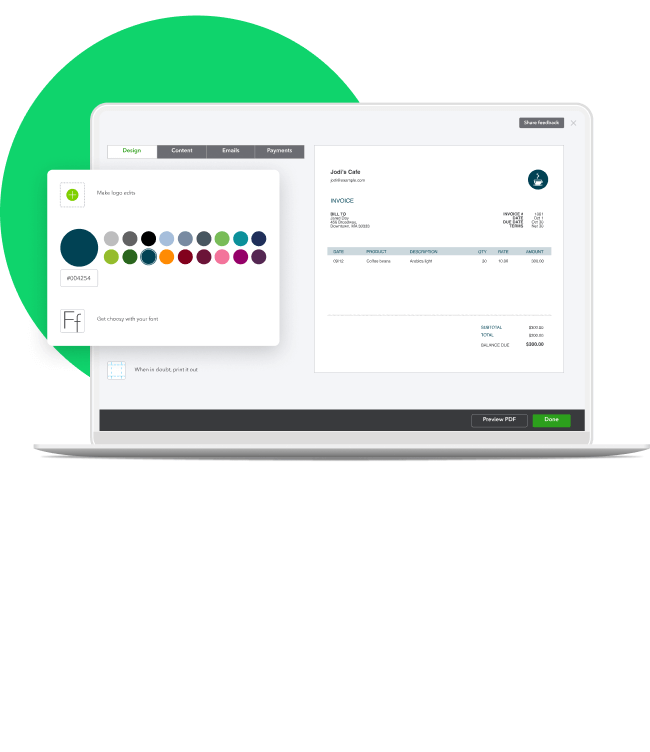

If so, you will likely need to create a rental invoice — also known as a rental receipt — to ensure you and your renter understand the terms of your agreement. Keeping detailed records of your rental income is also useful for tax purposes.

Read on for guidance on which rental agreements require an invoice, the items you should include, and why it's important to create a rental invoice template.