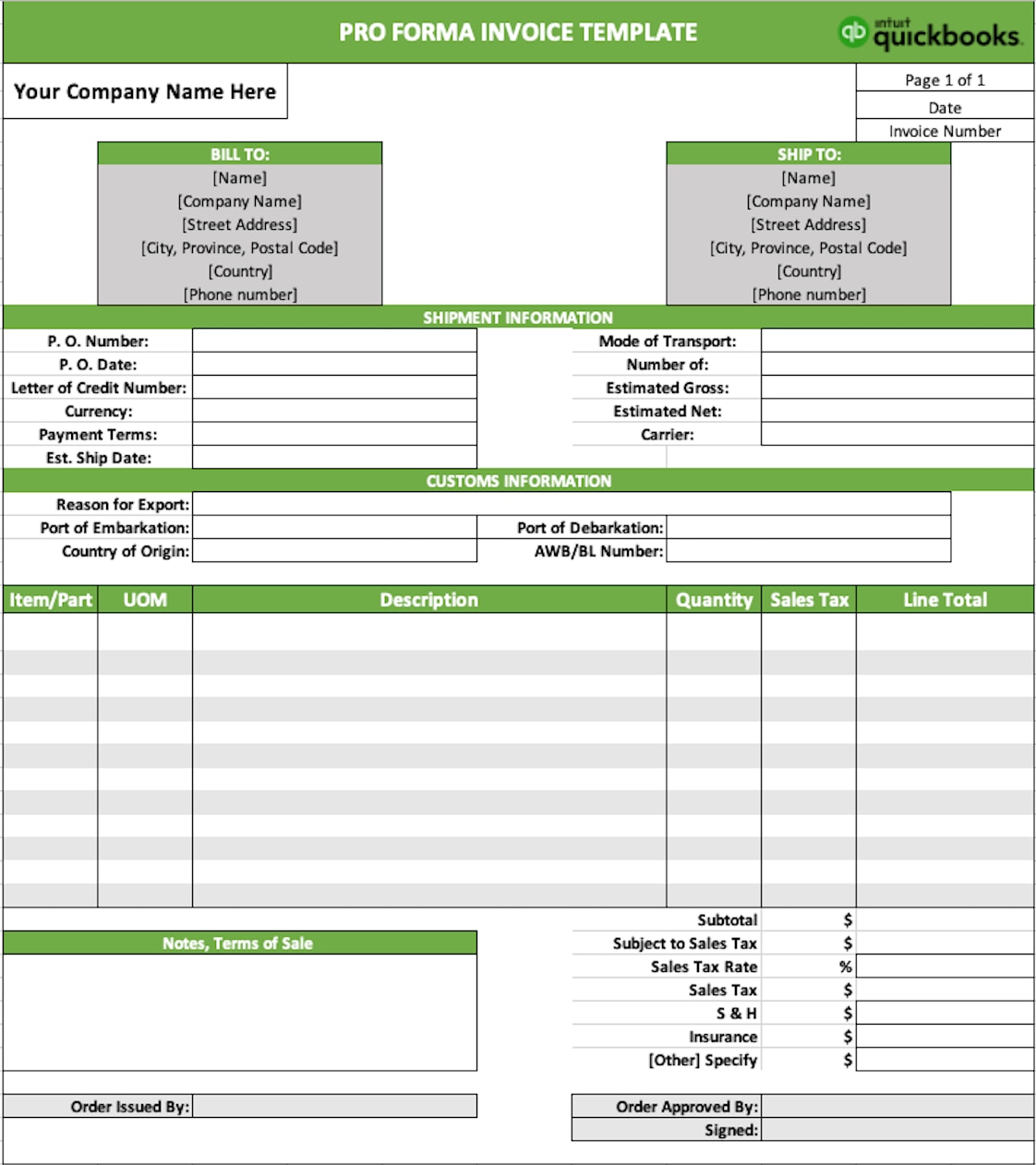

A pro forma invoice is an initial bill for a product or service from a company to a customer before it has been bought and delivered. This preliminary document confirms the purchase of goods or services with precise pricing but does not require the customer to make a payment when it is received.

So how does a pro forma invoice relate to your business?