When calculating the cost of a new hire, it’s important to note wages are merely the base cost of hiring an employee. As an employer, you also have to make Canada Pension Plan (CPP) contributions, employment insurance premiums, and other expenses. Some analysts estimate you should account for 1.2 to 1.4 times your employee’s salary when calculating their actual cost. However, the numbers vary based on your situation. To help you create an estimate, here are some key factors to take into account.

How to Calculate the True Cost of a New Employee

Key Takeaways

Canada Pension Plan Premiums

In most cases, you must withhold CPP premiums from employee cheques and match these payments. Premiums change annually, so it is important that you check the CRA website for the most up-to-date rates. These rates also vary depending on what type of employee you have hired.

As of 2022, you must remit 5.7% of earnings over $3,500 and up to $64,900. For example, if your employee earns $25,000 per year, you contribute $25,000 * .0570 or $1,425 in 2022.

Employment Insurance Premiums

You also must withhold Employment Insurance (EI) premiums from paycheques. However, rather than matching these premiums, you contribute 1.4 times the employee contribution. For example, if the employee contribution is $100, you contribute $140.

Adjusted annually, the EI premium rate for employees is 1.58% as of 2022. To estimate your annual contribution when hiring a new employee, multiply their salary by 0.0158 and multiply the result by 1.4. Note that you only pay EI premiums on earnings less than $60,300. If you pay your employee more than this amount, your maximum annual contribution is $1,333.84 for 2022.

Holidays

After your employees have been with you for 30 days, they are entitled to general holidays off with pay. If they work these days, they must receive time and a half, plus holiday pay. If you have a part-time employee, they are eligible for paid holidays proportional to how many hours they work. For example, an employee who works an average of 20 hours per week, should receive half a paid day at every holiday.

There are nine general holidays, and there are a few different ways to account for these days when assessing how much it costs to hire an employee. If you like, you can plan to be without help for these days and just include the holidays in the employee’s salary.

Alternatively, you may figure out what your employee earns in a day, multiply that amount by 1.5, and then by 9. For example, if your employee earns $200 per day, assume each holiday will cost you $300, and in total, the nine holidays cost $2,700. When you add this figure to your employee’s salary, you can see how much it would cost to have your employee (or a temp) work these days.

Vacations

In most cases, you have to provide employees with two weeks of paid vacation per year. Based on provincial laws, this number increases as employees stay with the company. If you can get by without your employee’s help for two weeks per year, you don’t have to account for any additional funds to accommodate vacations. You simply have to keep the employee’s annual salary in mind. However, if you cannot get by without help, you need to account for the cost of hiring a temp or paying other workers during this period.

Benefits

The benefits you play your employees can improve satisfaction, adding value. But you should be aware that they also add significant cost. Some common benefits are:

- Health and dental insurance

- Retirement savings plan (e.g., RRSP matching)

- Wellness programs

Recruitment and onboarding fees

This is the initial investment when onboarding new employees:

- Hiring fees: think of job board postings, recruitment agency fees, or background checks.

- Training: all the time and resources you spend on initial training, including management time, course subscriptions, or any other related feed.

- Equipment and workspace: likely will you have costs associated with the operation to consider, such as cost of computers, software licenses, office supplies, and dedicated workspace.

Indirect costs/overhead

Consider whether there have been any additional costs not included in the previous categories, such as payroll and HR tasks that enable the onboarding, administrative support, or some other professional development costs.

Example

Take, for example, an employee with a $60,000 annual salary. Notice how the true cost goes beyond their wage.

- Base Salary: $60,000

- Employer CPP: $3,361.75

- Employer EI: $1,377.60

- Statutory Holidays (9 days): $2,070

- Health Benefits: $2,000 - $5,000 (estimated)

- Recruitment/Training (first year): $1,000 - $3,000 (estimated)

This means the total annual cost for this employee could range from approximately $69,809.35 to $71,809.35.

Other Variables to Consider

When calculation the cost of an employee there are other variables that you have to take into consideration. It can also depend on what industry your company is in, the size and location of your company, and the role you are hiring for.

- Industry: All industries have different standards in terms of hourly wages and salaries. It is important to check with online guides to see what the standard rates are in your specific industry. It is also important to remember to stay competitive within your field in order to attract top talent.

- Company Size: The larger your business, the lower employee cost you have, and you can usually afford to offer higher salary rates to your employees. Smaller businesses may have a difficult time offering competitive rates.

- Location: Where your company is located is also factored into how much you'll be paying your employees. For instance, cost of living will be different in Vancouver, BC compared to Trois-Rivières, Québec. Keeping up with cost of living in the city that your business operates out of will help attract top talent.

- Role: You also need to take the actual role into consideration when deciding what salary or wage you are offering. The rarer the skill set and experience means the higher the compensation. There is also the amount challenging tasks that are required for role.

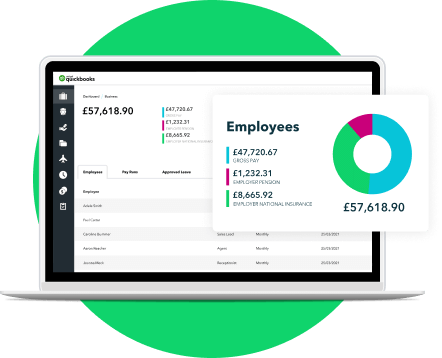

Automate Your Payroll

Make payroll an important part of your business operations with QuickBooks, plus Payroll. Use the payroll feature to automate the process so you won't have to worry about getting bogged down in the books. Easily and accurately run payroll within QuickBooks Online, and let the software do the math and stay on top of tax rates. Join millions across the country and try it today!