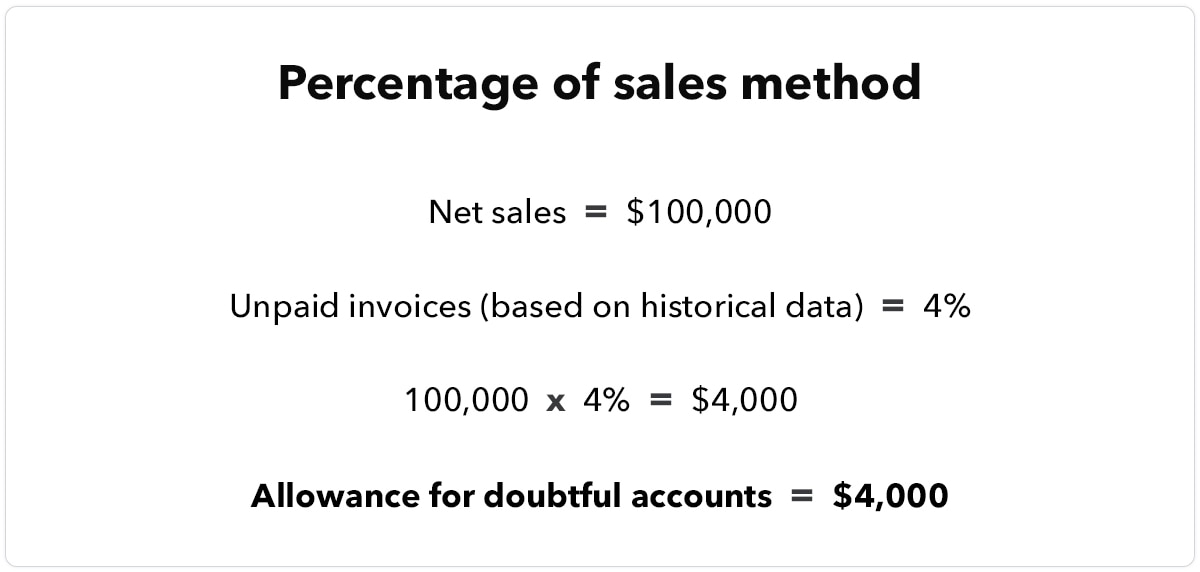

Doubtful accounts are past-due invoices that your business does not expect to actually collect on before the end of the accounting period. In other words, doubtful accounts are an estimated percentage of accounts receivable that aren’t likely to ever hit your bank account. After a certain period of time going uncollected, a doubtful account can become a bad debt, which is ultimately a cost that’s absorbed by your business.

In order to generate more accurate financial statements with this in mind, accounting teams often rely on something called an “allowance for doubtful accounts.” The allowance for doubtful accounts is also known as ADA or a bad debt reserve. This amount allows your organization to plan for uncollectible debts that impact your bottom line and budget.

In this post, we explain the importance of ADA, how to calculate it, where to record it, and more.