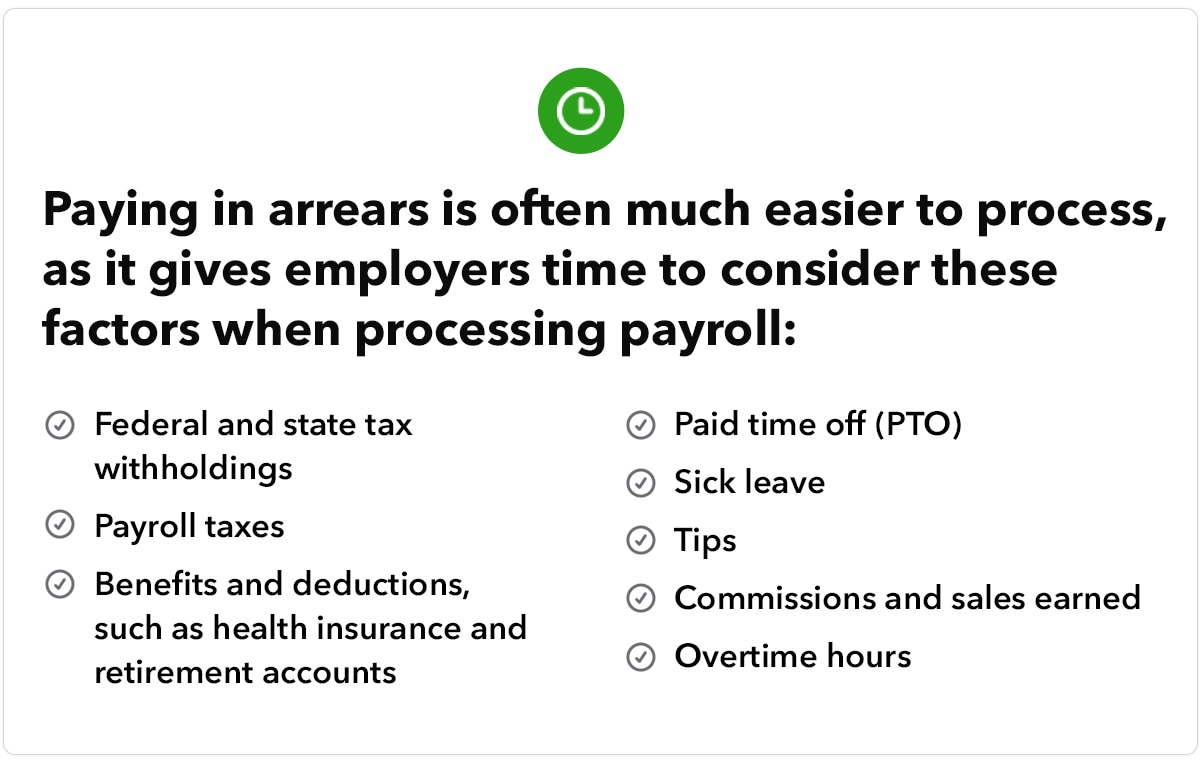

As you process payroll, several factors need to be considered, including:

- Federal and provincial tax withholdings

- Payroll taxes

- Benefits and deductions, such as health insurance and retirement accounts

- Paid time off (PTO)

- Sick leave

- Tips

- Commissions and sales earned

- Overtime hours

Paying employees after they’ve performed work is much easier to process, as it gives you time to consider these factors when processing payroll. Depending on your payroll schedule, whether it’s weekly, biweekly, monthly, and so forth, wages are scheduled after the payroll period.

Let’s look at an example. Say Jill works from March 1 to 15, and you pay her on March 20. In this scenario, you would be paying her in arrears. Paying in arrears doesn’t mean the payment is late. It only becomes a late payment if you fail to make the payment by your payment contract's due date. Paying at the end of the period gives you time to secure financing, such as through sales or by processing accounts receivable, to pay your employees.

On the other hand, when employees are paid in current, it can make processing payroll more challenging, especially for commissioned and hourly employees. Because there’s no gap between the end of a pay period and the day employees get paid, employers will have to predict employee hours.

For example, if a workweek is Monday through Sunday and you pay employees every Friday, you’ll have to process payroll early. You’ll then have to project what an employee will work on Friday, Saturday, and Sunday. If they take a sick day or work overtime one of those days, they will be overpaid or underpaid for that pay period. This will then need to be adjusted the following pay period.

At the end of the day, whether you choose to pay current or in arrears, it’s essential to pay on time and accurately. It’s also important to comply with local, provincial, and federal labor laws when processing payroll.