When you register with WorkSafeBC, an account will be opened in the name of your company, or “firm”. Reporting payroll and making remittances to WorkSafeBC may be done on a quarterly or annual basis depending on the amount of your premiums.

Certain expenses paid by the WCB have zero impact on EI benefits. The following payments are not regarded as earnings and are not allocated under the WCB:

- Pensions and lump-sum amounts paid following a final settlement

- Payments that cover the cost of injury or illness-related expenses, including:

- Medical expenses and costs associated with purchasing or renting prostheses

- Physiotherapy or chiropractic care

- Auxiliary care expenses for day-to-day activities

- Tuition and training fees

- Dispensing fees

- Payments for permanent impairment services, covering

- Disfigurement or permanent diminished capacity

- The loss of enjoyment of life directly tied to an injury or illness

Penalties for non-reporting of payroll and non-remitting of payments will be imposed. It is therefore important for employers to report your payroll by the due date – even if your payroll is zero.

Contact the Employers’ Advisers Office for information about the calculation of wages and salaries; shareholder earnings; prorating common payroll; and payments to contractors/subcontractors.

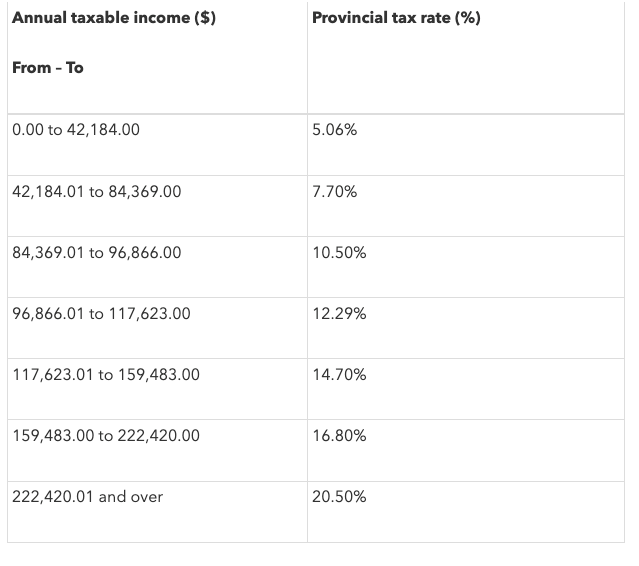

Before deciding which tax table you should use, you must first determine your employees’ province or territory of employment. This is dependent on whether or not you require your employees to report to work at a place of business, or if they are remote workers first.

Should an employee report to work at your place of business, the province or territory of employment would be that in which the business is located.

Use the tax table below for the province or territory of employment identified in order to withhold payroll deductions.