Learn about all the benefits of automated payroll software. Discover what to look for and the essential features of the best payroll software in Canada.

Payroll management is an essential part of any small to medium-sized business. There are a lot of things to consider when putting together a payroll system. Keeping on top of changing tax rates, remittances, payment schedules, and more can be tiresome and can also open the door to human error. An automated payroll system can help you stay organized, stay within the laws, and offer a level of transparency to your employees that a manual payroll process cannot.

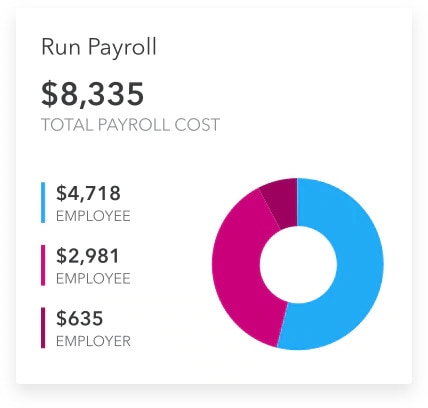

There are many benefits to switching over to an automated payroll, including the ability to add multiple payees, take advantage of cloud-based storage system, and more.