Payroll is a lot more than just paying your employees on time. An important part of the payroll process that some business owners overlook is ensuring they’ve made the proper deductions and remittances from their employees’ pay cheques. This article will explain what pay deductions and remittances are, the amounts you need to pay to the Canada Revenue Agency (CRA), how employee benefits tie into the process, and more.

Payroll Deductions and Remittances: What You Need to Know

What are Payroll Deductions?

A payroll deduction is a specific amount of money taken from an employee’s gross wage to pay for a service or government program. The amount left after these deductions is the net wage, which an employer pays the employee.

Deductions can be both mandatory and voluntary. A mandatory deduction includes government programs that all businesses with employees must pitch into, such as pension plans, insurance, and taxes. A voluntary deduction includes healthcare benefits, savings bonds, charitable contributions, and social funds. Before making a deduction, you will need to account for all taxable benefits on your employees’ pay. Once you’ve accounted for all taxable benefits,you can make the appropriate deductions.

Each tax season, the Canada Revenue Agency issues a payroll deductions table for each province to ensure businesses calculate appropriate decreases in their employees’ wages.

Examples of Payroll Deductions

The most common payroll deductions in Canada are:

- The Canadian Pension Plan

- Quebec Pension Plan

- Employment Insurance

- Federal Income Tax

- Provincial/Territorial Income Tax

Canada Pension Plan (CPP)

The Canadian Pension Plan is a mandatory deduction that must be made for any employee between the ages of 18 and 70, who is in pensionable employment, and is not already receiving CPP or disability. The CPP contributions cover all provinces, except Quebec, which has its own Quebec Pension Plan (QPP).

As an employer, you will need to use the annual CPP contribution rates and maximums to calculate the proper deductions. This amount withheld is used for each employee’s pension plan, which provides basic benefits to them when they retire or become disabled.

Employment Insurance Premiums (EI)

Employment insurance is another mandatory form of deduction. EI is a program run by Canada’s federal government that protects workers who are unable to work due to sickness, pregnancy, maternity leave, or when caring for a seriously ill family member, by paying out their benefits.

Employees will deduct EI premiums from each dollar of their pay, up to the yearly maximum. The employer will also contribute to the EI, which is 1.4 times the premium withheld for each worker. Employers can use the annual EI premium rate and maximum to calculate the appropriate deductions from payroll.

For employees working in Quebec, they will be required to pay into the Quebec Parental Insurance Plan (QPIP) while also meeting a reduced EI premium rate.

Federal Income Taxes

Income taxes are paid at a federal and provincial or territorial level and are the third main mandatory form of deductions. Employers are responsible for deducting income taxes from the income they pay their employees and must consider the provincial employment taxes to withhold the proper amount. Here are the federal income tax rates as of 2023:

- 15% on the first $53,359 of taxable income

- 20.50% on the portion of taxable income over $53,359 up to $106,717

- 26% on the portion of taxable income over $106,717 up to $165,430

- 29% on the portion of taxable income over $165,430 up to $235,675

- 33% on taxable income over $235,675

To correctly calculate income taxes, employers will need to use Form TD1, known as the Personal Tax Credits Return. Individuals will need to complete this form and provide it to their employer to keep on file. Individuals in Quebec need to use a different form, the TP-1015.3-V, Source Deductions Return. It’s important to note that there are federal TD1 forms and provincial and territorial ones.

Provincial and Territorial Income Tax

In addition to the federal income tax, Canadians also pay provincial income taxes depending on their province of residence and business location. Unlike federal taxes, provincial tax rates aren’t a flat percentage of your earnings but can be split into portions with different rates. So, if you earn $50,000 in British Columbia, you might pay a 5.05% tax rate on your first $40,000 and 7.7% on the leftover $10,000. You can check the tax rate for your province here.

How to Calculate Payroll Deductions

To calculate your employees’ payroll deductions, you first need to look at their total earnings, including any taxable benefits they may have received. For instance, if you provide your employees with room and board, that’s considered a taxable benefit. You need to add the value of that benefit to your employees’ pay before calculating payroll deductions.

After you’ve added their total earnings, you can calculate how much income tax to withhold using the Payroll Deductions Online Calculator or Guide T4127 (Payroll Deductions Formulas).

You must also deduct CPP or QPP (for Quebec employees) from your employees’ cheques. All employees between the ages of 18 and 70 must make these contributions. Remember, you must match your employees’ CPP/QPP contributions. Lastly, you must also calculate EI premiums and withhold them from your employees’ payments – remember, you need to remit 1.4 times each employee’s payment.

What are Remittances?

Once you’ve made the source deductions, the remaining amount is considered a remittance that you must pay (i.e., “remit”) to the CRA Typically, any amount of money transferred from one party to another in the form of an invoice, bill, or any other purpose is a remittance.

Remitting Payroll Deductions

After you write your employees’ cheques, you need to remit the payroll deductions you’ve withheld by the 15th of the following month. For instance, if you pay your employees in April, you must remit the deductions by May 15th. It’s crucial for employers to meet the specific remittance deadlines each year, including income taxes, CPP contributions and EI premiums. If you don’t remit your source deductions on time, you could incur penalties from the CRA.

You can pay your remittances online through your CRA My Business Account via the My Payment portal or by setting up a pre-authorized debit from your bank account. With an original remittance voucher, you can also pay at your bank or mail a payment to the CRA.

How do you Remit Payroll Deductions to the CRA?

Employers can remit their payroll deductions to the Canada Revenue Agency by way of mail or online. My Business Account is the CRA portal where businesses can register and file their source deductions online.

Employers must meet specific remittance deadlines each year. Suppose they do not remit their source deductions on time, including income taxes, Canada Pension Plan contributions, and Employment Insurance Premiums. In that case, the CRA can incur penalties against you.

Late Remittance Penalty Charges

If a business were to inaccurately file their taxes or file them late, they could incur fines from the CRA. The penalties for late or nonpayments include:

- 3% if payment is one to three days late

- 5% if payment is four to five days late

- 7% if payment is six to seven days late

- 10% if payment is more than seven days late, or no amount is paid at all

- 20% for recurring penalties in one calendar year

If you fail to make these payments and fines, the CRA can garnish wages or other sources of income, seize and sell your business assets, or use applicable statutes and laws to acquire the amount owing, resulting in prosecution, fines, and possible imprisonment. The easiest way to steer clear of fines and other repercussions is to make sure you are up to date on all the due dates for your payments.

Remittance Schedule

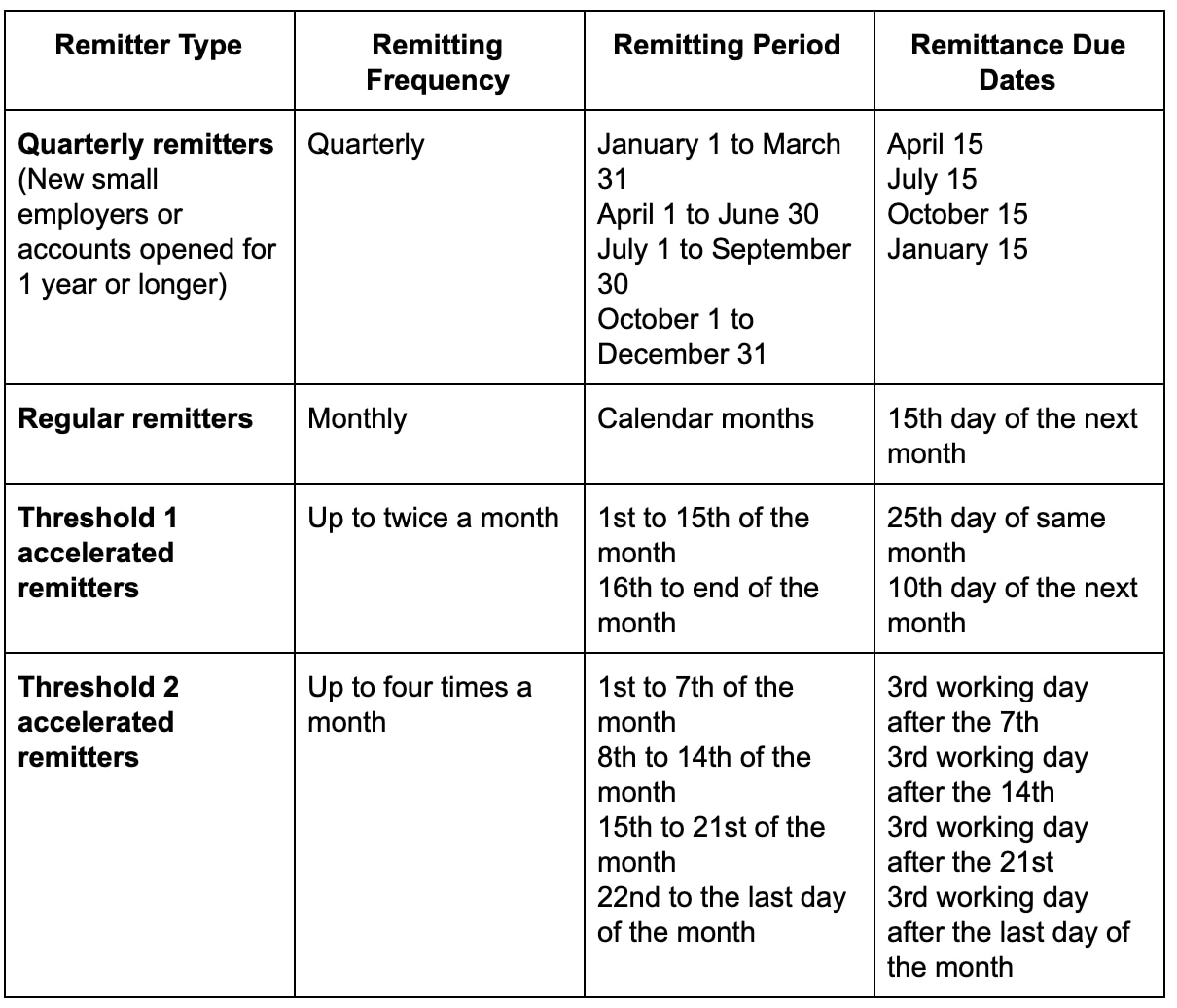

Employers must follow the payroll remittance schedule as outlined by the Canadian government.

If a due date falls on a weekend or statutory holiday, the CRA must receive the remittance on the following business day.

Small businesses that do not have any source deductions to remit within a month or quarter are known as nil remittances. Typically, this happens when a company has no employees or hires seasonal workers. In these instances, you still need to report to the CRA the nil remittance status.

Remitter Type

Your remitter type is what will dictate the frequency and remittance period to use for your payroll filing. To figure out what type your small business falls under, you will need to look at your average monthly withholding amount (AMWA) from two calendar years ago.

This amount covers the total sum of all payroll deductions you have paid to the CRA in a calendar year, averaged out monthly. Using this data from the past two years will categorize your business in the new, regular, accelerated, or quarterly remitter type.

You will also be able to check your remitter type on your My Business Account with the CRA to ensure you fall under the right category.

Making your Remittance Payments

To remit payments to the CRA, you will need to fill out specific forms dictated by your remitter type. Regular, quarterly, and monthly remitters must use Form PD7A, Remittance Voucher – Statement of Account for Current Source Deduction. Accelerated remitters should use either Form PD7A(TM), Remittance Voucher – Statement of Account for Current Source Deduction, or Form PD7A-RB, Remittance Voucher.

Alongside the completed form, you will need to send the CRA applicable payments. To pay your small business’s payroll remittance amount, you can choose one of the methods below:

- Online using the My Business Account

- By phone

- The CRA’s My Payment Service

- Pre-authorized debit

- At your Canadian financial institution with the attached personalized remittance voucher

- By mail with an attached cheque only, sent to Canada Revenue Agency, 875 Heron Road, Ottawa ON K1A 1B1

- Through a third-party service, if you’ve chosen to outsource your payroll

Forms You’ll Need

Completing T4 Forms

After every tax year, you have to complete a T4 slip for each of your employees. Then, you need to fill out a T4 summary with all your employees’ information. If you paid a pension to any previous employees or made payments to subcontractors, you should also fill out a T4A for them.

You must complete these forms for any employee you paid more than $500 or any employee on whose behalf you made payroll deductions. These forms must be given to your employees by the last day of February following the year during which they worked for you.

Filling Out Form TD1

To determine how much income tax you should withhold from your employees’ cheques, you should have them fill out Form TD1 (Personal Tax Credits Return). All new hires need to fill out this form, but you can also use it for employees who want to change their claims or increase their source deductions.

Start with the federal TD1. Then, if an employee claims more than the basic personal amount, you also fill out the provincial or territorial TD1. For instance, if they note a dependent, you must have the employee fill out the provincial or territorial form.

Individuals with multiple employers should not claim personal tax credit amounts on multiple TD1 forms. Instead, they should check the box next to “more than one employer” on the back of the form. Then, they should skip filling out lines 1 to 12 on the front of the form and write a zero on line 13.

Review the information on the form to ensure it’s correct. Double-check your employees’ SINs to make sure they match their photo IDs. You don’t have to send this form to the CRA when you're done. You simply keep it for your records and use it to help you calculate payroll deductions, but if the CRA requests to see these forms, you need to present them.

QuickBooks Payroll Add-On

When you add QuickBooks Payroll to your accounting software, you can easily and quickly calculate payroll. You enter the details from your employees’ TD1 forms. Then, when it’s time to pay your employees, you put in their earnings for the pay period.

At this point, the software does the rest. It calculates how much income tax you should withhold as well as your employees’ EI premiums and CPP contributions, and it can remit these amounts to the CRA for you. Because the software is cloud-based, it is automatically updated when the rates or the maximum annual contributions change, meaning you don’t have to worry about using outdated numbers or payroll formulas.

You can also create custom payroll options with QuickBooks Payroll. If you pay some employees a monthly salary and others weekly wages, the QuickBooks Payroll Add-On can handle these differences. If you like, you can set up the system to automatically deposit your employees’ paycheques into their bank accounts and send them their pay stubs online.

Streamline your business's payroll deductions and remittance process using quality cloud-based software, such as QuickBooks Online.

Disclaimer

Money movement services are provided by Intuit Canada Payments Inc.

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by region, province, state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.