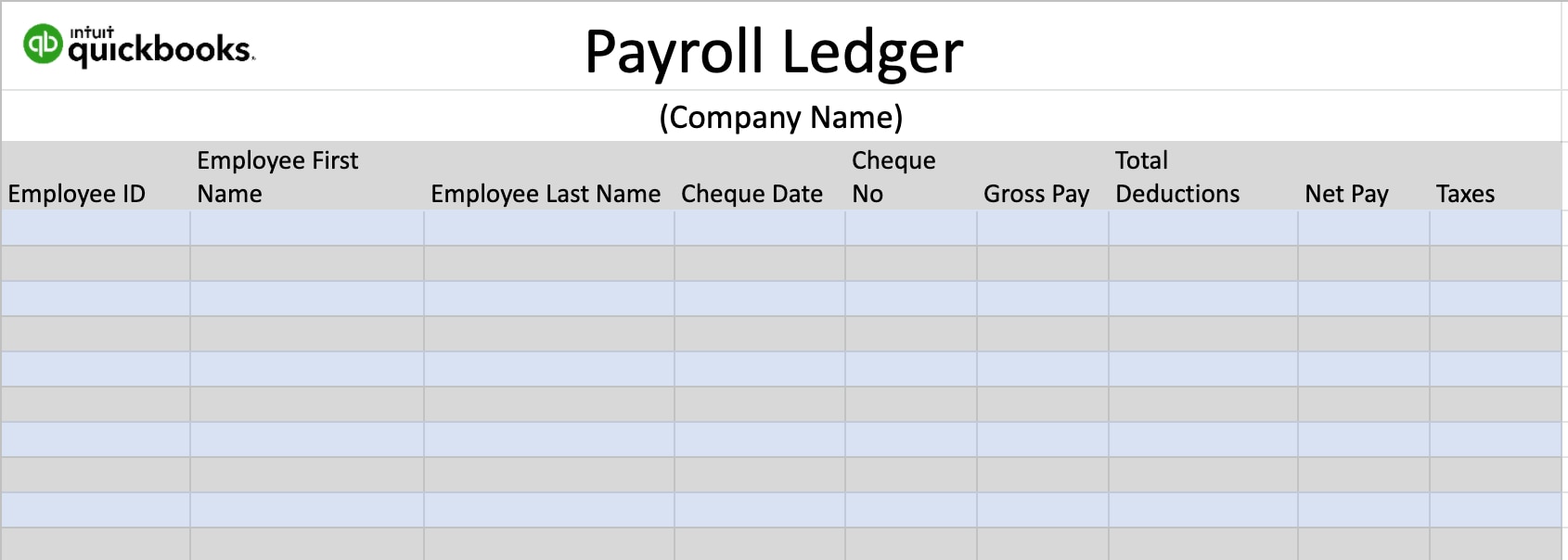

A payroll ledger is a standard method of recording payment information of each employee, contractor or business entity who receives funds from an employer’s payroll department, and is a tool for helping the employer keep track of their business expenses. They are used to keep track of an employer’s total amount of dollar expenses when they process payroll and are normally laid out in a spreadsheet.

The primary role of a payroll ledger is to organize and determine the net payroll cost, but it plays other functions. For example, it shows the frequency of payments, employee pay totals, benefits, and other deductions and the tax withholdings. Therefore it can give you answers to questions like: “How much money did employee X earn?” “What are the benefits associated with employee X?” and “Did any deductions apply to employee X?”