Canada's 2024 budget has rolled out, bringing with it critical updates and new opportunities for small business owners across Canada. From tax reforms to green initiatives and support for the development of artificial intelligence, this article explores this year's budget and what the changes it brings mean for the finances and operations of small businesses.

Canada budget 2024: What small business owners need to know

Key tax implications of Canada’s 2024 budget

The 2024 budget rolls out some key tax changes that every entrepreneur should keep an eye on. From new tax rates to updated rules on alternate minimum taxes and capital gains, here’s a breakdown of what these changes could mean for your personal and business finances.

Introduction of a new 33% tax bracket

What’s changing: There’s now a 33% tax rate for earners in the highest income category.

If you find your business income pushing you into this bracket, it might be time to revisit your tax planning. Consider changing how you draw income from your business, and employing strategies like deferring income or making tax-efficient investments to help you manage the tax increase more effectively.

Updates to the alternative minimum tax (AMT)

What’s changing: The 2024 budget tightens the AMT rules, which are rules ensuring everyone pays at least a minimum amount of tax.

Now’s a good time to evaluate how these changes might affect your ability to use deductions and credits, especially if you’ve claimed a lot of deductions in previous tax returns. Consulting with a tax expert can help optimize your tax strategy under the new rules.

Changes in capital gains tax rules

What’s changing: The capital gains inclusion rate, which determines how much of your capital gains are taxable, has been increased from 50% to two-thirds for transactions above the $250,000 threshold for individuals (and for all capital gains for corporations and trusts).

Planning to sell some high-value assets? Now more than ever, timing is everything. For example, to minimize the tax impact, it may be beneficial to align these sales with years where your overall income is lower.

What’s changing: The limit for the lifetime capital gains exemption (LCGE), which applies to the sale of qualified small business corporation shares and qualified farm or fishing property, has been raised to $1.25 million.

This LCGE limit increase provides a significant tax advantage if you've been thinking about selling your business, as the higher limit lets you protect a larger portion of your gains from taxes when you decide to sell qualifying assets.

The 2024 budget’s top tax incentives for small businesses

With a batch of tax incentives aimed at fostering business growth and encouraging eco-friendly practices, this year's budget offers support for both your business's bottom line and your efforts to operate sustainably. From tax credits for investing in clean energy to rebates that help manage carbon emissions costs, these initiatives can help you not only grow your business but also invest in a sustainable future.

Clean electricity investment tax credit

Small businesses now have a financial push to go green. With the clean electricity investment tax credit, a 15% refundable tax credit, investments in renewable energy sources like solar panels and wind turbines are more affordable. This tax credit makes it less costly to adopt technologies that can significantly lower your monthly energy bills.

Accelerated capital cost allowance (CCA)

The changes in the accelerated CCA rules allow for a quicker deduction of the cost of new productivity-enhancing assets. Faster write-offs often translate to improved cash flow and lowered tax bills in the short term — particularly valuable for businesses in sectors where staying ahead with the latest technology is crucial.

Canada carbon rebate for small businesses

Small businesses grappling with the costs of the pollution pricing fuel charge now have a helping hand through the Canada carbon rebate for small businesses. This refundable tax credit is designed to help offset these costs, making it more affordable for businesses to operate in an environmentally conscious way. It’s an effective support measure that encourages small businesses to reduce their carbon footprint without straining their budgets.

Canadian entrepreneurs’ incentive

The Canadian entrepreneurs’ incentive provides a strategic tax advantage for owners thinking about selling their businesses. By reducing the capital gains inclusion rate on the sale of qualifying small business shares, this incentive counteracts the 2024 budget’s increase of the overall capital gains inclusion rate from 50% to two-thirds — making the transition or sale of your business, if eligible, financially smoother and more rewarding.

Broader 2024 budget reforms for small business growth

This year's budget introduces a slew of measures that offer good news for small businesses. These initiatives refine financial management and boost training opportunities, helping your small business cut through red tape and equip your employees for better performance in today’s fast-paced market.

Banking and financial measures

The 2024 budget introduces key reforms such as reduced banking fees, including a cap of $10 for non-sufficient funds (NSF) fees, and the elimination of hidden fees through stronger regulations against drip pricing — measures that offer a direct benefit for small businesses that often deal with tight budgets.

Alongside these reforms, the budget also champions consumer-driven banking, which allows businesses to share their financial data securely with fintechs and other financial service providers — opening the door to innovative financial tools that can help businesses manage cash flows, compare investment opportunities, and improve financial decision-making, all within a secure framework overseen by the Financial Consumer Agency of Canada.

Workforce development initiatives

With a heavy investment in training and job placement programs, this year’s budget pours almost $3 billion annually into ensuring the workforce meets the evolving needs of small businesses, with a special emphasis on apprenticeships to prepare individuals with the skills necessary to immediately contribute to industries that depend on expert labour.

A strengthened artificial intelligence (AI) ecosystem

The 2024 budget serves up a significant $2.4 billion investment in AI initiatives, with a substantial portion of this investment allocated toward helping small and medium-sized businesses and startups build and apply AI solutions in ways that can fundamentally change their operations and help them grow. The budget also proposes establishing an AI Safety Institute to ensure the safe adoption of AI.

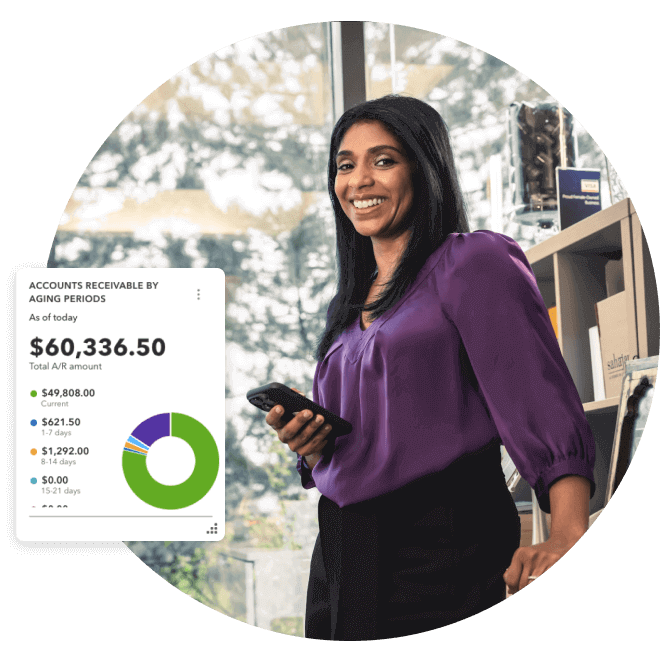

Boost your business efficiency with QuickBooks

As you leverage the incentives and measures offered by the 2024 budget, QuickBooks can be your go-to tool for financial and operational management. QuickBooks is designed to streamline your processes, making it easier to capitalize on new technologies and skills. Tap into QuickBooks today and see how it drives your business forward.

Frequently asked questions

Disclaimer

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by region, province, state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.