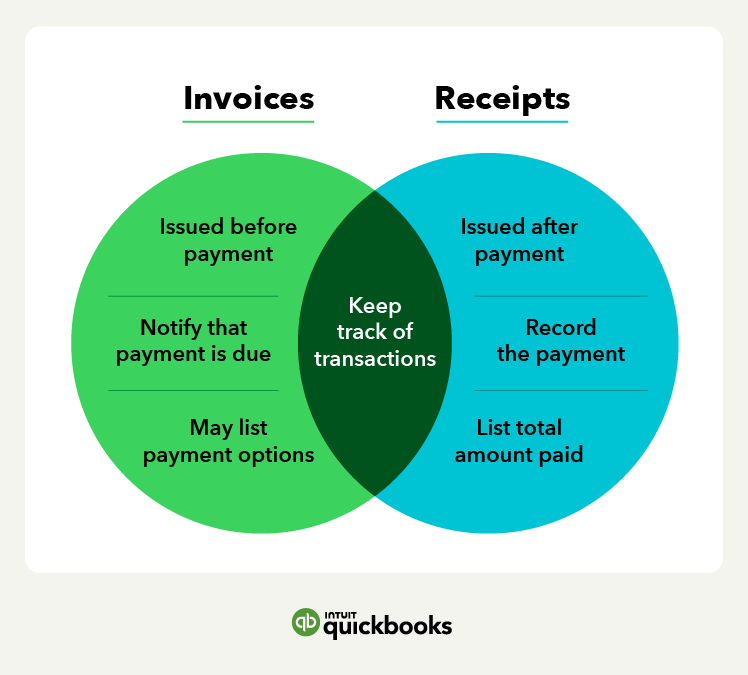

In the bustling world of Canadian business, mastering the art of financial documentation is like navigating a ship through ever-changing waters. It's essential, yet often overlooked. As a business owner, you're the captain of this ship, and understanding the difference between an invoice and a receipt is your compass to smooth sailing.

Why does this matter? Because when it comes to business transactions, clarity and accuracy are more than just good practice — they are your anchors in the stormy seas of financial management.

Picture this: a customer confused about a charge, a missed opportunity for a tax deduction, or a payment slipping through the cracks. These are the waves that can rock your business boat.

In this guide, you'll not only learn to distinguish between these crucial documents, but also discover how they can streamline your operations, keep your finances in check, and ensure you're sailing smoothly towards business success.

Clearer, more efficient financial management is possible.