Have you ever wondered what truly represents your stake in your business? The answer lies in two words: owner’s equity. It's a concept that sounds like a complex financial term only accountants need to understand. But owner’s equity isn’t just a number on your financial statements. It’s the heartbeat of your business’s financial story — a narrative that tells the tale of your business’s past decisions, current standing, and potential future.

What is owner's equity and how do you calculate it?

Owner’s equity: More than just a number

Think of equity ownership as the true measure of your business’s net worth, an important indicator of its financial health and potential. It reflects the real value that you, as a business owner, have built up over time — a dynamic number that evolves with your business.

Having a clear grasp of the concept is a powerful tool. It gives you a straightforward way to assess how well your business is doing financially, and serves as a solid foundation for making informed, strategic decisions.

Whether you’re planning for expansion, assessing the impact of a new product line, or preparing for market shifts, understanding owner’s equity lets you evaluate your company’s financial position accurately and plan for sustainable growth.

What is owner's equity?

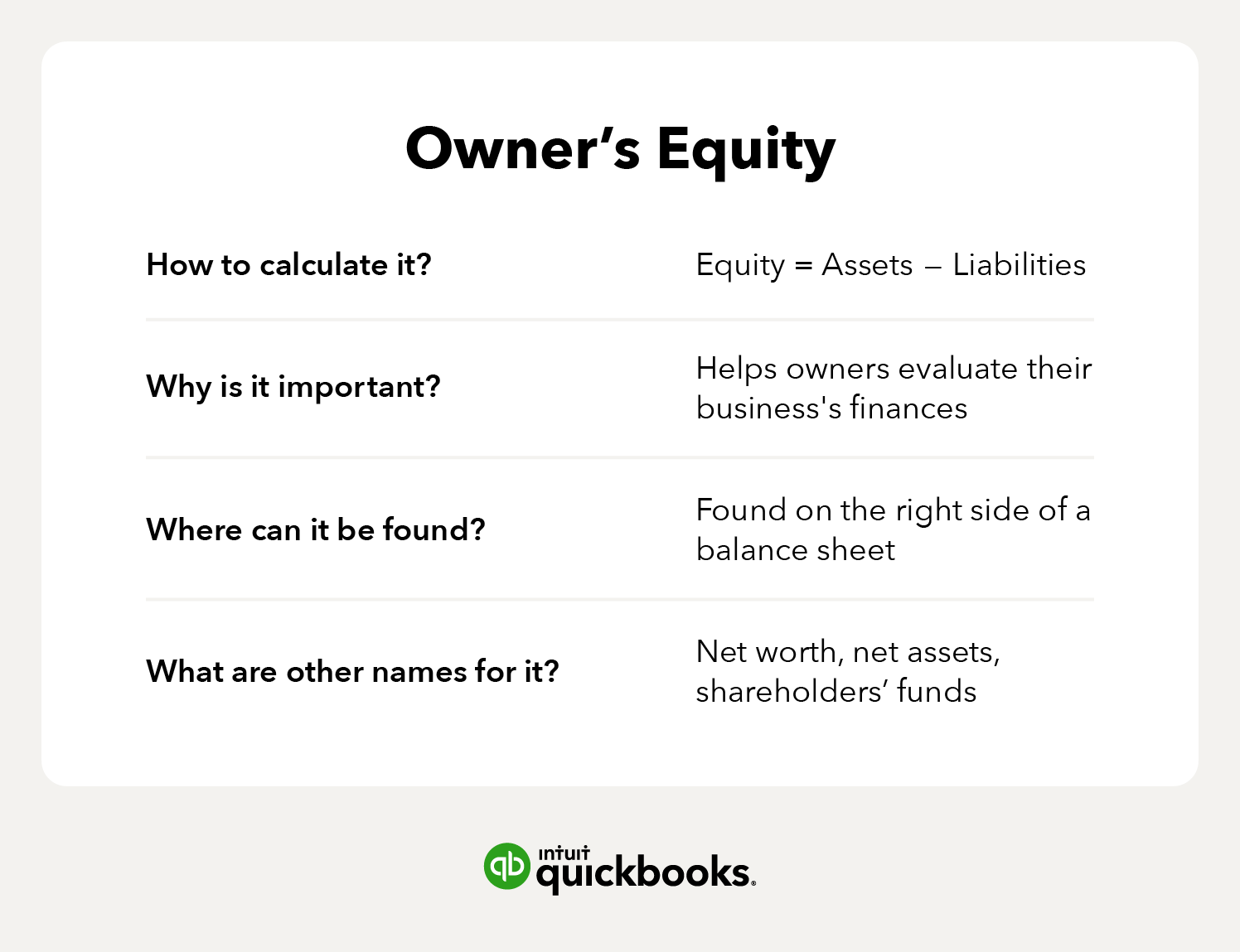

In financial terms, owner’s equity represents an owner’s claim on the assets of their business, after all liabilities have been accounted for. In simpler terms, it’s the amount that remains for the business owner once all the business’s debts have been paid off.

The impact of business structure on owner’s equity and its components

Whether you’re navigating the straightforward path of a sole proprietorship, harmonizing financial interests in a partnership, or managing the complex finances of a corporation, each type of business structure places its own distinct financial fingerprint on owner’s equity, affecting its overall value as well as its individual components.

Sole proprietorship

The sole owner’s equity is a direct measure of the business’s net worth, reflecting the owner’s investment and the business’s profits and losses — a straightforward view of the business’s financial health.

With a sole proprietorship, the owner’s total investment in the business and the business’s net earnings add to the owner’s equity. Subtracted from this are any personal withdrawals made by the owner and any outstanding business debts.

Partnership

In a partnership, the owners (or partners) hold equity shares based on their contributions to the partnership and the profit-sharing formula set out in the partnership agreement, with each partner’s stake represented by their share of the equity.

Owner’s equity is increased by each partner’s capital contributions (their investment in the partnership) and profit shares, and decreased by partner withdrawals and the partnership’s collective debts.

Corporation

Corporations are owned by shareholders (or stockholders). Their equity is in the form of stock or shares, which represents their ownership in the company.

Increases in owner’s equity come from shareholder investments and retained earnings (corporate earnings that have been reinvested in the corporation). Decreases come from treasury stock purchases (shares repurchased by the corporation from shareholders) and corporate liabilities.

Owner’s equity on a balance sheet

You can locate the figure for owner’s equity on your business’s balance sheet. It forms part of the basic accounting equation:

Assets = Liabilities + Owner’s equity

where the value of the assets (on the left side of the balance sheet) equals the sum of the liabilities and owner’s equity (on the right side of the balance sheet).

Here’s a quick primer on assets and liabilities:

- Assets: what your business owns, such as property and equipment

- Liabilities: what your business owes, such as loans or bills

Owner’s equity is the number that remains when liabilities are subtracted from assets. And, as you can see from its location on a balance sheet, it’s not considered an asset of your business, because it’s not owned by your business. Practically speaking, because you, as the business owner, have ownership rights to the owner's equity, it functions as a liability the business owes to you.

The dynamics of increasing and decreasing owner’s equity

Owner’s equity behaves much like a bank account balance, reflecting the ups and downs of financial activity.

Similar to making a deposit into a bank account, owner’s equity grows (or increases) when:

- Your business makes money.

- You decide to put more money into the business.

- Your business assets (for example, real property) increase in value.

And much like withdrawals from an account, owner’s equity decreases when:

- Your business loses money.

- You decide to take money out of the business.

- Your business assets decrease in value.

Calculating owner’s equity

When you’re calculating owner’s equity, you’re basically determining the net value of a business.

Owner’s equity is quantified by the following straightforward equation:

Owner’s equity = Total assets - Total liabilities

- Total assets are all the resources owned by the business, such as cash, inventory, and property.

- Total liabilities are all the debts and obligations owed by the business, such as credit card debt, car loans, and monthly lease payments.

To calculate owner’s equity, simply rearrange the owner's equity equation to the following:

Assets - Liabilities = Owner’s equity

and then plug in the relevant numbers. The figure you get will be a snapshot of your business’s financial health. This, in turn, reflects the net value that you, as the owner of the business, own.

Example: Let’s say Wendy is the sole owner of Neverland Enterprises. On its balance sheet, Neverland has the following assets:

- Cash: $50,000

- Property: $150,000

- Equipment: $50,000

- Inventory: $50,000

for total assets of $300,000.

Neverland also owes the following liabilities:

- Bank loan: $100,000

- Credit card balance: $20,000

for total liabilities of $120,000.

Here’s how to calculate Neverland’s owner’s equity:

$300,000 (assets) - $120,000 (liabilities) = $180,000

- This $180,000 represents Wendy’s stake in Neverland Enterprises — that is, her financial interest in the business.

Understanding the statement of owner’s equity

Every statement of owner’s equity reveals a vivid financial tale of the business over a specified time period. It’s essentially a summary or breakdown of the changes in your capital account, which represents the section of the balance sheet that details the owner’s equity in the business.

Usually prepared after the income statement, the owner’s equity statement (also known as the statement of changes in owner’s equity) focuses on a specific reporting period (often a year). It starts with an opening balance — the initial amount in the capital account at the beginning of the period being documented — and then tracks:

- Any increases from capital contributions (the owner’s additional investments) and business profits

- Any decreases from capital distributions (withdrawals made by the owner) and business losses

It concludes with a closing balance, which must match the owner's equity figure on your balance sheet for the same period.

Example: A statement of owner’s equity for Neverland Enterprises might show an opening balance of $150,000, increases from $20,000 in capital contributions and $30,000 in profits, and decreases from $10,000 in capital distributions and $10,000 in losses, for a closing balance of $180,000 — a figure that matches the owner’s equity amount of $180,000 calculated in the previous section.

Master your business finances

Navigating the intricacies of your business’s financial statements can be a complex task — but it doesn’t have to be. Streamline your financial management with QuickBooks Online's intuitive solutions to demystify your financial reporting and experience the ease of having your financial information accurately calculated and readily accessible.

Disclaimer

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by region, state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.