Understanding working capital

Working capital is defined as (current assets less current liabilities), and this formula measures a firm’s ability to generate sufficient cash inflows to operate in the short term (six to 12 months).

Current assets include cash, and assets that will be converted into cash within a year. Accounts receivable and inventory balances, for example, are expected to be collected in cash over a period of months.

Similarly, current liabilities include balances that must be paid within a year, including accounts payable and the current portion of long-term debt. If a business converted all current assets into cash, and used the cash to pay all current liabilities, any cash remaining equals working capital.

Financially healthy firms have a positive working capital balance, meaning that current assets are greater than current liabilities. Free cash flow assumes that working capital must be set aside for business operations, which is why the balance is subtracted from the cash flow total.

Every business must purchase new assets, and perform repair and maintenance on assets.

Why capital investments are necessary

Capital is defined as money invested in the company to purchase assets and to operate the business. Every firm uses assets to generate revenue, and assets must be properly maintained and eventually replaced. If you own a restaurant, you need ovens, refrigerators, and other equipment to create and serve food.

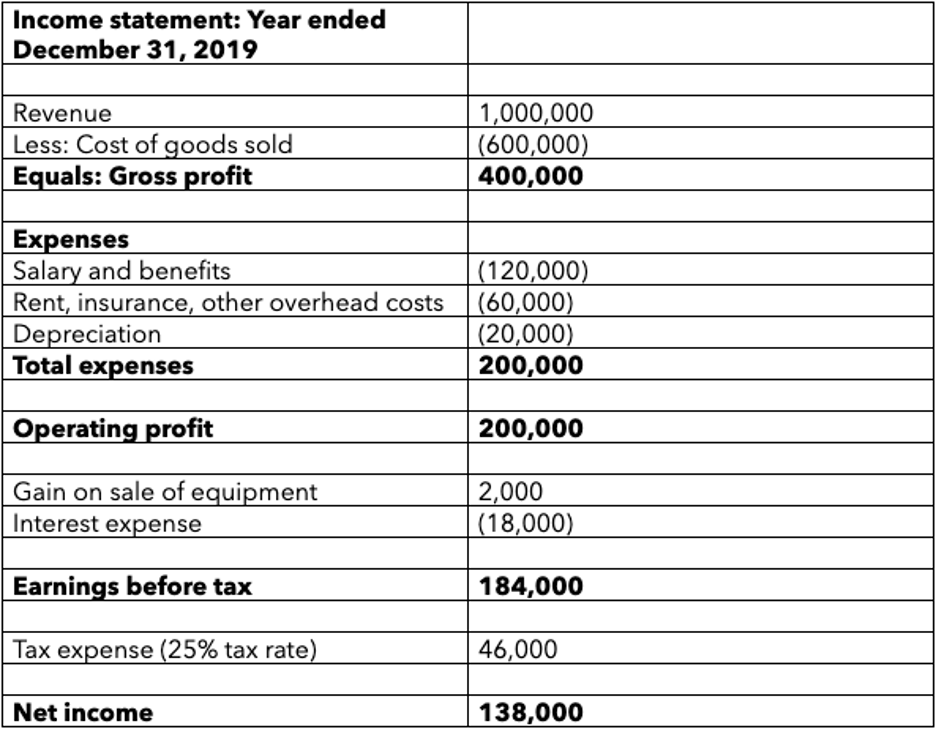

Free cash flow subtracts the dollars needed to maintain and replace assets. NOPAT does not account for working capital or capital spending, and the formula calculates profitability before considering depreciation expense and tax expenses.

Some analysts prefer the free cash flow calculation, which sets aside dollars required for working capital and capital spending.

You have dozens of financial reports that may help you manage your business, and the amount of data may seem overwhelming. So where do you go from here?