Offer peace of mind

Managing payments in QuickBooks makes bookkeeping more seamless and transparent.

Automate billing for repeat business

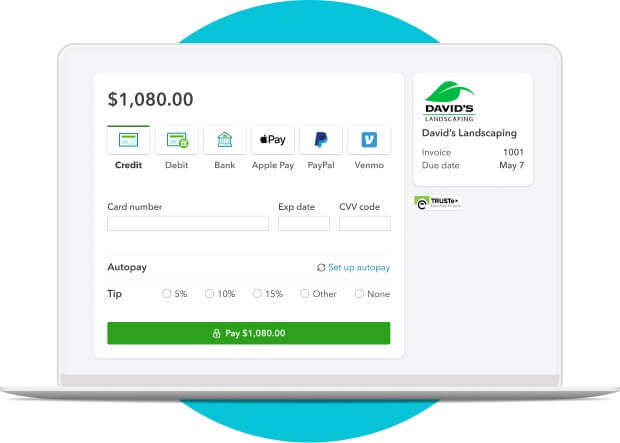

Clients can schedule invoices in advance and let their customers set up autopay.

Send instantly payable invoices

Let your clients create and send invoices that their customers can pay online right away.

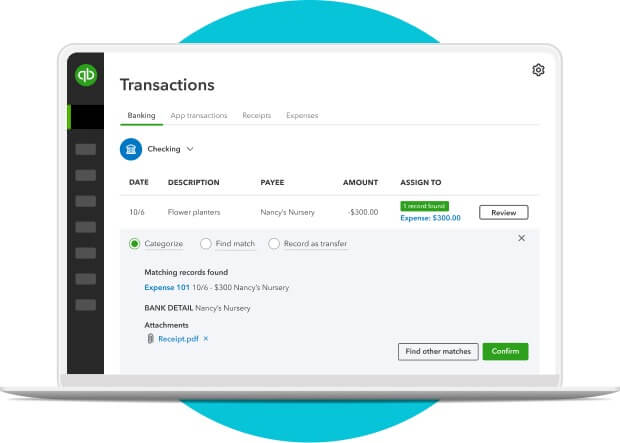

Reduce manual matching by 60%

Payments accepted through QuickBooks get automatically matched to bank transactions.¹

Simplicity at every step

Clients will get paid 4x faster by letting customers pay them through the invoice.² They can even request payments with a link or take in-person payments with the GoPayment app and card reader.

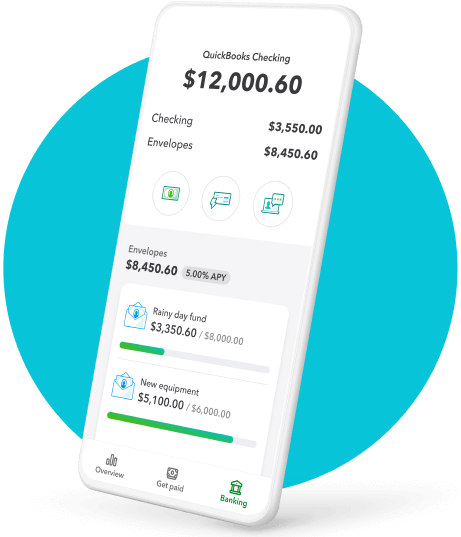

QuickBooks Checking gets you access to instant deposits, and you can stash and grow your money in envelopes that earn 5.00% APY and earn interest, with no monthly fees or account minimums.**

With real-time tracking, your clients know when customers view and pay their invoices. And once they take a payment, QuickBooks updates automatically for a clear financial picture.**

See how our rates stack up

Check out your accountant discount and share these special rates with your clients.

QuickBooks

Square

Stripe

Cards & digital wallets

Invoices or quick requests paid using Visa, Mastercard, Discover, American Express, Apple Pay, PayPal, and Venmo

2.8%

3.3% + 30¢

No PayPal or Venmo

2.9% + 30¢*

No PayPal or Venmo

ACH bank payments

Invoices or quick requests paid using an electronic transfer that pulls money from a customer’s bank account into yours

1%

Max $10

1%

$1 min, no max

1.2%*

No max

Card reader

In-person payments with a card reader. Takes Visa, Mastercard, Discover, American Express, Also takes Apple Pay, Google Pay, and Samsung Pay.

2.3%

2.6% +10¢

2.7% + 5¢

Keyed-in cards

Payments processed by manually entering a customer’s card information.

3.3%

3.5% + 15¢

3.4% + 30¢

Cards & digital wallets

Invoices or quick requests paid using Visa, Mastercard, Discover, American Express, Apple Pay, PayPal, and Venmo

QuickBooks

2.8%

Square

3.3% + 30¢

No PayPal or Venmo

Stripe

2.9% + 30¢*

No PayPal or Venmo

ACH bank payments

Invoices or quick requests paid using an electronic transfer that pulls money from a customer’s bank account into yours

QuickBooks

1%

Max $10

Square

1%

$1 min, no max

Stripe

1.2%*

No max

Card reader

In-person payments with a card reader. Takes Visa, Mastercard, Discover, American Express, Also takes Apple Pay, Google Pay, and Samsung Pay.

QuickBooks

2.3%

Square

2.6% +10¢

Stripe

2.7% + 5¢

Keyed-in cards

Payments processed by manually entering a customer’s card information.

QuickBooks

3.3%

Square

3.5% + 15¢

Stripe

3.4% + 30¢

Rates are accurate as of 9/12/2023. All listed rates are per transaction. Not all payment plans shown; only most comparable plan by feature are highlighted. *Stripe may charge an additional 0.4%/0.5% fee per paid invoice based on plan.