#Claims

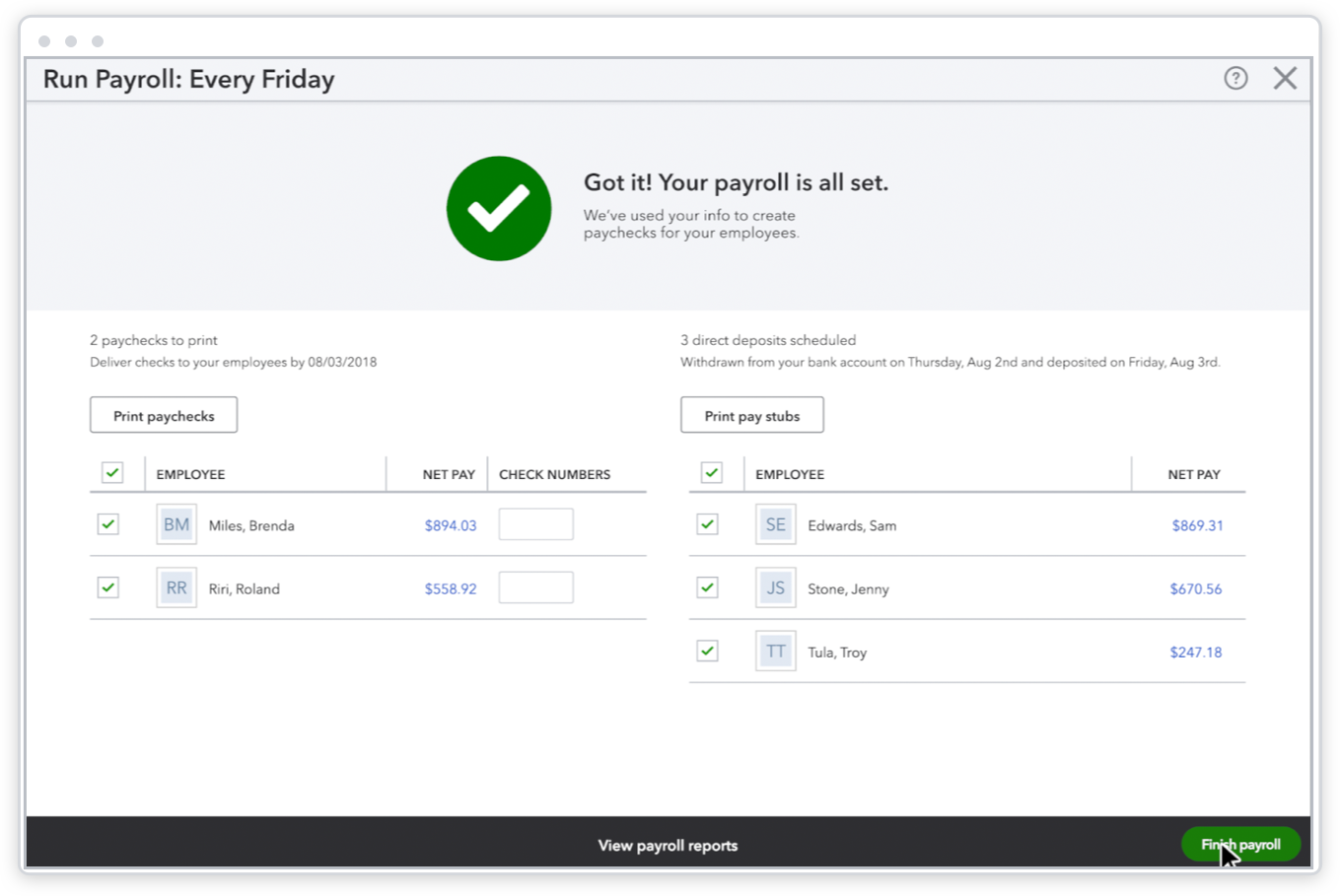

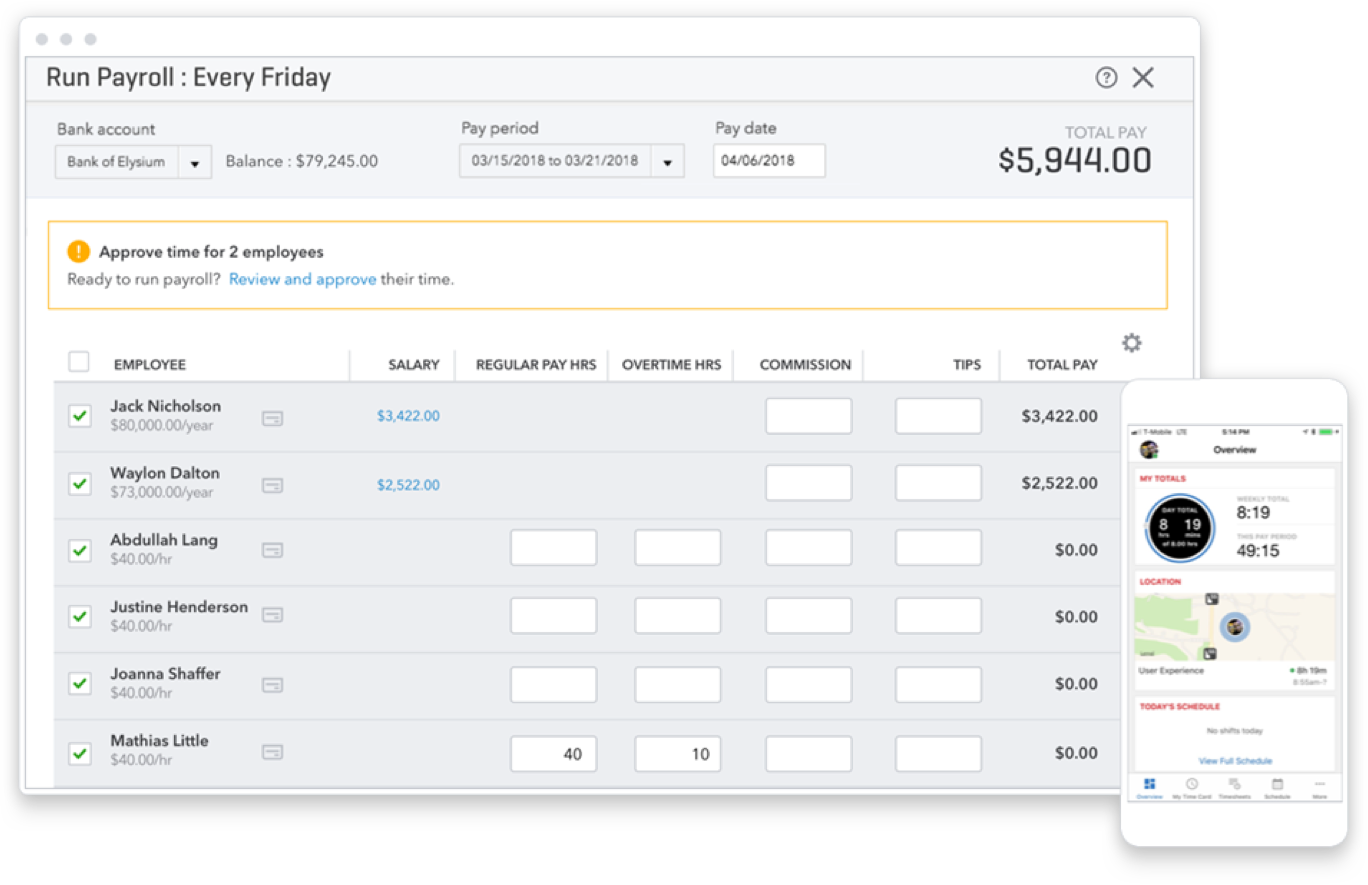

1. 5 minutes payroll claim: Run payroll in less than 5 minutes with QuickBooks payroll: Median time for QuickBooks payroll customers to view and approve payroll is less than 5 minutes. Based on an Intuit survey of 505 QuickBooks Payroll customers in December 2018 who stated average time savings compared with their prior solution.

2. 97% of accountants say QuickBooks Online is more accurate than Desktop: Based on Intuit survey Jan 2022, amongst remunerated QuickBooks Online users who expressed an opinion, when they compared QuickBooks Online to their prior QuickBooks Desktop Pro, Pro Plus, Premier, Premier Plus or Mac Plus products. Survey did not include Enterprise customers.

ProAdvisor Preferred Pricing - ProAdvisor Discount

Terms and Conditions

FOR QUICKBOOKS ONLINE ACCOUNTANT CUSTOMERS WHO TAKE ADVANTAGE OF THE 30% OFF QUICKBOOKS ONLINE SIMPLE START, ESSENTIALS, PLUS, OR ADVANCED SUBSCRIPTION WITH PROADVISOR PREFERRED PRICING - PROADVISOR DISCOUNT OFFER

Eligibility: This offer is eligible to accounting firms who register or have registered for QuickBooks Online Accountant (“QBOA”) and use the ProAdvisor Discount option (“QBOA Customer”) for the QuickBooks Online (“QBO”), QuickBooks Online Payroll (“QBOP”), and QuickBooks Time (formerly TSheets) (collectively, “QuickBooks”) subscription fees. (The ProAdvisor Discount invoicing option means that the QBOA user agrees to pay for the QBO subscription fees (“ProAdvisor Discount”). Offer is available to new QuickBooks subscribers only.

Pricing: Eligible QBOA Customers will be entitled to the following discounts:

- 30% off the then-current list price of QuickBooks Online Simple Start, Essentials, Plus, or Advanced

- 30% off the then-current list price of QBOP and 15% off the then-current per employee list price

- 30% off the then-current list price of QuickBooks Time (Formerly TSheets) and 15% off the then-current per employee list price

Discount and list price subject to change at any time at Intuit’s sole discretion. All prices are quoted without sales tax. If you add or remove services, your service fees will be adjusted accordingly.

Offer Terms:All QuickBooks subscriptions must be entered through ProAdvisor Discount and activated within 6 months of offer sign up. The discount will be terminated for any subscriptions which are not activated within the 6 month activation period. The discount is valid only for the named individual or company that registered for QuickBooks subscription and cannot be transferred to another client, individual, or company. Cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Billing: The QBOA Customer's account will automatically be charged on a monthly basis. The first bill date will be on the date of enrollment unless the QBOA Customer already has other QuickBooks subscriptions through the ProAdvisor Discount, in which case the charge will be deferred to the next existing bill date at a prorated rate for all active subscriptions at the ProAdvisor Discount until the billing for subscription is transferred or the subscription is terminated. Subscriptions will be charged to your credit card through your account. Payment is due, in full, immediately upon monthly invoicing. To remove the QuickBooks subscription from ProAdvisor Discount, please click here and follow the prompts. All future monthly subscription charges will be transferred to the QuickBooks company at the then-current list price. You may remove subscriptions from ProAdvisor Discount at any time. Transfer of the billing for the subscription will become effective at the end of the monthly billing period and then the QuickBooks company will be responsible for the then-current list price of the subscription fees. You will not receive a pro-rated refund. Transfer of the billing for the subscription will not terminate the QBOA Customer’s user rights. For more information on managing user rights or deleting clients, please see here.

QuickBooks requires a persistent internet connection (a high-speed connection is recommended) and a computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements). Network fees may apply.

ProAdvisor Preferred Pricing - Direct Discount

Terms and Conditions

FOR QUICKBOOKS ONLINE ACCOUNTANT CUSTOMERS WHO TAKE ADVANTAGE OF THE 30% OFF FOR QUICKBOOKS ONLINE SIMPLE START, ESSENTIALS, PLUS, OR ADVANCED SUBSCRIPTION FOR THE FIRST 12 MONTHS OF THE SUBSCRIPTION WITH PROADVISOR PREFERRED PRICING CLIENT DISCOUNT OFFER

Eligibility: This offer is eligible to accounting firms who register or have registered for QuickBooks Online Accountant (“QBOA”) and use the Client Discount option for the QuickBooks Online (“QBO”), QuickBooks Online Payroll (“QBOP”), and QuickBooks Time (formerly TSheets) (collectively, “QuickBooks”) subscription fees (“QBOA Customers”). The Client Discount invoicing option means that the QBOA user enters in the client’s information and the client is billed for the QuickBooks subscription fees directly (“Client Discount”). Offer is available to new QuickBooks subscribers only.

Pricing: Eligible QBOA Customers will be entitled to apply the following discounts for the first 12 months of the service for their client starting from the date of enrollment, followed by the then-current fee for the service.

- 30% off the then-current list price of QuickBooks Online Simple Start, Essentials, Plus, or Advanced

- 30% off the then-current list price of QBOP and 15% off the then-current per employee list price

- 30% off the then-current list price of QuickBooks Time (formerly TSheets) and 15% off the then-current per employee list price.

Discount and list price subject to change at any time at Intuit’s sole discretion. All prices are quoted without sales tax. If you add or remove services, your service fees will be adjusted accordingly.

Offer Terms: All QuickBooks subscriptions must be entered through Client Discount. The discount is valid only for the named individual or company that registered for QuickBooks subscription and cannot be transferred to another client, individual, or company. Cannot be combined with any other Intuit offer. Offer valid in the US only and is non-transferable. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Billing: The QuickBooks customer's account will automatically be charged on a monthly basis. The first bill date will be on the date of enrollment. Subscriptions will be charged to the credit card through the QuickBooks account. Payment is due, in full, immediately upon monthly invoicing. To remove the QuickBooks subscription from your Client Discounts, please click here and follow the prompts. Removal of the billing for the subscription will become effective at the end of the monthly billing period. All future monthly subscription charges to the QuickBooks account will be at the then-current list price. You may remove subscriptions from your Client Discounts at any time. The QuickBooks customer may cancel their subscription at any time, by going to the Account & Settings in QBO and selecting “Cancel.” The QuickBooks customer will not receive a pro-rated refund. Removal of the Client Discount for the subscription will not terminate the QBOA customer’s user rights. For more information on managing user rights or deleting clients, please see here.

QuickBooks requires a persistent internet connection (a high-speed connection is recommended) and a computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements). Network fees may apply.