The accounting industry’s digital transformation has helped accounting professionals streamline operations, improve client services, and stay ahead of the curve — thanks to the continued integration of technology into day-to-day work. Ledgers bound in paper and cumbersome manual calculations are a thing of the past as accounting professionals adopt automated processes, artificial intelligence, and data analytics to provide more value to their clients. As a result, accounting professionals are leveraging technology to weather an ever-evolving business landscape, and provide robust services to their clients that meet the unique needs of today's fast-paced and highly-competitive environment.

The 2024 Intuit QuickBooks Accountant Technology Survey unpacks how technology is arming the industry with the tools it needs to stay ahead, stay responsive, and stay resilient. New data from the QuickBooks-commissioned survey of 993 accountants and bookkeepers throughout Canada highlights the following important trends:

- Advancements in cloud accounting and digital technologies rank as the single greatest positive impact on the profession over the last 5 years.

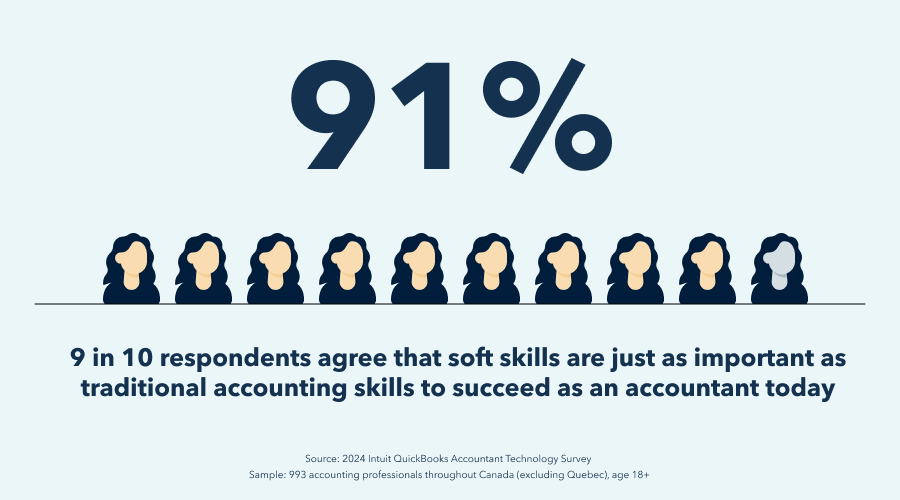

- 90% of respondents agree that a willingness to learn and adopt new technologies is just as important as traditional accounting skills to succeed as an accounting professional today.

- On average, accounting firms are earmarking $30,000 to spend on accounting tech over the next 12 months.

- 99% of respondents have used AI to help clients over the last 12 months.

- Respondents point to an unimproved economy as the #1 threat to the industry's future.

- 91% of respondents agree that more tech-advanced clients are better prepared to weather economic challenges such as inflation and high interest rates than less tech-advanced clients.

- 91% of respondents agree that if the workforce does not stop shrinking, accounting professionals will need to rely on technology even more for business success.

- Client financial and technology management needs are on the rise.

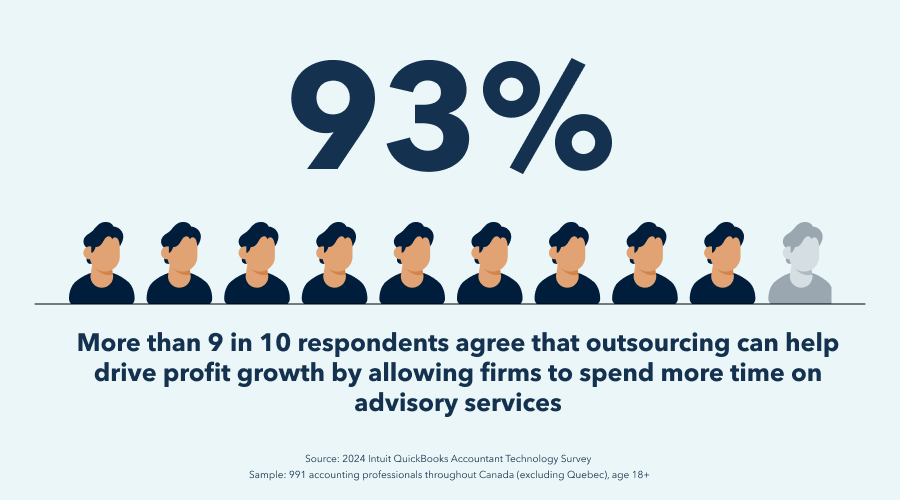

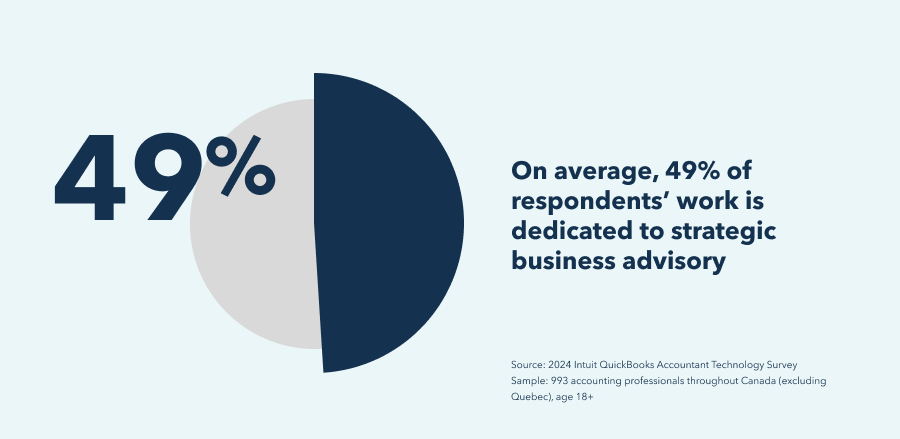

- More than 9 in 10 respondents say technology will cut time with compliance.

- More than 8 in 10 respondents say technology will help elevate the quality of advisory work.

- Implementing or optimizing accounting technology solutions is the service respondents say they’ve delivered that has contributed the most to their clients’ increasing profits (for purposes of the report, profitability is anything above breaking even or above $0).