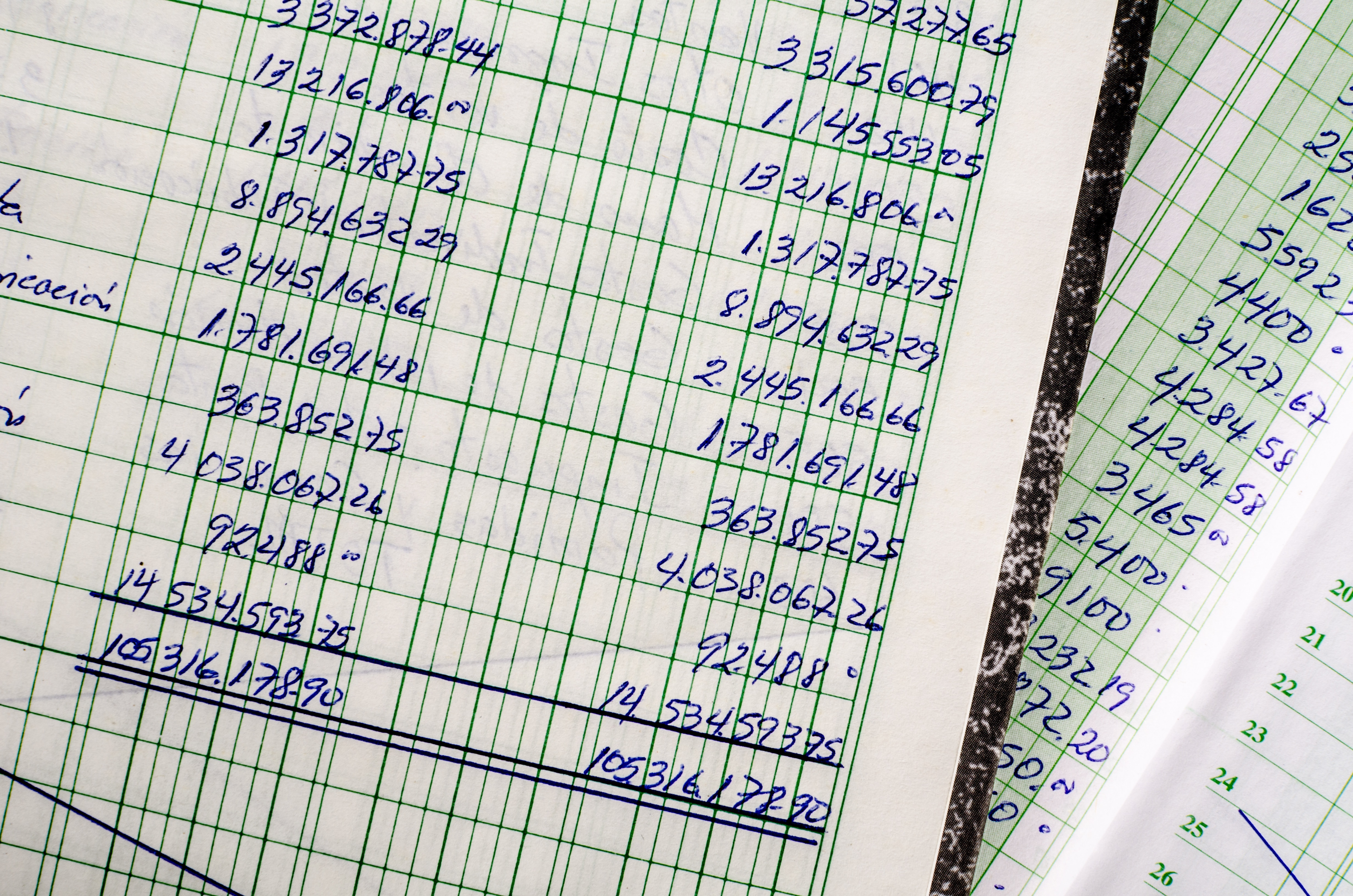

A numerical mistake within your accounting journals could lead to a landslide of problems by the end of an accounting period. Like one rock dislodging from a mountainside, one calculation error could cause further damage down the line of the fiscal period, resulting in a full-blown landslide of your business’s financial statements.

Therefore, your journal entries and accounting ledgers ‘ periodic adjustment is required to ensure all transactions are accurately recorded. Adjusting journal entries throughout an accounting period will save you time, money, and a massive headache. So let’s take a look at how to account for these entry updates properly.